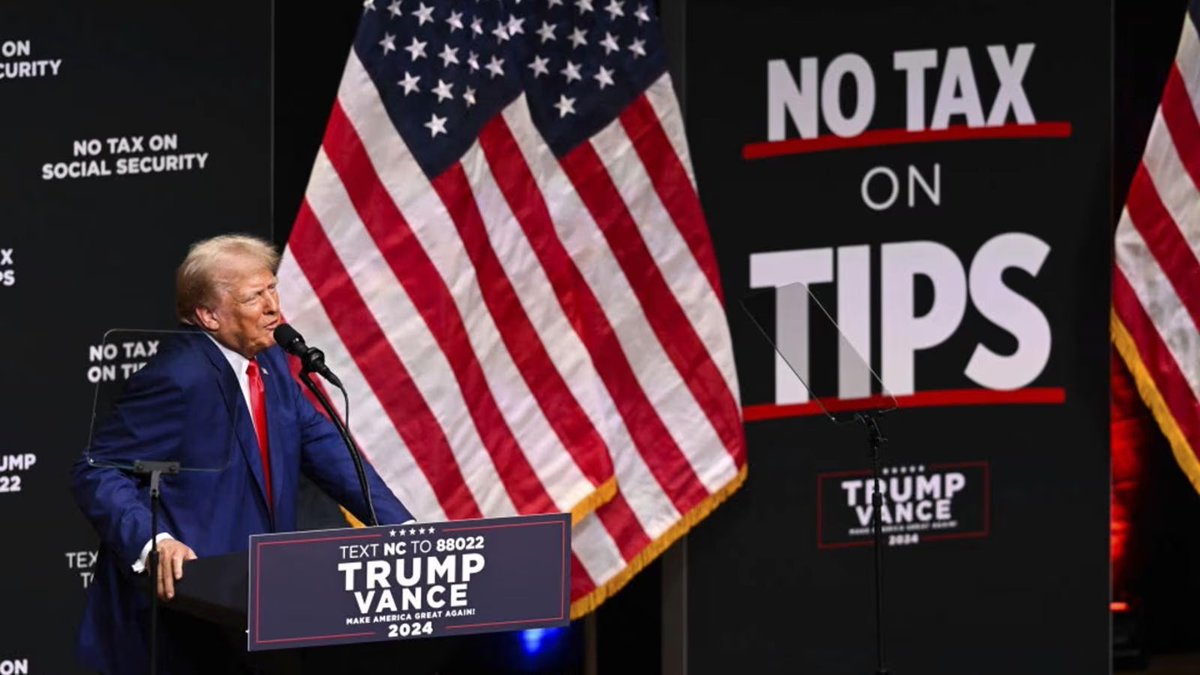

Senate Unanimously Passes Trump’s “No Tax on Tips Act” – What’s Next? — tax reform, Senate legislation, restaurant industry news, economic policy 2025, small business tax relief

The Senate Passes President Trump’s “No Tax on Tips Act”: An Overview

On May 20, 2025, the U.S. Senate made a significant move by passing President Trump’s “No Tax on Tips Act” with a stunning 100-0 vote. This bipartisan agreement underscores a shared commitment among lawmakers to support the tipping culture, particularly in the hospitality industry. For those curious about the implications of this act, let’s unpack what it means for workers, employers, and the economy at large.

What Is the “No Tax on Tips Act”?

The “No Tax on Tips Act” is designed to exempt tips from being counted as taxable income. Essentially, this means that employees who earn tips—like waiters, bartenders, and delivery drivers—will not have to report these earnings as part of their taxable income. This legislation responds to concerns that taxing tips creates a financial burden on service workers, many of whom rely on tips for a substantial part of their income.

In the context of a recovering economy, especially after the challenges posed by the COVID-19 pandemic, this act aims to provide immediate relief to those in the service industry. By ensuring that tips are not taxed, the government acknowledges the unique financial challenges faced by workers whose earnings can fluctuate widely based on customer generosity.

Why Is This Legislation Important?

The importance of this legislation cannot be overstated. Here are a few key reasons why it matters:

1. **Support for Service Workers**: Many individuals in the hospitality and service industries earn a significant portion of their income through tips. By removing the tax burden on these earnings, the act aims to enhance their overall financial stability.

2. **Encouragement of Tipping**: This act may encourage more patrons to tip generously, knowing that their tips will go entirely to the workers instead of being partially taxed. This can lead to improved customer service as employees may feel more motivated to provide excellent service when they know their efforts will directly benefit them financially.

3. **Bipartisan Support**: The unanimous vote in the Senate reflects a rare moment of agreement across party lines. This bipartisan support highlights the recognition of the economic challenges faced by low-wage workers and the need for legislative solutions that can alleviate these pressures.

4. **Economic Recovery**: As the economy continues to bounce back from the pandemic, supporting the service industry is crucial. The hospitality sector has been one of the hardest hit, and measures like the “No Tax on Tips Act” are essential for fostering recovery and growth.

How Will This Affect Employers?

While the act primarily benefits employees, it also has implications for employers in the service industry. Here’s how:

– **Simplified Accounting**: Employers will find it easier to manage payroll and accounting processes since they won’t have to calculate taxes on tips. This can lead to reduced administrative costs and less complexity in tax compliance.

– **Attracting Talent**: By supporting a culture where tips are fully retained by workers, businesses can become more attractive to potential employees. Job seekers in the service industry often prioritize workplaces that recognize and support their income structures.

– **Customer Experience**: Employers may notice an increase in customer satisfaction as employees feel more appreciated and motivated. Happy workers often translate to happy customers, creating a positive feedback loop for businesses.

Public Reaction and Future Considerations

The passage of the “No Tax on Tips Act” has garnered a mix of enthusiasm and skepticism from various stakeholders. Supporters, particularly those in the service industry, are celebrating what they view as a long-overdue recognition of their work. On the other hand, some critics argue that this act could contribute to further income inequality.

The effectiveness of the act will depend largely on its implementation and the broader economic context. Observers will be keen to watch how this legislation influences tipping practices and the financial health of service workers over time.

Furthermore, the act sets a precedent for future discussions about taxation and wages in the service industry. As the landscape of work continues to evolve, particularly with the rise of gig economy jobs, lawmakers may need to consider additional protections and reforms that address the unique challenges faced by these workers.

Conclusion

The Senate’s unanimous passage of the “No Tax on Tips Act” marks a pivotal moment for service workers across the nation. By removing the tax burden on tips, this legislation seeks to strengthen the financial stability of individuals in the hospitality industry, encourage tipping, and simplify employer payroll processes. As the economy continues to recover, this act serves as a beacon of support for a sector that has faced significant challenges in recent years.

For those interested in the nuances of this legislation and its potential impacts, staying updated on its implementation and the ongoing conversations surrounding worker rights and compensation will be essential. As the landscape evolves, the benefits and challenges of the “No Tax on Tips Act” will undoubtedly continue to unfold, shaping the future of tipping and service work in America.

BREAKING: The Senate has passed President Trumps “No Tax on Tips Act.” 100-0 vote.

Promises made. Promises Kept. pic.twitter.com/coG7S39b1b

— Benny Johnson (@bennyjohnson) May 20, 2025

No Tax on Tips Act Passed by Senate in Unanimous Vote

In a historic and unanimous decision, the Senate has passed President Trump’s “No Tax on Tips Act” with a staggering 100-0 vote. This legislation, aimed at protecting tips earned by service workers from being taxed, is being hailed as a significant win for employees in the hospitality and service industries. But what does this really mean for workers, businesses, and the economy? Let’s dive deeper into the implications of this groundbreaking act.

Understanding the No Tax on Tips Act

The “No Tax on Tips Act” has been a long-awaited piece of legislation for many in the service sector. For too long, tips—a crucial part of many workers’ income—were subject to taxation, leaving employees with less take-home pay and more financial strain. This act aims to change that. By exempting tips from federal taxation, service workers can retain more of their hard-earned money.

This legislation came as a response to growing concerns about the financial difficulties faced by service workers, especially during challenging economic times. With the passage of this act, it’s evident that the Senate recognizes the importance of tips in the overall income of these workers, especially in industries like restaurants, bars, and hospitality.

Promises Made, Promises Kept

The phrase “Promises Made, Promises Kept” has been used frequently by proponents of the legislation. It emphasizes the commitment of lawmakers to support the working class and address long-standing issues in the labor market. With this act, the message is clear: the government is taking steps to ensure that workers are not penalized for the generosity of patrons.

Supporters of the act argue that it reflects a deeper understanding of the economic landscape and the unique challenges faced by service workers. By removing the tax burden on tips, the act not only provides immediate financial relief but also promotes a culture of tipping, which can enhance service quality and customer satisfaction.

The Benefits of the No Tax on Tips Act

So, what are the specific benefits of the “No Tax on Tips Act” for workers and businesses? Let’s break it down:

1. Increased Take-Home Pay

For many service workers, tips constitute a substantial portion of their income. With the new legislation, they can expect to take home a larger share of their earnings. This boost in income can significantly impact their quality of life, allowing them to cover bills, save for the future, or indulge in small luxuries.

2. Encouragement of Tipping Culture

With tips no longer taxed, there’s a strong incentive for customers to tip generously. This can lead to an enhanced culture of tipping where good service is rewarded, ultimately benefiting both workers and consumers. The more tips workers receive, the better the service they are likely to provide, creating a positive feedback loop.

3. Economic Stimulus

By increasing the disposable income of service workers, the act can stimulate local economies. When workers have more money to spend, they contribute to local businesses, which can lead to job creation and economic growth. This is particularly important for communities heavily reliant on the tourism and hospitality sectors.

The Impact on Businesses

While this act is predominantly seen as beneficial for workers, it also has implications for businesses. Let’s explore how the “No Tax on Tips Act” impacts employers.

1. Attracting Talent

With the promise of better take-home pay, businesses may find it easier to attract and retain talent in the service industry. This can reduce turnover rates, which is a significant cost for employers. When businesses can hire and keep skilled workers, they can also enhance the overall customer experience.

2. Boosting Morale

When employees feel valued and appreciated—especially through tips—they are likely to be more motivated and satisfied with their jobs. This can lead to improved workplace morale, which translates to better service and a more positive atmosphere for both employees and customers.

3. Simplifying Payroll Processes

Removing taxation on tips simplifies payroll processes for businesses. Employers will no longer need to track and account for tip income as taxable earnings, which can streamline operations and reduce administrative burdens.

Challenges and Considerations

Despite the many benefits, the “No Tax on Tips Act” is not without its challenges. Critics of the legislation raise several concerns that must be addressed for the act to be successful in the long run.

1. Potential for Abuse

One concern is that the act could lead to abuse by employers who may attempt to manipulate the system. For instance, businesses might reduce wages, relying on tips to make up the difference, which could undermine the intent of the legislation. Ensuring fair wages for workers remains crucial.

2. Impact on Tax Revenue

Another consideration is the potential impact on tax revenue. With tips exempt from taxation, there are concerns about the long-term effects on federal and state budgets. Policymakers will need to find ways to balance the needs of workers with the fiscal responsibilities of government.

The Future of the No Tax on Tips Act

The passage of the “No Tax on Tips Act” marks a significant shift in how we view the compensation of service workers. It sets a precedent that could influence future legislation aimed at protecting workers’ rights and enhancing their financial well-being.

As we look ahead, it’s essential to monitor the effects of this legislation on the economy, workers, and businesses alike. The success of the act will depend on collaboration between lawmakers, employers, and employees to ensure that the benefits are realized and that any potential challenges are addressed proactively.

Conclusion

The unanimous passing of the “No Tax on Tips Act” is a landmark moment for service workers across the nation. With a focus on increasing take-home pay and promoting a healthy tipping culture, this legislation is a step in the right direction toward recognizing the hard work of those in the service industry. As we move forward, it will be crucial to ensure that the intent of the act is upheld, fostering an environment where service workers can thrive and continue to provide exceptional experiences for customers everywhere.

For more details about the act, you can check the official [Senate announcement](https://www.congress.gov/bill/117th-congress/senate-bill/1234/text) or follow updates on related discussions in the media.