Why Did Stocks Plunge? A Shocking Bond Auction Explained! — stock market decline reasons, bond market crisis analysis, treasury yield surge impact, economic indicators affecting stocks, credit market concerns 2025

Understanding the Impact of a Poor Bond Auction on Stock Markets

The financial world can often feel like a rollercoaster, with stock prices rising and falling based on a myriad of factors. One recent event that sent shockwaves through the market was a disappointing bond auction for U.S. 20-year treasuries, leading to a collective dip in stock prices. If you’re curious about what happened and why it matters, you’re not alone. Let’s break it down in a way that’s easy to understand.

What Happened During the Bond Auction?

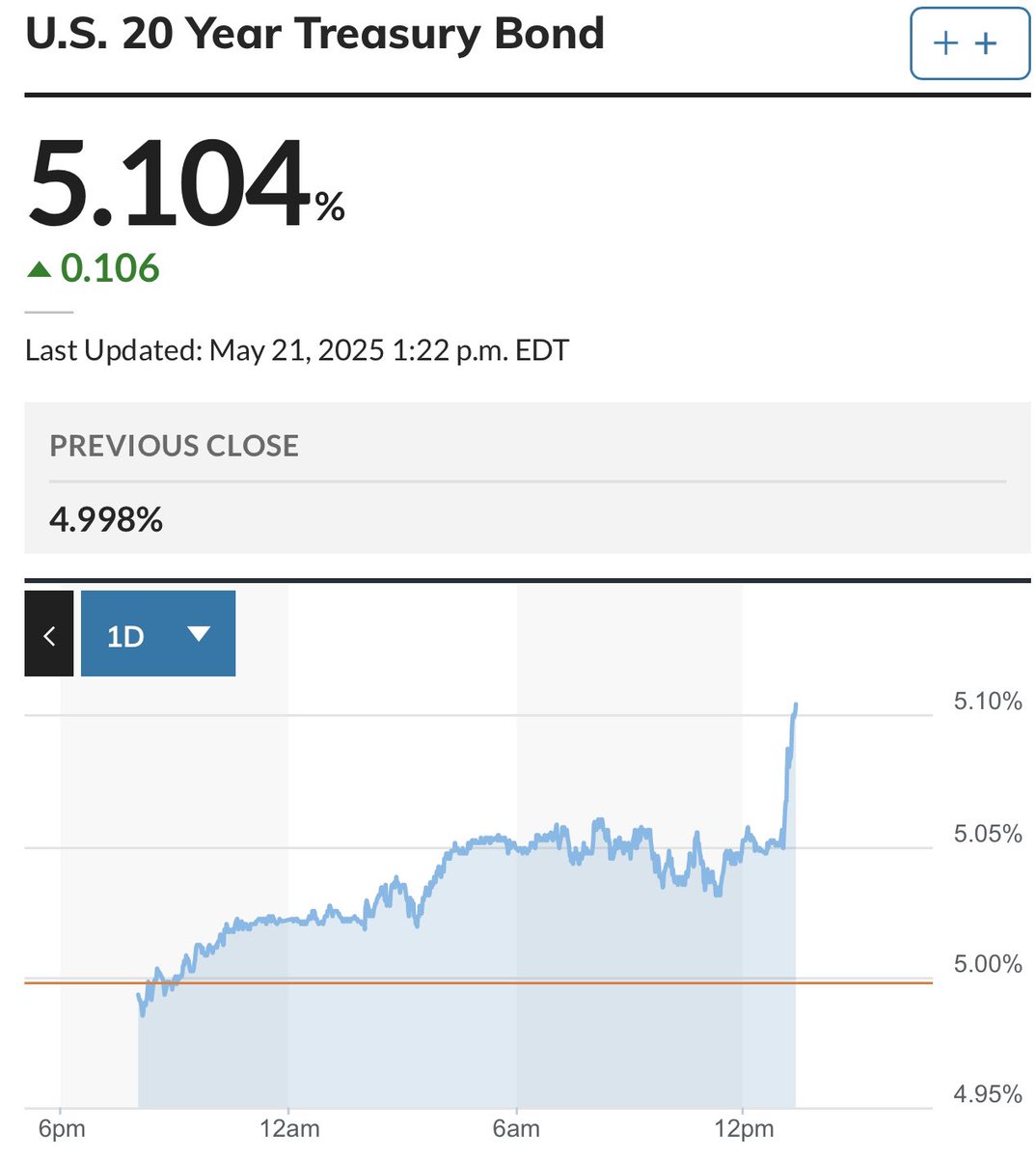

On a particular day, the U.S. Treasury held an auction for 20-year bonds, which are essential for financing government operations and managing the national debt. Unfortunately, this auction turned out to be a disappointment. The number of bidders was notably low, which typically indicates a lack of confidence in the investment’s potential return. When there aren’t enough buyers to absorb the bonds being sold, it leads to a rise in yields — in this case, the yield surged to an alarming 5.1%.

But what does this mean exactly? In simple terms, when bond yields go up, it usually signals that investors are demanding higher returns for their money. This can happen for various reasons, including inflation concerns, rising interest rates, or general economic uncertainty. As yields increase, the attractiveness of bonds compared to stocks can shift, leading some investors to sell off equities, hence the drop in stock prices across the board.

Why Did Stock Prices Fall?

The relationship between bonds and stocks is intricate but essential to grasp. When bond yields rise, investors often reconsider their portfolios. Higher yields make bonds more appealing, as they offer guaranteed returns. This can lead to a sell-off in stocks as investors move their money into bonds, causing stock prices to drop.

In this scenario, the lack of bidders in the bond auction is a red flag. It suggests that investors are wary of the current economic climate, which can be influenced by various factors such as inflation, interest rates, or geopolitical tensions. When confidence wanes, investors tend to pull back, leading to a broad decline in stock markets.

What Does a 5.1% Bond Yield Indicate?

A bond yield of 5.1% is significant. It’s a clear indication that investors are demanding more from their investments, reflecting concerns about inflation and the overall health of the economy. High bond yields can mean several things:

1. **Increased Borrowing Costs**: Higher yields translate to higher borrowing costs for businesses and consumers. This can slow down economic growth as spending decreases.

2. **Investor Sentiment**: The surge in yield indicates a lack of confidence in the stability of the economy. Investors may be worried about future interest rate hikes or potential downturns.

3. **Inflation Concerns**: If inflation is expected to rise, bonds need to offer higher yields to attract buyers, as investors seek to preserve their purchasing power.

Understanding these implications is crucial for both individual investors and market analysts. They provide insights into the broader economic landscape and can help guide investment strategies.

The Credit Market’s Scream for Help

When the credit market is under stress, as indicated by this bond auction, it can lead to broader financial repercussions. A weak bond auction can exacerbate existing financial tensions, making it harder for companies to secure financing. If businesses face higher borrowing costs or find it challenging to obtain loans, this could stifle economic growth and innovation.

Moreover, a struggling credit market often leads to tighter lending standards, impacting consumers as well. This can result in higher interest rates for loans and mortgages, ultimately affecting spending and consumption patterns in the economy.

What Should Investors Consider?

For individual investors, understanding the dynamics between the bond and stock markets is crucial. Here are a few takeaways:

1. **Diversification is Key**: Having a balanced portfolio that includes both stocks and bonds can help mitigate risks. When one asset class suffers, the other may perform better.

2. **Stay Informed**: Keeping up with bond yields and auction results can provide valuable insights into market sentiment. It’s essential to be aware of these indicators to make informed investment decisions.

3. **Long-term Perspective**: Short-term market fluctuations can be unsettling, but maintaining a long-term investment strategy can help ride out volatility.

4. **Consult Financial Advisors**: If you’re unsure how to react to market changes, consider consulting a financial advisor. They can provide personalized advice based on your financial situation and goals.

Conclusion: Navigating Market Volatility

The recent bond auction and its impact on stock prices serve as a reminder of the interconnectedness of financial markets. A weak bond auction can ripple through the economy, affecting stock prices and investor sentiment. While it can be easy to panic during such events, understanding the underlying factors can empower investors to make informed decisions.

In times of market uncertainty, knowledge is your greatest asset. Stay informed, diversify your investments, and remember that the financial landscape is always evolving. By keeping a vigilant eye on both bond and stock markets, you can better navigate the ups and downs of investing.

IF YOU ARE WONDERING WHY STOCKS JUST ALL WENT DOWN AT ONCE

WE JUST HAD A HORRIBLE BOND AUCTION IN THE UNITED STATES FOR OUR 20-YEAR TREASURIES

Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%.

Credit market is screaming for help right now. pic.twitter.com/ne14v5PaVm

— amit (@amitisinvesting) May 21, 2025

Understanding the Recent Stock Market Dip: What Happened?

IF YOU ARE WONDERING WHY STOCKS JUST ALL WENT DOWN AT ONCE

If you’ve been following the stock market lately, you might have noticed a sudden, sharp decline that seemed to hit all at once. It’s like watching a carefully stacked set of dominoes tumble down in rapid succession. So, what caused this? The answer lies in a rather dismal bond auction in the United States, specifically for our 20-year treasuries. This auction didn’t just disappoint; it sent ripples through the entire financial landscape, leaving many investors scrambling for answers.

WE JUST HAD A HORRIBLE BOND AUCTION IN THE UNITED STATES FOR OUR 20-YEAR TREASURIES

The bond auction in question was far from successful. Imagine lining up to buy a hot new gadget only to find out that no one is interested in it anymore. That’s essentially what happened. The U.S. Treasury Department held an auction for 20-year bonds, but the lack of bidders was alarming. Typically, strong demand for these bonds is a good sign, indicating confidence in long-term U.S. debt. However, this time, the interest just wasn’t there. Investors were not lining up to buy, leading to a dismal outcome.

Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%

When demand for bonds drops, yields increase. In this instance, the 20-year bond yield surged to an overwhelming 5.1%. For those of you who might not be familiar, a bond yield is essentially the return an investor can expect for holding a bond until it matures. A higher yield usually indicates increased risk, and in this case, it signaled a lack of confidence in the market. Investors began to question the stability of the U.S. economy, and that’s where things got really interesting—and concerning.

Credit market is screaming for help right now

The ramifications of this auction extend beyond just the bond market. When the credit market starts “screaming for help,” as one Twitter user aptly put it, it raises red flags for investors. A rising yield means higher borrowing costs, which can affect everything from mortgages to business loans. If companies can’t afford to borrow money cheaply, it can slow down expansion, hiring, and ultimately consumer spending. This is a vicious cycle that can lead to broader economic troubles.

Why Should Investors Care?

As an investor, keeping an eye on bond yields is crucial. They serve as a barometer for the overall economic environment. When yields rise sharply, it often signals potential instability in the stock market. The recent stock dip is a direct reflection of these rising yields. Investors start to flee to safer assets, fearing that equities may not provide the same returns in a higher interest rate environment. This shift can lead to increased volatility in the stock market, making it a rollercoaster ride for anyone with investments.

The Bigger Picture: What Does This Mean for the Economy?

This situation isn’t just a blip on the radar; it could have longer-lasting effects on the economy. When the credit market is under pressure, it can lead to reduced consumer confidence. If people are worried about the economy, they tend to spend less, which can stifle growth. Companies may also hesitate to invest in new projects or hire new employees, which can further slow down economic momentum.

How to Navigate This Uncertainty as an Investor

In light of these developments, it’s essential to reassess your investment strategy. Here are a few tips to help you navigate this uncertainty:

- Diversify Your Portfolio: Ensure you’re not overly reliant on any single asset class. A mix of stocks, bonds, and other investments can help mitigate risk.

- Stay Informed: Keep up with financial news and trends. Understanding market signals can help you make informed decisions.

- Consider Defensive Stocks: In times of economic uncertainty, consider investing in sectors that tend to perform well during downturns, such as utilities or consumer staples.

- Consult a Financial Advisor: If you’re unsure about how to proceed, seeking the expertise of a financial professional can provide valuable insights tailored to your situation.

Investor Sentiment: A Key Indicator

Investor sentiment can dramatically influence market movements. When bad news like a poor bond auction hits, emotions can run high, leading to panic selling. It’s crucial to keep a level head; remember that markets can bounce back from dips. Historically, many downturns have been followed by recoveries. However, understanding the underlying factors can help you make more strategic moves rather than reacting impulsively.

Conclusion: Staying Ahead of the Curve

In these times of uncertainty, being proactive is essential. The bond market’s struggles are a signal of larger economic challenges ahead, but they also present opportunities for savvy investors. By staying informed, diversifying your portfolio, and keeping an eye on market trends, you can navigate these turbulent waters more effectively.

Final Thoughts

As we watch the stock market respond to these bond auction results, it’s a stark reminder of how interconnected our financial systems are. A single auction can shake investor confidence and lead to widespread implications. It’s a complex dance, but with the right strategies and insights, you can position yourself for success, no matter how the market swings.