“Historic $12 Billion Exodus: Are Japanese Stocks on the Brink of Collapse?”

Japanese stock market analysis, historic financial trends in Asia, investment strategies for global markets

Historic Weekly Outflow from Japanese Stocks: What It Means for Investors

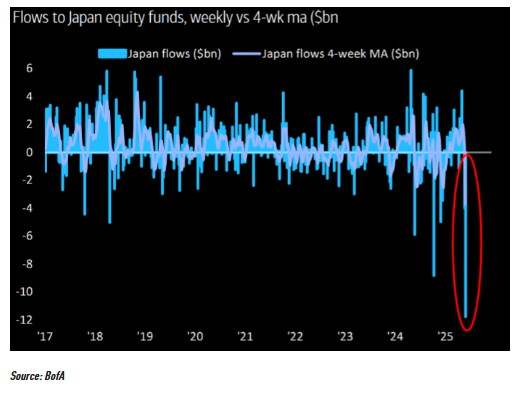

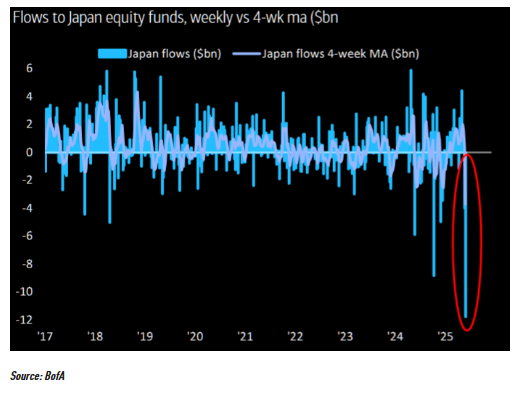

In a shocking turn of events, Japanese stocks have recently experienced a massive outflow of nearly $12 billion in a single week, marking the largest such outflow in history. This significant financial development has raised eyebrows globally and has left many investors wondering what is driving this unprecedented shift in capital.

Understanding the Scale of the Outflow

The reported outflow, which was highlighted in a tweet by Barchart, has sent ripples through the financial markets. Such a substantial withdrawal of funds indicates a loss of confidence among investors in the Japanese stock market. Historically, outflows of this magnitude are rare and often signal underlying economic issues or a shift in investor sentiment.

As Japan’s economy faces various challenges, including an aging population, sluggish growth, and deflationary pressures, the recent withdrawal may be a reflection of broader concerns about economic stability. Investors are increasingly cautious, leading to a reevaluation of their positions in Japanese equities.

Factors Contributing to the Outflow

Several key factors have contributed to this massive outflow from Japanese stocks:

1. **Economic Concerns**: Japan has long grappled with economic stagnation and a declining birthrate, resulting in a shrinking workforce. These structural challenges raise concerns about long-term growth prospects.

2. **Global Economic Conditions**: Recent global economic uncertainties, including inflationary pressures and rising interest rates in other major economies, have prompted investors to seek safer or more promising investment opportunities elsewhere.

3. **Market Volatility**: The Japanese stock market has exhibited increased volatility in recent months, causing some investors to pull back amid fears of potential losses. This volatility can be driven by both domestic and international factors, including geopolitical tensions.

4. **Currency Fluctuations**: The strength or weakness of the Japanese yen can also impact investment decisions. A weaker yen might make Japanese exports more competitive but could deter foreign investment as it affects returns.

The Impact on Japanese Stocks

The immediate impact of this historic outflow is likely to be felt across various sectors of the Japanese stock market. Companies that rely heavily on foreign investment may experience significant declines in their stock prices as confidence wanes.

Additionally, sectors such as technology, manufacturing, and exports, which are vital to Japan’s economy, could be adversely affected. A sustained outflow may lead to a broader market correction, as investors reassess their positions and move capital to markets perceived as more stable or lucrative.

What This Means for Investors

For investors, this development serves as a critical reminder of the importance of diversification and vigilance in portfolio management. Here are a few strategies that investors might consider in light of this outflow:

1. **Diversification**: As the Japanese market faces uncertainty, diversifying investments across different regions and sectors can help mitigate risks. Investors should consider allocating funds to emerging markets or established economies that show stronger growth potential.

2. **Stay Informed**: Keeping abreast of economic indicators and market trends in Japan and globally will help investors make informed decisions. Understanding the implications of macroeconomic factors, such as interest rates and inflation, is crucial.

3. **Risk Assessment**: Investors should continually assess their risk tolerance and investment strategies. If exposure to Japanese equities is a concern, it may be prudent to rebalance portfolios to align with current market realities.

4. **Long-term Perspective**: While short-term volatility can be unsettling, maintaining a long-term investment perspective can lead to better outcomes. Historically, markets have rebounded from downturns, and investors who remain patient often see their investments recover over time.

Conclusion: Navigating the Uncertainty

The record-breaking outflow from Japanese stocks underscores a pivotal moment for investors and the broader financial landscape. As Japan grapples with significant economic challenges, the massive withdrawal of nearly $12 billion serves as a crucial indicator of market sentiment.

For those invested in or considering Japanese equities, it is essential to approach the situation with a strategic mindset. By diversifying investments, staying informed, and maintaining a long-term perspective, investors can navigate the uncertainty and position themselves for future opportunities.

As the situation continues to evolve, keeping a close eye on market trends and economic indicators will be vital. The Japanese stock market may face hurdles in the short term, but with careful planning and analysis, investors can weather the storm and emerge stronger in the long run.

BREAKING : Japan

Japanese Stocks just saw a weekly outflow of almost $12 Billion, the largest in history pic.twitter.com/Rv2av1qG3G

— Barchart (@Barchart) May 31, 2025

BREAKING : Japan’s Stock Market Sees Unprecedented Outflow

If you’ve been keeping an eye on the financial news lately, you might have stumbled upon a jaw-dropping report: Japanese stocks just faced a staggering weekly outflow of nearly $12 billion, marking the largest outflow in history. That’s right! This news, shared by Barchart, has sent shockwaves through the financial community and left investors on edge. But what does this mean for Japan, its economy, and global markets? Let’s dive in and unpack this significant event.

Understanding the Outflow: What Happened?

So, what exactly led to this massive outflow? Essentially, a combination of factors has triggered investors to pull their money out of the Japanese stock market. Economic concerns, geopolitical tensions, and shifts in market sentiment have all contributed to this historical event.

Economic Concerns

Japan has been grappling with several economic challenges. Despite efforts to stimulate growth, the country continues to face low inflation rates and sluggish economic performance. Investors are increasingly wary of the Bank of Japan’s monetary policies, which have included negative interest rates and extensive asset purchases. These measures, while aimed at boosting the economy, have led to skepticism about their long-term effectiveness.

Geopolitical Tensions

On the international front, geopolitical tensions in the Asia-Pacific region have also played a role. Issues such as North Korea’s missile tests and strained relations with neighboring countries have created an atmosphere of uncertainty. This unpredictability has led many investors to reconsider their positions in Japanese stocks, seeking safer havens for their capital.

Market Sentiment Shift

The sentiment in the stock market can shift rapidly, and it appears we’re witnessing one of those shifts right now. With the prospect of rising interest rates in other parts of the world, particularly the United States, many investors are reevaluating their portfolios. The allure of higher returns in more stable markets has drawn attention away from Japan, leading to a surge in outflows.

The Impact on Japanese Stocks

The immediate impact of this outflow is evident: Japanese stock indices have seen significant declines. The Nikkei 225 and Topix indices have both taken hits as investors react to these alarming figures. But what does this mean for the future?

Short-Term Effects

In the short term, we can expect increased volatility in Japanese stocks. The outflow has created a sense of panic among some investors, leading to further sell-offs. This could result in lower stock prices, at least until stability returns to the market. Companies with strong fundamentals may find themselves undervalued, presenting potential buying opportunities for those looking to invest in Japan.

Long-Term Considerations

Looking further down the road, the long-term implications of this outflow could be significant. If Japan’s economic challenges aren’t addressed effectively, we might see more investors looking elsewhere for growth opportunities. The government and the Bank of Japan will need to take decisive actions to restore confidence in the economy and the stock market.

What Investors Should Do Now

As an investor, you might be wondering what steps to take in light of this outflow. Here are a few strategies to consider:

Diversification is Key

Now more than ever, diversification is crucial. If you have significant investments in Japanese stocks, consider reallocating some of your portfolio to other markets or asset classes. This can help mitigate risk and protect your investments from further declines.

Stay Informed

Keep a close eye on news related to Japan’s economy, as well as global market trends. Being informed will allow you to make smarter investment decisions. Follow reliable financial news sources and stay updated on any changes in monetary policy or geopolitical developments.

Look for Opportunities

While the current environment may seem bleak, downturns can often present great buying opportunities. Look for fundamentally strong companies that may be undervalued as a result of the outflow. Performing thorough research and analysis can help you identify stocks with potential for long-term growth.

Global Implications of Japan’s Market Outflow

The implications of Japan’s stock market outflow extend beyond its borders. Global investors are watching closely, as Japan is the third-largest economy in the world. A significant downturn in its market can have ripple effects on other economies, especially those in Asia.

Impact on Asian Markets

Other Asian markets may experience increased volatility as investors react to the news from Japan. If money continues to flow out of Japan, neighboring economies could benefit as investors seek opportunities in countries like South Korea, Taiwan, and China. However, this shift could also lead to increased competition for investment dollars, which may drive prices higher in those markets.

Global Financial Markets

Investors worldwide should also be aware of how Japan’s outflow can impact global financial markets. As Japan is a significant player in international trade and finance, any instability can influence currency markets, commodities, and even interest rates globally. For example, if investors flock to safer assets like U.S. Treasuries, we may see yields drop, impacting borrowing costs and investment strategies in other nations.

Final Thoughts on Japan’s Stock Market Situation

The recent outflow of almost $12 billion from Japanese stocks is a wake-up call for investors and policymakers alike. It emphasizes the need for a robust economic strategy to address the underlying issues that are driving this behavior. For investors, staying informed, diversifying, and looking for opportunities in challenging times can make all the difference.

As we navigate this turbulent landscape, remember that markets are cyclical. What goes down can come back up, and with the right approach, you can position yourself to take advantage of future opportunities in Japan and beyond.

For more financial insights and updates, be sure to check out resources like Barchart and other reputable financial news outlets.

“`

BREAKING : Japan Japanese Stocks just saw a weekly outflow of almost $12 Billion, the largest in history