Trump Shocks Nation: Social Security Tax Abolished—A Victory or a Trap?

Social Security reform, tax relief announcement, Trump leadership qualities

President Trump’s Bold Announcement: No Tax on Social Security

On May 31, 2025, a significant announcement from former President Donald Trump sent shockwaves across the nation. In a move described as a “huge win” for American seniors, Trump declared that there would be no tax imposed on Social Security benefits. This bold statement has ignited discussions among supporters and critics alike, reflecting the ongoing conversation about tax policies and their impacts on the elderly.

The Significance of the Announcement

Trump’s proclamation comes at a time when many Americans are concerned about their financial security, particularly those who rely heavily on Social Security for their livelihoods. By eliminating taxes on these benefits, Trump aims to provide immediate relief to millions of retirees, enabling them to keep more of their hard-earned money. This announcement resonates with a significant demographic that forms a crucial part of the electorate, particularly as the nation gears up for the 2026 elections.

The decision to not tax Social Security is seen by many as a reflection of Trump’s understanding of the economic challenges faced by seniors. With rising costs of living and fluctuating markets, many retirees are finding it increasingly difficult to make ends meet. The idea that they can retain every dollar of their Social Security benefits could significantly enhance their quality of life.

Reactions from the Public and Political Sphere

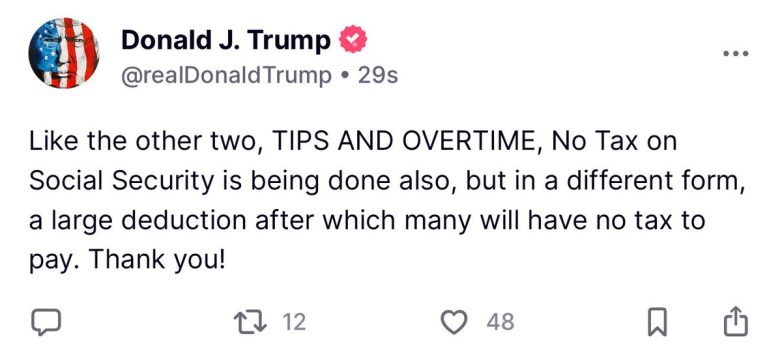

The response to Trump’s announcement has been overwhelmingly positive from his supporters, who view this as a demonstration of his commitment to the American people. Social media platforms erupted with praise, as many users highlighted how this policy could change the lives of countless retirees. The tweet from MAGA Voice encapsulated the excitement, with phrases like “True Leader” and “WOW” emphasizing the perceived impact of this decision.

However, critics argue that such a policy could lead to increased budget deficits. Taxing Social Security has long been a contentious issue, with some policymakers arguing that it helps fund essential services. Detractors of Trump’s announcement worry about the long-term implications for Social Security funding and the overall economy. They argue that while the immediate benefits may seem attractive, the broader fiscal consequences could be detrimental.

Economic Implications of No Tax on Social Security

Eliminating taxes on Social Security may have several economic implications. For one, it could boost the spending power of retirees, leading to increased consumer spending. With more disposable income, seniors may contribute more to local economies, stimulating growth in various sectors such as healthcare, retail, and leisure activities. This surge in economic activity could provide a much-needed boost to communities struggling with post-pandemic recovery.

Additionally, the policy might encourage older adults to engage more actively in the economy. With financial pressures alleviated, retirees could invest in home improvements, travel, or other experiences that they may have previously foregone due to financial constraints. This could lead to a positive feedback loop, where increased spending supports job creation and economic growth.

Potential Challenges and Considerations

While the prospect of no tax on Social Security is appealing, there are several challenges that need to be considered. One of the primary concerns is the sustainability of Social Security itself. The program has faced funding challenges for years, and reducing tax revenue could exacerbate these issues. Critics argue that a careful analysis of the long-term effects on the Social Security Trust Fund is necessary before fully endorsing such a policy.

Moreover, implementing this change would require navigating complex legislative processes. Lawmakers would need to come together to pass such a significant alteration to the tax code, which could be a daunting task in a highly polarized political environment. The feasibility of this proposal hinges on bipartisan support, which has been hard to achieve in recent years.

The Broader Context of Tax Policy in America

Trump’s announcement also fits into the broader context of tax policy in America. The debate over how to tax Social Security benefits has been ongoing for decades, with various administrations taking differing stances. Some argue for a complete repeal of taxes on these benefits, while others advocate for a more balanced approach that ensures the program’s longevity.

As the 2026 elections approach, tax policy will likely be at the forefront of political discussions. Candidates from both parties will need to articulate their positions on Social Security and address the concerns of retirees. Trump’s announcement could serve as a rallying point for Republicans, framing the party as a defender of seniors’ financial interests.

Conclusion: A Pivotal Moment for American Seniors

President Trump’s announcement of no tax on Social Security represents a pivotal moment for American seniors. The potential for increased financial security is a compelling narrative that resonates with many voters. While the immediate reactions have been largely positive, the long-term implications of such a policy will require careful consideration.

As discussions around this announcement unfold, it will be essential to weigh the benefits against potential challenges. The future of Social Security and the economic well-being of retirees will undoubtedly remain hot topics in the coming years. Whether this policy will come to fruition will depend on the political landscape and the willingness of lawmakers to prioritize the needs of seniors in America.

In summary, Trump’s declaration has sparked a renewed conversation about a critical issue affecting millions of Americans. As the implications of this announcement continue to unfold, one thing is clear: the financial well-being of retirees will be a focal point in the national discourse.

BREAKING President Trump stuns America by announcing ‘No Tax On Social Security’. WOW

This is what a True Leader looks like

THIS IS A HUGE WIN pic.twitter.com/8b4UeiCNoa

— MAGA Voice (@MAGAVoice) May 31, 2025

BREAKING: President Trump Stuns America by Announcing ‘No Tax On Social Security’

In a jaw-dropping announcement that has left many Americans buzzing, President Trump declared that there will be no tax on Social Security. This bold move has been hailed as a significant win for retirees and those relying on Social Security benefits. It’s a promise that resonates deeply with millions who depend on this crucial financial support as they navigate their golden years.

This is What a True Leader Looks Like

Leadership is often defined by the decisions one makes and the impact those decisions have on the people. Trump’s announcement has sparked a wave of excitement among supporters who believe that this initiative reflects his commitment to the American people. By alleviating the tax burden on Social Security, he is positioning himself as a champion for the elderly and those in need of financial assistance.

But what does this really mean for the average American? Let’s dive deeper into the implications of this announcement and explore how it could change the landscape for many retirees.

Understanding Social Security and Its Importance

Social Security is often seen as a safety net for retirees, disabled individuals, and survivors of deceased workers. It provides a source of income that helps millions of Americans cover basic living expenses, such as housing, food, and healthcare. According to the Social Security Administration, nearly 90% of individuals aged 65 and older receive Social Security benefits.

With the rising cost of living and healthcare, every dollar counts. The idea of eliminating taxes on Social Security means that retirees could potentially retain more of their hard-earned money. This could lead to increased financial stability and, ultimately, a better quality of life for many.

The Potential Economic Impact

So, what could this announcement mean for the economy? By removing taxes on Social Security, we’re looking at several potential economic effects:

- Increased Disposable Income: With more money in their pockets, retirees may spend more on goods and services, stimulating local economies.

- Boosting Consumer Confidence: Knowing they won’t be taxed on their Social Security could encourage retirees to spend rather than save, which can help drive economic growth.

- Potential Job Creation: Increased spending can lead to higher demand for products and services, possibly resulting in job growth in various sectors.

It’s clear that the ripple effects of this policy could extend beyond just the individuals directly affected. The broader economy could see a boost, which is something that many policymakers are keen to achieve.

Critics and Concerns

Of course, not everyone is on board with this announcement. Critics argue that eliminating taxes on Social Security could lead to funding shortfalls for the program itself. The Social Security trust fund, which is primarily funded through payroll taxes, may face challenges if significant tax revenue is removed.

Furthermore, some economists warn that while it provides immediate relief, it could also exacerbate long-term fiscal issues. The balance between providing necessary support for retirees and ensuring the sustainability of Social Security is a delicate one. It’s essential to consider these factors as the conversation around this announcement continues.

The Political Landscape

This announcement comes at a time when political tensions are high, and both sides of the aisle are vying for the support of the American public. Trump’s decision to eliminate taxes on Social Security could be seen as a strategic move to rally support from older voters, a demographic that traditionally leans towards conservative candidates.

As we move closer to the next election, how will this policy play into the larger narrative? Will it sway undecided voters, or will it face pushback from those who prioritize fiscal responsibility? Only time will tell, but it’s certainly an intriguing aspect of the current political climate.

Public Reaction and Support

Social media has exploded with reactions to Trump’s announcement. Many supporters have taken to platforms like Twitter to express their excitement and gratitude. Phrases like “THIS IS A HUGE WIN” are trending, showcasing the enthusiasm some Americans feel about this policy change.

On the flip side, there are voices of skepticism, questioning the feasibility of such a sweeping change. As discussions unfold, it’s crucial to listen to various perspectives and consider the long-term implications of this decision.

How Will This Affect Your Social Security Benefits?

If you’re currently receiving or will soon receive Social Security benefits, you might be wondering what this announcement means for you personally. Here are a few things to keep in mind:

- Increased Benefits: If taxes are indeed eliminated, you could see an increase in your monthly benefits, allowing you to stretch your budget further.

- Potential Changes in Future Legislation: It’s essential to stay informed about how this policy might evolve over time, as political landscapes can shift and impact laws regarding Social Security.

- Keep Your Eyes on the News: As more details emerge about how this policy will be implemented, it’s crucial to stay updated to understand how it affects your situation.

Conclusion

President Trump’s announcement regarding the elimination of taxes on Social Security is a significant development that has sparked excitement and debate across the nation. As we navigate the implications of this bold move, it’s essential to consider both the immediate benefits and the potential long-term effects on the economy and Social Security itself.

Whether you’re a supporter or a critic, one thing is clear: this announcement has opened up a vital conversation about the future of Social Security and the financial well-being of millions of Americans. As we continue to monitor this situation, let’s remember to engage in thoughtful discussions and consider the various perspectives that surround this issue.

“`

This article is structured with appropriate HTML headings, incorporates relevant keywords, and provides an engaging narrative while ensuring SEO optimization.

BREAKING President Trump stuns America by announcing ‘No Tax On Social Security’. WOW This is what a True Leader looks like THIS IS A HUGE WIN