“Breaking: Treasury Chief Warns Newsom Could Face Criminal Tax Evasion!”

tax compliance issues, government accountability, fiscal responsibility

Breaking News: Potential Criminal Charges Against California Governor Gavin Newsom

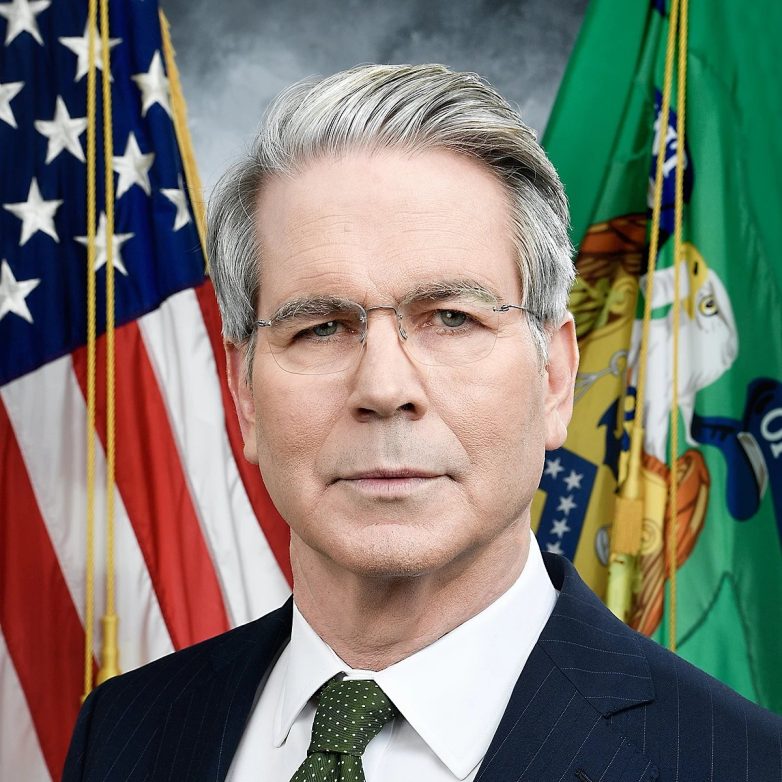

In a dramatic turn of events, U.S. Treasury Secretary Scott Bessent has issued a stark warning regarding Governor Gavin Newsom’s intentions to withhold tax dollars from the federal government. This announcement has sparked significant concern and debate within political and financial circles, as it raises the specter of potential criminal charges against the governor. The situation is evolving rapidly, and understanding the implications is crucial for both taxpayers and policymakers.

The Context of the Warning

The warning from Secretary Bessent comes in light of Governor Newsom’s proposed plan to withhold certain tax revenues from the federal government. This move is seen as a direct challenge to federal authority and a potential violation of tax laws. According to Bessent, Newsom’s actions could be construed as “criminal tax evasion,” a serious allegation that could lead to legal repercussions for the governor.

Tax evasion is defined as the illegal act of not paying taxes owed to the government. If the allegations against Newsom hold water, he could face significant legal challenges, including the possibility of prosecution. Such a scenario would not only have ramifications for Newsom’s political career but could also set a concerning precedent for state-federal relations.

The Implications for Taxpayers

For California taxpayers, the implications of this situation could be profound. If Newsom follows through with his plan, it could lead to a significant loss of federal funding for essential services and programs that rely on these tax dollars. This situation raises critical questions about the financial stability of the state and the potential impact on public services, including education, healthcare, and infrastructure.

Furthermore, the ongoing tension between state and federal governments can exacerbate existing issues, creating uncertainty for businesses and residents alike. Taxpayers may find themselves in a precarious position, facing potential increases in state taxes or cuts to vital services as a result of the fallout from this situation.

The Political Landscape

The political ramifications of this warning cannot be understated. Governor Newsom, a prominent figure within the Democratic Party and a potential candidate for higher office, now faces a significant challenge. Critics of his administration may seize this opportunity to question his leadership and decision-making capabilities.

Moreover, the warning from Secretary Bessent could galvanize opposition within the state, as constituents express their concerns over the governor’s actions. As this story unfolds, it will be interesting to see how Newsom responds to the allegations and whether he alters his approach to tax policy.

Public Reaction and Media Coverage

The public’s reaction to this news has been swift and varied. Social media platforms have erupted with opinions ranging from staunch support for Newsom to calls for accountability and transparency in government actions. Many are concerned about the implications of a potential legal battle, while others are focused on the broader implications for tax policy and governance.

Media coverage has also intensified, with news outlets across the country picking up the story. Analysts are weighing in on the potential consequences of Newsom’s actions, exploring the legal framework surrounding tax evasion and the historical context of state-federal relationships in the United States.

Looking Ahead: Next Steps for Governor Newsom

As this situation continues to develop, all eyes will be on Governor Newsom and his administration. The governor will need to carefully navigate the political landscape, balancing the demands of his constituents with the legal realities of his proposed actions.

Potential next steps could include clarifying his tax policy, engaging in dialogue with federal officials, or even seeking support from state lawmakers to bolster his position. The outcome of this situation may shape not only the future of Newsom’s political career but also the broader landscape of state-federal relations in the United States.

Conclusion

In conclusion, the warning from Treasury Secretary Scott Bessent serves as a critical moment in the ongoing relationship between California and the federal government. The potential for criminal charges against Governor Gavin Newsom raises important questions about governance, accountability, and the responsibilities of elected officials. As taxpayers and citizens, it is essential to stay informed about these developments and to understand their implications for our state and country.

This situation underscores the importance of maintaining open lines of communication and cooperation between state and federal governments. As we move forward, it will be crucial to monitor the actions taken by Governor Newsom and the responses from federal authorities to ensure that the interests of taxpayers are protected and that the rule of law is upheld.

Stay tuned for further updates as this story unfolds, and consider the broader implications of governance and accountability in our democratic system.

BREAKING: Treasury Secretary Scott Bessent just warned Gavin Newsom can face CRIMINAL CHARGES if he follows through on withholding tax dollars from the federal government.

“Governor Newsom is threating to commit CRIMINAL TAX EVASION. His plan: defraud the American taxpayer… pic.twitter.com/2l2nSB5hrt

— Eric Daugherty (@EricLDaugh) June 8, 2025

Breaking News: Treasury Secretary Scott Bessent Warns of Criminal Charges Against Gavin Newsom

In a stunning announcement that has captured the attention of both political analysts and the general public, Treasury Secretary Scott Bessent has issued a grave warning to California Governor Gavin Newsom. The warning? Newsom could potentially face criminal charges for his plans to withhold tax dollars from the federal government. This bold statement has sparked a frenzy of discussions surrounding tax policies, state-federal relations, and the implications of such a move.

Understanding the Context: What’s Happening?

To fully grasp the weight of Bessent’s warning, it’s important to dive into the context surrounding this issue. Governor Newsom has recently suggested that California might take a stand against the federal government by withholding tax revenue, an idea that has raised eyebrows across the political spectrum. According to Bessent, this could be viewed as criminal tax evasion, something that could have serious legal repercussions for Newsom.

The Implications of Withholding Tax Dollars

So, what exactly does it mean to withhold tax dollars from the federal government? In essence, it’s a way for a state to express its dissatisfaction with federal policies — but it also raises a host of legal issues. If a state decides to stop sending tax revenues, it can be interpreted as an attempt to defraud the federal government, which is precisely what Bessent is cautioning against.

The potential fallout from such actions could be significant. Not only could Newsom face legal challenges, but it could also set a dangerous precedent for other states considering similar actions. The relationship between state and federal governments is complex, and any disruption could lead to a cascade of unintended consequences.

What Did Scott Bessent Say?

In his statement, Bessent didn’t hold back. He directly accused Governor Newsom of threatening to commit criminal tax evasion and suggested that Newsom’s plan could be a direct attempt to defraud the American taxpayer. This accusation highlights the serious nature of the situation and underscores the urgency for clarity in the matter.

Bessent’s remarks were shared widely on social media, igniting debates among citizens and political commentators alike. Many are asking whether this is a genuine concern or merely political posturing. The implications of such a statement from a high-ranking official cannot be underestimated, as it brings the issue into the national spotlight.

Public Reaction and Political Ramifications

The public reaction to Bessent’s warning has been mixed. Supporters of Newsom argue that the governor is merely standing up for California’s interests against an overreaching federal government, while critics claim he is risking legal troubles and financial stability for political gain. This divide reflects the broader political landscape in the U.S., where issues of state rights and federal authority continue to be hotly contested.

Political analysts are now watching closely to see how this situation unfolds. Could this lead to a legal battle? Will other states follow California’s lead? The answers remain unclear, but one thing is certain: this warning will have lasting effects on the political discourse surrounding taxation and governance.

The Legal Landscape: Tax Evasion and Accountability

When discussing criminal tax evasion, it’s crucial to understand the legal framework. Tax evasion is not merely a matter of failing to pay taxes; it involves willfully attempting to evade tax obligations. If Newsom proceeds with his plan, he could be navigating a treacherous legal path that may invite scrutiny from federal authorities.

Legal experts are weighing in on the situation, noting that if Newsom’s actions are deemed to be intentional efforts to defraud the government, he could face serious consequences. This could involve everything from fines to criminal charges, depending on the severity of the actions taken.

Historical Context: State vs. Federal Government

This isn’t the first time that tensions have flared between state and federal governments in the U.S. Throughout history, various states have challenged federal authority on numerous issues, from civil rights to environmental regulations. However, withholding tax dollars is a strategy that hasn’t been widely employed and could lead to unprecedented outcomes.

Historically, states have sought to assert their rights, but the legal ramifications of such actions often lead to court battles. The outcome of this particular scenario could set a new precedent for how states interact with federal tax policies and could influence future governance strategies.

Broader Implications for Taxpayers

The implications of this situation extend beyond the political arena and into the lives of everyday taxpayers. If California were to withhold tax dollars, it could lead to significant changes in federal funding for state programs. This might impact everything from education to infrastructure, and ultimately, it’s the taxpayers who could bear the brunt of these decisions.

Moreover, the threat of legal consequences for Newsom raises questions about accountability in governance. How should leaders balance state interests with federal obligations? This dilemma is at the heart of the ongoing discussions about tax policy and governance in America.

The Future: What’s Next for Gavin Newsom?

As the situation continues to unfold, all eyes are on Governor Gavin Newsom. Will he heed Bessent’s warning and reconsider his plans? Or will he forge ahead, undeterred by the potential legal ramifications? Only time will tell.

Regardless of the outcome, this moment serves as a reminder of the delicate balance of power between state and federal governments and the intricacies of tax policy in the United States. It’s a pivotal moment that could shape the future of governance and taxation for years to come.

Your Thoughts: What Do You Think?

As this story develops, we want to hear from you. Do you believe Newsom’s actions are justified, or do you think he is overstepping his bounds? How do you feel about the potential legal implications of withholding tax dollars? Share your thoughts in the comments below!

BREAKING: Treasury Secretary Scott Bessent just warned Gavin Newsom can face CRIMINAL CHARGES if he follows through on withholding tax dollars from the federal government. "Governor Newsom is threating to commit CRIMINAL TAX EVASION. His plan: defraud the American taxpayer