“Senator Schmitt’s Controversial 15% Tax on Remittances Sparks Outrage!”

remittance tax legislation, Mexican protests impact, US-Mexico financial relations

Introduction

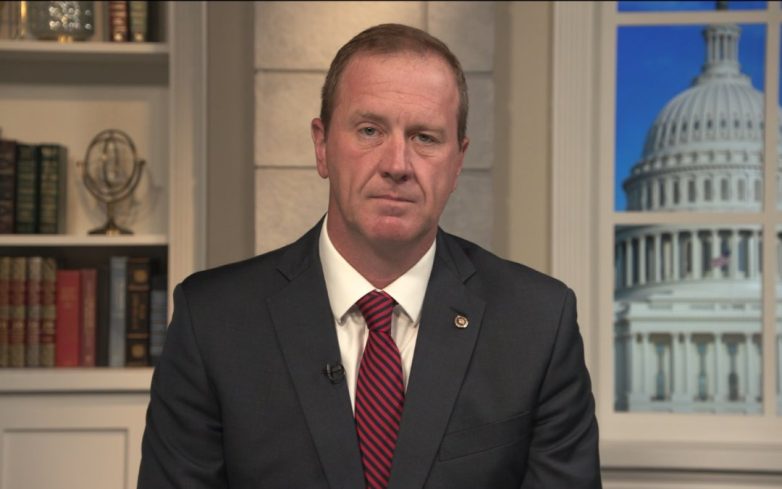

In recent political developments, Mexican President Andrés Manuel López Obrador’s call for protests in the United States has sparked significant reactions from U.S. lawmakers. Notably, Senator Eric Schmitt has proposed a substantial increase in the tax on remittances sent from the United States to Mexico. This proposed legislation, which aims to raise the remittance tax from 3.5% to an eye-catching 15%, has ignited discussions surrounding its potential implications, both economically and socially.

The Context of the Proposed Legislation

Senator Schmitt’s introduction of this legislation comes against the backdrop of increasing tensions between the U.S. and Mexico. The calls for protests by President López Obrador are seen by some as a direct challenge to U.S. policies and attitudes towards Mexico. In light of this, Schmitt’s proposal appears to be a response aimed at addressing concerns about economic strain caused by remittances.

Remittances, which are funds sent back to Mexico by Mexican nationals living in the U.S., represent a significant source of income for many families in Mexico. In fact, billions of dollars are transferred annually, making remittances a crucial component of the Mexican economy. Schmitt’s proposed increase in the remittance tax aims to generate additional revenue for the U.S. government while also reflecting a broader sentiment among some lawmakers that foreign aid should not be funded through the financial contributions of everyday Americans.

Implications of the Increased Remittance Tax

The proposed increase from a 3.5% tax to a staggering 15% could have profound implications. For many families in Mexico relying on these funds for everyday expenses, such as food, education, and healthcare, this increase could result in reduced financial support. The additional taxes may lead to a decrease in the amount of money sent back home, affecting the quality of life for countless individuals who depend on these remittances.

Moreover, the legislation may also have adverse effects on the relationship between the U.S. and Mexico. By imposing such a hefty tax, it could be perceived as a punitive measure against Mexican nationals and could exacerbate already tense diplomatic relations. Critics of the legislation argue that it does not address the root causes of migration and economic disparity but instead penalizes those who are trying to support their families from afar.

Public Reaction and Opposition

The public reaction to Senator Schmitt’s proposal has been mixed. Many advocates for immigrant rights and organizations that support Mexican nationals in the U.S. have expressed strong opposition to the tax increase. They argue that it unfairly targets vulnerable communities and overlooks the significant contributions that immigrants make to the U.S. economy.

On the other hand, proponents of the legislation argue that it is a necessary step to ensure that the financial burden of supporting foreign economies does not fall on American taxpayers. They believe that by increasing the tax on remittances, the U.S. government can better manage its financial resources and address domestic economic issues.

Economic Impact on the U.S. and Mexico

The economic ramifications of a 15% remittance tax could extend beyond individual families and affect broader economic dynamics. For the U.S., this legislation may serve as a means to generate additional revenue, but it could also deter individuals from sending money back home, leading to a decrease in remittance flows.

In Mexico, the immediate impact could be a reduction in the funds that families receive, which could in turn affect local economies that are heavily reliant on this influx of cash. Many businesses in Mexico depend on the purchasing power of families receiving remittances, and a decline in these funds could lead to decreased consumer spending and economic slowdown in certain regions.

Political Landscape and Future Considerations

As discussions surrounding the remittance tax continue, the political landscape is likely to shift. The proposal has the potential to mobilize various interest groups, including immigrant rights advocates, economic analysts, and policymakers. The debate may also influence upcoming elections, as candidates position themselves on issues related to immigration and economic policy.

In the future, it will be essential for lawmakers to consider alternative solutions to address the underlying issues that lead to high levels of remittances. Initiatives aimed at improving economic conditions in Mexico, such as investments in infrastructure, education, and job creation, could serve as more sustainable approaches to reduce dependency on remittances.

Conclusion

Senator Eric Schmitt’s proposal to increase the remittance tax to 15% has sparked significant attention and debate. While it aims to generate additional revenue and address concerns about foreign aid, the potential consequences for families in Mexico and the diplomatic relationship between the U.S. and Mexico cannot be overlooked. As the situation unfolds, it will be crucial for policymakers to engage in constructive dialogue and explore comprehensive solutions that address both economic and humanitarian concerns. The outcome of this proposed legislation will likely have lasting effects on the lives of many and the broader economic landscape of both nations.

In conclusion, as the discourse around remittance taxes continues, it is essential for all stakeholders to consider the long-term implications of such policies and work towards solutions that foster cooperation and economic stability for both the U.S. and Mexico.

WHOAH! Following the Mexican President’s call for protests in the United States, Senator Eric Schmitt will be introducing legislation to impose a 15% tax on all remittances to Mexico.

“I’m introducing legislation to quadruple the proposed remittance tax — from 3.5% to 15%.… pic.twitter.com/iQ7V92IpLV

— George (@BehizyTweets) June 9, 2025

WHOAH! Following the Mexican President’s Call for Protests in the United States

So, if you’ve been following the news lately, you might have stumbled upon a rather startling announcement regarding the financial relationship between the U.S. and Mexico. Just recently, the Mexican President called for protests in the United States, and it seems that this has sparked quite the political firestorm. Enter Senator Eric Schmitt, who is stepping into the spotlight with a bold legislative move. He’s proposing to impose a whopping 15% tax on all remittances to Mexico. Yes, you read that right – 15%!

What Are Remittances and Why Do They Matter?

Before we dive deeper into the legislation, let’s take a moment to understand what remittances are and why they are crucial. Remittances are money transfers sent by individuals working abroad to their families or communities back home. For Mexico, these funds are a lifeline, significantly contributing to the economy. In fact, in 2021 alone, Mexicans living abroad sent over $40 billion back home, making remittances one of the country’s top sources of income.

Now, imagine the impact of a 15% tax on that amount! This could potentially reduce the funds available for families who rely on this money for everyday expenses, education, and healthcare. So, it’s no wonder the announcement has raised eyebrows.

Eric Schmitt’s Proposed Legislation

Senator Eric Schmitt is making waves with his announcement. He stated, “I’m introducing legislation to quadruple the proposed remittance tax — from 3.5% to 15%.” This move is not just a random policy change; it’s a direct response to the Mexican President’s call for protests and could be seen as a way to exert pressure on the Mexican government.

Now, why would Schmitt want to raise the tax so dramatically? The idea is that by increasing the cost of sending money back home, it might deter some of the political actions that the Mexican government is taking, especially those that stir the pot in the United States. But at what cost?

The Political Implications

The announcement has sparked a heated debate across both sides of the border. Many are seeing this as a political maneuver rather than a genuine concern for economic impacts. Critics argue that this legislation could hurt families who depend on remittances for their survival. After all, the backbone of many Mexican families depends on these funds.

On the flip side, supporters of Schmitt’s proposal might argue that this is a necessary step to demonstrate that the U.S. won’t tolerate any interference in its domestic affairs. It’s a complicated situation that highlights the intricate relationship between the two nations.

Economic Impacts of a 15% Remittance Tax

Let’s break down the potential economic impacts of this proposed remittance tax. First off, it could lead to a significant reduction in the amount of money that families receive. For instance, if someone is sending $500 home every month, under the new tax, that family would receive only $425. Over time, this reduction can add up, severely impacting families who rely on these funds for basic needs.

Furthermore, this tax could lead to a shift in how people send money. Many might turn to informal channels, which could be riskier and less reliable. This shift could undermine the formal financial systems in place and potentially lead to a rise in illegal money transfer methods.

The Reaction from the Mexican Government

With the Mexican President calling for protests and Schmitt proposing this hefty tax, the Mexican government is likely to respond. Historically, Mexico has been vocal about protecting its citizens abroad and advocating for their rights. This situation presents a unique challenge for the Mexican government, as they must balance their response to domestic concerns while also addressing international relations with the U.S.

The protests called by the Mexican President could serve as a rallying point for communities in the U.S. who feel that their voices are not being heard. It’s a complex web of political maneuvering that could have lasting implications for U.S.-Mexico relations.

What This Means for Migrants and Their Families

For many migrants and their families, this proposed tax is more than just a political statement; it’s a direct threat to their livelihoods. Many families depend on these remittances for essentials, including food, housing, and education. A sudden increase in tax could mean less money for kids’ tuition or even less food on the table.

Moreover, migrants often work in low-paying jobs and struggle to send money home regularly. Adding a 15% tax could deter them from sending money altogether, which would be devastating for their families back home.

Broader Implications for U.S.-Mexico Relations

This legislative proposal is not just a tax issue; it signals a broader strain in U.S.-Mexico relations. Historically, the two countries have had a complicated but interdependent relationship, with trade, migration, and cultural exchange playing significant roles.

However, with tensions rising over issues like immigration policies, border security, and now this remittance tax, it seems the relationship might be heading into turbulent waters. It’s crucial for both governments to navigate this carefully to avoid escalating the situation further.

Potential Alternatives

Given the potential negative fallout of a remittance tax, one has to wonder if there are better alternatives to address the underlying issues. Instead of imposing a hefty tax, perhaps dialogue and collaboration between the U.S. and Mexico could lead to more constructive solutions.

For example, both governments could work together on policies that address the root causes of migration, such as economic instability and violence in Mexico. By investing in community development and safety, the need for families to rely on remittances could decrease, benefiting everyone involved.

Public Opinion and the Road Ahead

As the news of this proposed tax spreads, public opinion is likely to play a significant role in shaping the outcome. Many people, especially those in the immigrant community, will undoubtedly voice their concerns regarding the impact of such a tax.

Social media platforms, community organizations, and advocacy groups will likely rally to oppose the legislation, emphasizing the need for compassion and understanding in policy-making. It’s essential for lawmakers to listen to their constituents and consider the human impact of their decisions.

Conclusion: A Wait-and-See Approach

As we keep an eye on how this situation develops, one thing is clear: the proposed remittance tax could have far-reaching effects on families, economies, and international relations. It’s a complex issue that deserves thoughtful consideration and dialogue. While Senator Eric Schmitt’s proposal may be seen as a political tactic, the real consequences will be felt by the millions of families who depend on remittances to survive.

Moving forward, it will be interesting to see how both the U.S. and Mexican governments respond to this challenge and what steps they will take to ensure that the needs of their citizens are met without compromising their political integrity.

WHOAH! Following the Mexican President's call for protests in the United States, Senator Eric Schmitt will be introducing legislation to impose a 15% tax on all remittances to Mexico. "I'm introducing legislation to quadruple the proposed remittance tax — from 3.5% to 15%.