Bitcoin Surges Past $100K for 30 Days: Is This the Start of a Crypto Revolution?

Bitcoin price surge, cryptocurrency market trends, digital asset investment strategies

Bitcoin Surpasses $100,000 for 30 Consecutive Days: A Historic Milestone

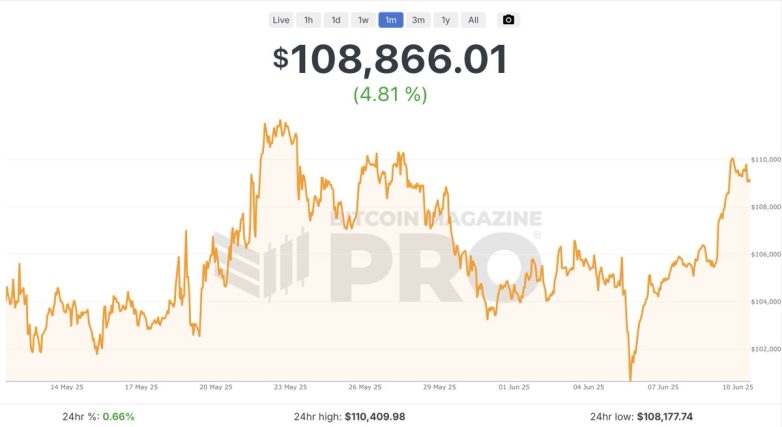

In a remarkable development for the cryptocurrency world, Bitcoin has maintained a price above $100,000 for an unprecedented 30 consecutive days. This milestone, reported by Bitcoin Magazine on June 10, 2025, marks a significant moment in the evolution of Bitcoin as both a digital asset and a mainstream investment. This article will delve into the implications of this achievement, the factors that contributed to this surge, and what it could mean for the future of Bitcoin and the cryptocurrency market.

The Significance of Bitcoin Reaching $100,000

Reaching the $100,000 mark signifies more than just a number; it represents a culmination of years of growth, acceptance, and technological advancements within the cryptocurrency sector. This price point has long been regarded as a psychological barrier for investors and enthusiasts alike. The fact that Bitcoin has not only reached but sustained this price for 30 days illustrates a newfound stability and confidence in the market.

Historically, Bitcoin has been known for its volatility, with prices swinging dramatically in short periods. However, this recent achievement indicates a shift towards a more mature market, where investors are beginning to see Bitcoin as a reliable store of value, comparable to traditional assets like gold.

Factors Driving Bitcoin’s Price Surge

Several key factors contributed to Bitcoin’s recent price surge and its ability to maintain this level:

1. **Increased Institutional Adoption**: Over the past few years, more institutional investors have entered the cryptocurrency space, treating Bitcoin as a legitimate asset class. Major companies and financial institutions have begun to allocate portions of their portfolios to Bitcoin, seeking to capitalize on its potential for appreciation.

2. **Global Economic Uncertainty**: In light of ongoing global economic challenges, including inflation and geopolitical tensions, many investors are turning to Bitcoin as a hedge against traditional market fluctuations. This trend has been amplified by Bitcoin’s fixed supply, which contrasts sharply with fiat currencies subject to inflationary pressures.

3. **Technological Advancements**: The development of Bitcoin’s underlying technology, including improvements in scalability and transaction efficiency, has made it more appealing for everyday use. The Lightning Network, for instance, allows for faster transactions and lower fees, enhancing Bitcoin’s utility as a medium of exchange.

4. **Growing Public Awareness**: As more individuals become educated about cryptocurrencies, Bitcoin’s mainstream acceptance continues to grow. Increased media coverage, social media discussions, and the proliferation of cryptocurrency exchanges have all contributed to a more informed investor base.

The Future of Bitcoin and Cryptocurrency Market Trends

As Bitcoin continues to hover above the $100,000 mark, many are left wondering what the future holds for this digital currency. The sustained price point could lead to several potential outcomes:

1. **Continued Growth**: If Bitcoin maintains its appeal to both retail and institutional investors, it could see continued upward momentum. As more people recognize its value proposition, demand may increase, pushing prices even higher.

2. **Increased Regulation**: With growing interest in Bitcoin, regulatory bodies around the world may take a closer look at cryptocurrency markets. While regulation can provide a framework for investor protection, it could also introduce challenges for innovation and market dynamics.

3. **Market Competition**: As Bitcoin solidifies its position, other cryptocurrencies will continue to compete for market share. Innovations in blockchain technology and the emergence of new cryptocurrencies could shift investor focus, potentially impacting Bitcoin’s dominance.

4. **Integration into Financial Systems**: The integration of Bitcoin into traditional financial systems, such as payment processors and banking services, may further legitimize its use. This could enhance Bitcoin’s role as a global currency, facilitating everyday transactions and international trade.

Conclusion: A New Era for Bitcoin

The fact that Bitcoin has remained above $100,000 for 30 consecutive days is a testament to the cryptocurrency’s growing acceptance and maturity. As it continues to evolve, both investors and enthusiasts are left with a sense of optimism about the future of Bitcoin.

The implications of this milestone extend beyond mere price appreciation; they signal a shift in how Bitcoin is perceived within the global financial landscape. As market dynamics continue to change, Bitcoin stands at the forefront of a new era in finance, characterized by decentralization, innovation, and the potential to reshape traditional economic models.

Investors and analysts alike will be closely monitoring Bitcoin’s performance in the coming months, as it sets the stage for what could be a transformative period in the world of cryptocurrency. Whether you are a seasoned investor or a newcomer to the cryptocurrency space, the recent developments surrounding Bitcoin offer a compelling narrative of growth, resilience, and potential future opportunities.

Stay informed and engaged as we witness the ongoing evolution of Bitcoin and its impact on the global economy. The journey has just begun, and the future looks bright for this pioneering digital asset.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever! pic.twitter.com/nfccEK3Wf0

— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

Bitcoin Stays Above $100,000 for 30 Consecutive Days

Wow, can you believe it? Bitcoin has officially stayed above $100,000 for 30 consecutive days! This is a monumental achievement in the world of cryptocurrency, and it’s turning heads everywhere. As we dive deeper into this topic, let’s explore what this milestone means for Bitcoin, its future, and the broader cryptocurrency landscape.

Understanding Bitcoin and Its Significance

Bitcoin, the first and most well-known cryptocurrency, was launched back in 2009. Since then, it has gone through numerous ups and downs, but it has always managed to capture the public’s imagination. The fact that it has now held a value of over $100,000 for a whole month is nothing short of revolutionary. This period of stability is unprecedented and speaks volumes about Bitcoin’s growing acceptance and adoption.

The Road to $100,000

Reaching and maintaining the $100,000 mark was no small feat. Several factors contributed to this remarkable milestone. For one, increased institutional interest has played a significant role. Companies like Tesla and MicroStrategy have made substantial investments in Bitcoin, signaling to the market that it’s not just a fad but a legitimate asset class. Additionally, the rise of decentralized finance (DeFi) has introduced more people to cryptocurrencies, further boosting demand.

Market Reactions and Community Sentiment

When the news broke that Bitcoin had surpassed the $100,000 threshold, the cryptocurrency community erupted in celebration. Social media platforms like Twitter were flooded with excitement. Many saw this as a validation of their long-held belief in Bitcoin’s potential. Bitcoin Magazine shared the news on Twitter, highlighting the significance of this achievement. The sentiment in the community is overwhelmingly positive, with many predicting further growth in the coming months and years.

What Does This Mean for Investors?

If you’re an investor or thinking about diving into the world of Bitcoin, this milestone could be a game-changer. Holding steady above $100,000 for 30 days suggests that Bitcoin is maturing as an asset. It’s becoming less volatile and more stable, which is appealing to both retail and institutional investors. However, it’s important to remember that the cryptocurrency market is still inherently risky. Always do your research and consider your financial situation before making any investment decisions.

Future Predictions for Bitcoin

With Bitcoin’s price now firmly above $100,000, what’s next? Many analysts are optimistic. Some predict that Bitcoin could reach even higher, possibly breaking the $200,000 barrier in the near future. Factors such as increased adoption, regulatory clarity, and technological advancements could all contribute to this growth. For example, the implementation of Bitcoin ETFs in various markets could provide more accessibility and liquidity, driving prices even higher.

The Role of Technology in Bitcoin’s Growth

As Bitcoin evolves, so does the technology behind it. Innovations like the Lightning Network are aimed at improving Bitcoin’s scalability and transaction speed. This technological advancement is crucial for Bitcoin to compete with traditional payment systems and could help maintain its price above $100,000. Furthermore, the ongoing development of blockchain technology promises to enhance security and transparency, making Bitcoin an even more attractive option for investors.

Challenges Ahead for Bitcoin

While the future looks bright, Bitcoin is not without its challenges. Regulatory scrutiny remains a significant concern. Governments around the world are still figuring out how to handle cryptocurrencies, and any sudden regulatory changes could impact Bitcoin’s price. Additionally, environmental concerns related to Bitcoin mining have come under fire, prompting discussions about sustainability in the crypto space.

Community and Cultural Impact

The cultural impact of Bitcoin reaching this milestone should not be underestimated. It’s not just a financial asset; it represents a movement towards decentralization and financial independence. Many see Bitcoin as a hedge against inflation and an alternative to traditional banking systems. This sentiment has only grown stronger as people seek more control over their financial futures.

Investing in Bitcoin: Tips and Considerations

If you’re considering investing in Bitcoin now that it’s above $100,000, here are some tips to keep in mind:

- Do Your Research: Educate yourself about Bitcoin and the cryptocurrency market. Understanding the fundamentals can help you make informed decisions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider diversifying your investments across different asset classes.

- Stay Updated: The cryptocurrency landscape is constantly changing. Keep up with the latest news and trends to stay ahead of the curve.

- Be Prepared for Volatility: Even with this recent stability, Bitcoin remains a volatile asset. Be prepared for price fluctuations.

- Think Long-Term: Many successful investors take a long-term approach. HODLing (holding on for dear life) has been a successful strategy for many Bitcoin enthusiasts.

The Global Impact of Bitcoin’s Success

Bitcoin’s rise to maintain a value above $100,000 for an entire month is not just significant for individual investors; it has global implications. Countries with unstable economies are increasingly looking to Bitcoin as a viable alternative to traditional currencies. This could lead to wider adoption and acceptance of cryptocurrencies in various regions, especially in places facing hyperinflation or currency devaluation.

Conclusion: A New Era for Bitcoin

The fact that Bitcoin has stayed above $100,000 for 30 consecutive days marks a new era for this digital currency. It reflects growing confidence among investors and a broader acceptance of cryptocurrencies in the financial system. As we move forward, it will be exciting to see how Bitcoin continues to evolve, adapt, and impact the world. Whether you’re a seasoned investor or a curious newcomer, this is a pivotal moment in the history of finance that you won’t want to miss!

“`

This structure provides a comprehensive, SEO-optimized article focused on Bitcoin’s recent achievement while maintaining an engaging and informal tone.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!