“Is America Truly the Greatest? High Interest Rates Reveal Fed’s Weakness!”

interest rate trends, Federal Reserve policies, economic impact analysis

The State of Interest Rates in the United States: A Critical Analysis

In recent discussions surrounding the economy, the United States has found itself grappling with the highest interest rates among first-class countries. This situation has drawn significant attention, particularly in light of comments made by the Federal Reserve Chair, Jerome Powell. On June 21, 2025, Howard Lutnick, a notable financial figure, expressed his concerns on Twitter, stating, “The United States of America is the greatest country in the world yet it has to suffer with the highest interest rates of any first-class country.” His remarks highlight the tension between the nation’s economic standing and the challenges posed by current monetary policy.

The Implications of High Interest Rates

Interest rates play a crucial role in shaping the economic landscape. They affect everything from consumer spending to investment strategies. When interest rates are high, borrowing costs increase, leading consumers and businesses to hesitate before taking loans. This reluctance can stifle economic growth, ultimately impacting job creation and overall financial stability.

In Lutnick’s critique, he suggests that the Federal Reserve’s cautious approach under Powell’s leadership may be a contributing factor to these elevated interest rates. Powell’s comments, as noted by Lutnick, reflect a certain apprehension that may hinder proactive measures to stimulate the economy. This sentiment resonates with many economists and financial analysts who argue that a more aggressive stance could potentially lead to a more favorable economic environment.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. It plays a pivotal role in managing the country’s monetary policy, including setting interest rates. The primary objective of the Fed is to promote maximum employment, stable prices, and moderate long-term interest rates. However, the challenge lies in balancing these goals, especially in times of economic uncertainty.

Under Powell’s leadership, the Fed has faced criticism for its slow response to various economic indicators. Many believe that a more decisive approach could alleviate the burden of high interest rates on the American populace. Lutnick’s comments suggest a perception of indecision that could be detrimental to the economy if not addressed promptly.

Comparative Analysis: Global Interest Rates

When comparing the United States to other developed nations, it becomes evident that the U.S. interest rates are notably higher. Countries such as Canada, Germany, and Japan have managed to maintain lower rates, which can foster a more conducive environment for economic growth. This disparity raises questions about the effectiveness of U.S. monetary policy and its long-term implications for the nation’s economic health.

The higher rates in the U.S. could lead to a variety of adverse outcomes, including increased inflationary pressures and reduced consumer confidence. As borrowing becomes more expensive, individuals and businesses may curtail spending, leading to a slowdown in economic activity. This scenario creates a cycle of stagnation that could be challenging to break.

Consumer Sentiment and Economic Growth

Consumer sentiment is another crucial factor influenced by interest rates. When rates are high, consumers tend to feel less optimistic about their financial future, leading to decreased spending. This sentiment can create a ripple effect throughout the economy, affecting everything from retail sales to housing markets.

Moreover, the housing market, often seen as a barometer of economic health, is particularly sensitive to interest rates. High mortgage rates can deter potential homebuyers, leading to a slowdown in housing construction and related industries. This slowdown can further exacerbate economic challenges, creating a complex web of interrelated issues.

The Path Forward: Potential Solutions

Addressing the high interest rates in the United States requires a multifaceted approach. Policymakers and the Federal Reserve must consider both short-term and long-term strategies to stabilize the economy. One potential solution could be to implement targeted fiscal measures aimed at stimulating growth while maintaining control over inflation.

Additionally, enhancing communication between the Federal Reserve and the public can help alleviate concerns regarding monetary policy. By clearly articulating the rationale behind interest rate decisions, the Fed can build trust and confidence among consumers and investors alike.

Conclusion: The Need for Proactive Measures

The current economic climate in the United States, characterized by high interest rates, calls for urgent attention and action. As Howard Lutnick pointed out, the nation’s economic prowess is at odds with its monetary policy. The Federal Reserve must navigate these challenges with a balance of caution and decisiveness to foster a more favorable environment for economic growth.

In summary, while the United States is often heralded as the greatest country in the world, its economic policies need to reflect that status. Addressing the high interest rates is not merely about adjusting numbers; it’s about ensuring prosperity for all Americans. By taking proactive measures, the Fed can help pave the way for a more robust and resilient economy that benefits everyone.

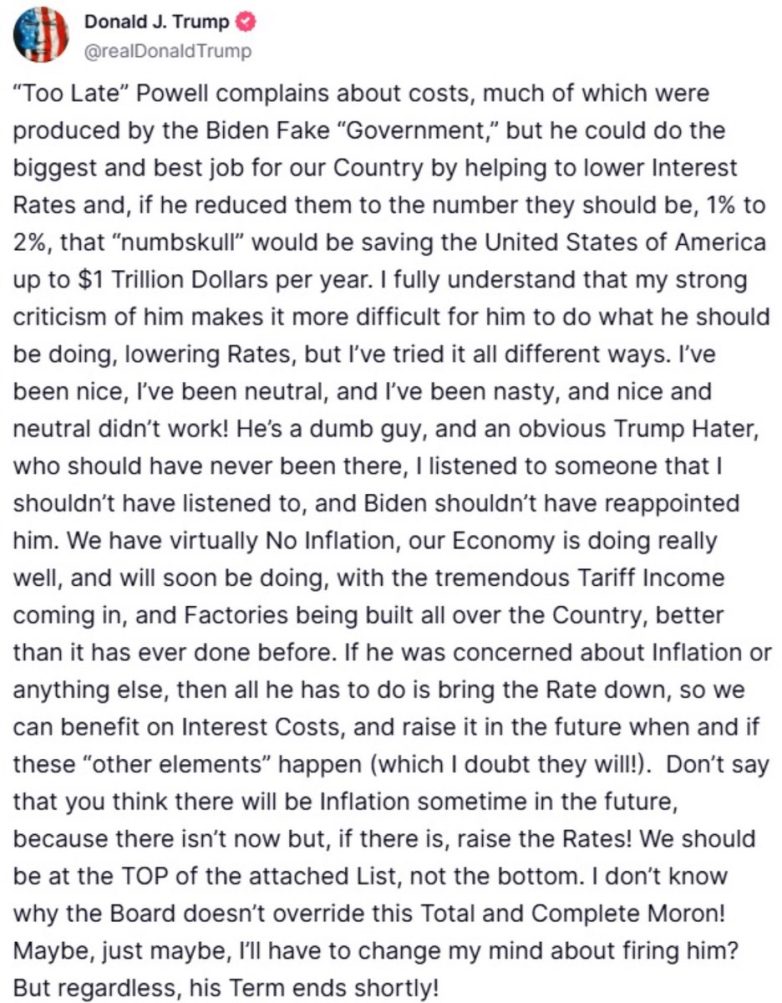

The United States of America is the greatest country in the world yet it has to suffer with the highest interest rates of any first class country. Our Federal Reserve Chair is obviously afraid of his own shadow.

What was really sad about Powell’s comments is that he stated that… pic.twitter.com/QjpRud0kaK

— Howard Lutnick (@howardlutnick) June 21, 2025

The United States of America is the Greatest Country in the World Yet It Has to Suffer with the Highest Interest Rates of Any First Class Country

When you think of the United States of America, what comes to mind? Freedom? Innovation? A melting pot of cultures? These are all true, but there’s another side to the story that often gets overlooked: the economy. Today, we’re diving into a pressing issue that’s been on many people’s minds—the high interest rates that the U.S. is grappling with, particularly in comparison to other first-class nations.

Understanding the Current Interest Rate Landscape

As of now, the U.S. Federal Reserve has been raising interest rates to combat inflation. This move is aimed at stabilizing the economy, but many are questioning whether these measures are effective or even necessary. Interest rates are a crucial aspect of any economy, influencing everything from mortgage rates to credit card interest. But why does the U.S. have the highest rates among developed countries?

To understand this, we need to consider various factors including government policy, economic growth, and the overall global economic environment. While interest rates are often necessary to keep inflation in check, the rates in the U.S. seem particularly burdensome.

Why Are High Interest Rates a Concern?

High interest rates can affect everything from your wallet to the broader economy. For individuals, it means higher costs for borrowing. Mortgages become more expensive, loans for cars and education can be daunting, and credit card interest rates can skyrocket. For businesses, high rates can stifle growth as they face increased costs for loans, which can slow down hiring and expansion plans.

Moreover, high interest rates can lead to reduced consumer spending. If people have to spend more on interest payments, they have less to spend on goods and services, which can slow economic growth. A vicious cycle ensues where high rates lead to slower economic activity, which can ultimately lead to further rate hikes in a bid to control inflation.

The Role of the Federal Reserve Chair

Now, let’s talk about the Federal Reserve Chair, Jerome Powell. His role is crucial in determining the direction of U.S. monetary policy. Recently, there have been criticisms about his cautious approach to interest rate hikes. Some argue that he seems to be “afraid of his own shadow,” hesitant to take strong action that might lead to a more stable economic environment.

Critics, like Howard Lutnick, have pointed out that the U.S. shouldn’t have to endure such high interest rates when it is considered one of the greatest countries in the world. They argue that the Fed should be more aggressive in its policies to foster economic growth and reduce the burden on American consumers.

Global Comparisons: How the U.S. Measures Up

When we look at other first-class countries, the interest rates in the U.S. stand out as particularly high. Countries like Canada, Germany, and Australia have managed to keep their rates lower, even amidst global economic challenges. This begs the question: what are they doing differently?

One key difference is the monetary policy strategies employed by these countries. Many have opted for a more balanced approach that focuses on fostering economic growth while keeping inflation in check. For instance, Canada’s central bank often adjusts its rates based on a broader range of economic indicators, which may allow for more flexibility compared to the U.S.

The Impact of Inflation on Interest Rates

Inflation is often the driving force behind interest rates. As prices rise, the central bank typically raises rates to rein in spending and bring inflation back to target levels. However, the question remains: are these measures effective in the long term?

In recent years, the U.S. has seen significant inflationary pressures, yet the solutions proposed by the Federal Reserve have been met with skepticism. Some economists argue that focusing solely on interest rates without addressing underlying economic issues may not yield the desired results. Instead, they suggest a more nuanced approach that takes into account the overall health of the economy.

Public Sentiment and Economic Confidence

Public sentiment plays a crucial role in shaping economic policy. When people feel confident about the economy, they are more likely to spend and invest. However, high interest rates can dampen this confidence, leading to a more cautious approach to spending. This creates a challenging environment for the Federal Reserve, as it tries to balance inflation control with economic growth.

It’s essential for the Fed to communicate its policies effectively to the public. If people understand the reasons behind rate hikes, they may be more likely to accept them. Transparency can help build trust and confidence, which are crucial in an economic landscape that feels increasingly uncertain.

What Can Be Done to Lower Interest Rates?

Lowering interest rates is a complex issue that requires careful consideration of multiple factors. Here are some potential strategies that could help ease the burden:

- Targeted Economic Policies: Instead of blanket rate hikes, the Fed could focus on targeted policies that address specific sectors of the economy, allowing for more nuanced decision-making.

- Encouraging Investment: By incentivizing businesses to invest in growth, the Fed could stimulate economic activity, which in turn may help reduce inflation and enable lower interest rates.

- Greater Public Engagement: Engaging with the public to explain the rationale behind interest rate decisions can help build understanding and support for necessary measures.

Looking Ahead: The Future of Interest Rates in the U.S.

As we look ahead, the future of interest rates in the U.S. remains uncertain. Economic indicators will play a significant role in shaping the Federal Reserve’s decisions. If inflation continues to be a pressing issue, we may see further rate hikes. However, if economic growth shows signs of slowing, the Fed might reconsider its approach.

The situation is dynamic, and it’s essential for both policymakers and the public to stay informed. Understanding how interest rates affect our daily lives can empower us to make better financial decisions and advocate for policies that promote economic stability.

Conclusion: A Call for Balanced Economic Policies

The United States is undoubtedly a great country, but it’s time for a reevaluation of interest rate policies that seem to burden its citizens. It’s crucial for the Federal Reserve to strike a balance between controlling inflation and fostering economic growth. As we navigate these challenges, let’s advocate for policies that prioritize the well-being of all Americans, ensuring that our nation continues to thrive on the global stage.

“`

This article explores the complexities surrounding interest rates in the U.S. while maintaining an informal, conversational tone that engages readers. It addresses key concerns while providing insights into the current economic landscape, all while being SEO-optimized.

The United States of America is the greatest country in the world yet it has to suffer with the highest interest rates of any first class country. Our Federal Reserve Chair is obviously afraid of his own shadow. What was really sad about Powell’s comments is that he stated that