Iran’s Parliament Votes to Close Strait of Hormuz: Global Oil Crisis Looms!

oil market impact, global shipping routes disruption, energy security concerns

Iranian Parliament Votes to Close the Strait of Hormuz: Implications and Consequences

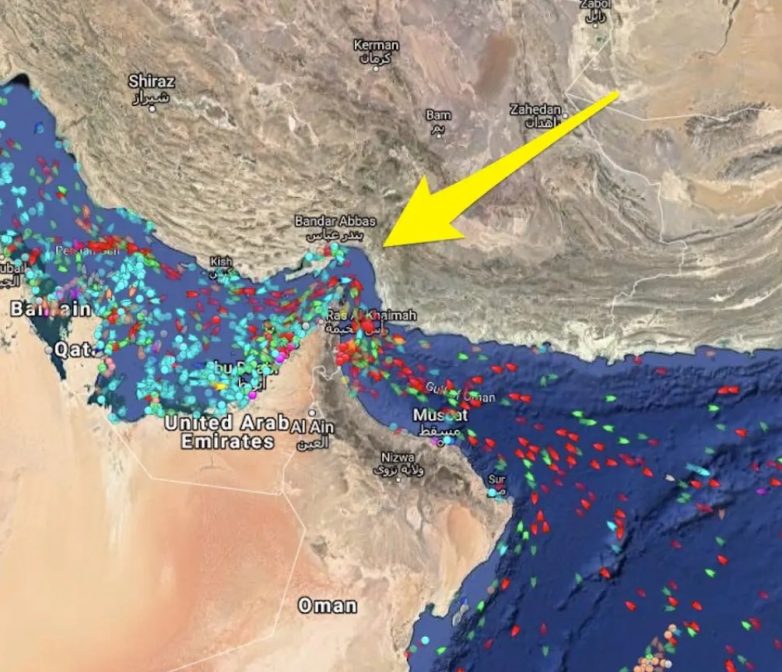

On June 22, 2025, a significant development unfolded in global geopolitics when the Iranian parliament voted to close the Strait of Hormuz, a critical waterway through which approximately 20% of the world’s oil supply passes. This decision has far-reaching implications for global oil markets, inflation rates, and gas prices in the United States. In this article, we will delve into what this decision means, the potential consequences, and how it could affect global economies.

The Importance of the Strait of Hormuz

The Strait of Hormuz is a narrow passage located between Iran and Oman, connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea. It serves as a vital conduit for oil shipments from the Middle East, making it one of the most strategically important maritime routes in the world. Any disruption in this passage can have immediate and severe repercussions for global oil supply and prices.

Immediate Impact on Oil Prices

Analysts predict that closing the Strait of Hormuz could lead to an immediate spike in oil prices, potentially increasing by 30% to 50% or even more. With oil prices already volatile due to geopolitical tensions, this decision could send shockwaves through the market. Higher oil prices would not only affect consumers but also impact businesses reliant on oil, leading to increased operational costs.

Global Inflation and Economic Consequences

The ripple effects of rising oil prices are likely to be felt across the globe, leading to an increase in inflation. As transportation and production costs rise, businesses may pass these expenses onto consumers, resulting in higher prices for goods and services. Countries that rely heavily on oil imports, including the United States, could see significant inflationary pressure, impacting household budgets and economic stability.

Gas Prices in the United States

One of the most immediate concerns for American consumers would be the potential rise in gas prices. As oil prices soar, so too do the costs associated with gasoline. Experts warn that U.S. gas prices could rise sharply, putting additional strain on families already facing rising costs due to inflation. This scenario could lead to a broader economic slowdown, as consumers may cut back on discretionary spending in response to higher fuel prices.

Geopolitical Tensions and Military Implications

The closure of the Strait of Hormuz is more than just an economic issue; it is also a geopolitical flashpoint. The United States and its allies have significant military interests in the region, and any attempt by Iran to enforce this closure could provoke a military response. The U.S. Navy has previously operated in the Strait to ensure the free flow of maritime traffic, and tensions could escalate rapidly if Iran attempts to block ships.

Long-term Economic Effects

If the closure of the Strait of Hormuz becomes a protracted issue, the long-term economic effects could be even more dire. Countries may seek alternative energy sources or suppliers, leading to shifts in global energy markets. This could result in a reorganization of alliances and partnerships as nations adapt to a changing landscape. Furthermore, countries heavily dependent on oil revenues, such as Saudi Arabia and other Gulf states, may find their economies affected, leading to broader regional instability.

Strategic Responses from Global Powers

In response to Iran’s decision, global powers may take various strategic actions. The United States could increase its military presence in the region to safeguard shipping routes, while countries like China and Russia may seek to capitalize on the situation to expand their influence in the Middle East. Diplomatic negotiations may also intensify as global leaders work to find a resolution that ensures the free flow of oil and stabilizes markets.

The Role of Alternative Energy Sources

As the world grapples with the implications of closing the Strait of Hormuz, the importance of transitioning to alternative energy sources becomes more apparent. Countries may accelerate their efforts to invest in renewable energy, such as solar and wind power, to reduce their dependence on oil. This shift could reshape the global energy landscape, promoting sustainability and energy independence in the long run.

Conclusion: A Pivotal Moment for Global Energy Security

The Iranian parliament’s decision to close the Strait of Hormuz marks a pivotal moment in global energy security. The potential for skyrocketing oil prices, increased inflation, and rising gas prices in the United States presents significant challenges for economies worldwide. As geopolitical tensions mount and military implications loom, the international community must navigate these turbulent waters carefully.

In the face of these challenges, the urgency of transitioning to alternative energy sources is underscored, advocating for a future that is less reliant on oil and more resilient to geopolitical disruptions. As this situation unfolds, the world will be watching closely, hoping for a resolution that maintains the stability of global oil markets and minimizes the economic fallout for consumers and businesses alike.

BREAKING: Iranian parliament has just voted to close the Strait of Hormuz.

– 20% of global oil passes through the Strait

HERE’s what to expect if successful:

– Oil Prices could spike by 30–50%+ almost immediately

– Global Inflation likely Rises

– U.S. Gas Prices likely… pic.twitter.com/WC4dmeagRE

— Brian Krassenstein (@krassenstein) June 22, 2025

Iranian Parliament Votes to Close the Strait of Hormuz: What You Need to Know

The recent news that the Iranian parliament has voted to close the Strait of Hormuz has sent shockwaves through global markets and raised concerns about the future of oil prices and global inflation. With nearly 20% of the world’s oil supply passing through this narrow passage, the implications of this decision are significant. In this article, we’ll break down what closing the Strait of Hormuz could mean for oil prices, inflation, and gas prices in the U.S.

Understanding the Importance of the Strait of Hormuz

The Strait of Hormuz is a critical maritime chokepoint linking the Persian Gulf with the Gulf of Oman and the Arabian Sea. It’s not just any waterway; it serves as the transit route for about 20% of the world’s crude oil supply. This strait is the lifeblood of global oil trade, making it a focal point for geopolitical tensions.

Given its strategic importance, any disruption in this area can have far-reaching consequences. The Iranian government’s decision to close the strait might be seen as a political maneuver, but the economic implications are what we’re really concerned about.

What Happens if the Strait of Hormuz is Closed?

If the Iranian parliament’s decision is successfully implemented, we could see a rapid escalation in oil prices. Analysts predict that oil prices could spike by 30% to 50% almost immediately. But why is that such a big deal?

Oil Prices Could Spike by 30–50%+

When we talk about oil prices, we’re discussing more than just what you pay at the pump. A substantial increase in oil prices can have a domino effect on the global economy. Higher oil prices often result in increased costs for goods and services. This is particularly true for countries that rely heavily on oil imports.

For instance, if oil prices were to rise by 30% to 50%, transportation costs would surge, and businesses would likely pass those costs onto consumers. This means that everything from groceries to clothing could see a price hike. So, if you think your budget feels tight now, just wait!

Global Inflation Likely Rises

With oil prices climbing, global inflation is likely to follow suit. Inflation occurs when there’s a general rise in prices, and a significant contributor to that rise is often the cost of energy. In this scenario, as oil prices increase, consumers and businesses spend more on fuel, driving up the overall cost of living.

Countries around the world might face mounting pressure to adjust monetary policies to combat rising inflation, potentially leading to increased interest rates. This can further impact economic growth, leading to a vicious cycle that could hurt consumers and businesses alike.

U.S. Gas Prices Likely to Rise

What does this mean for gas prices in the U.S.? If oil prices spike, you can bet that gas prices will follow suit. Imagine pulling up to the gas station and seeing prices soar. It’s not just a nuisance; it’s a financial burden for many households.

The U.S. has a complex relationship with oil prices, being both a producer and consumer. While domestic oil production might cushion some of the impact, a significant enough spike will still trickle down to consumers. Higher gas prices can reduce disposable income, impacting everything from dining out to travel plans.

The Geopolitical Ramifications

Beyond just economics, the decision to close the Strait of Hormuz stirs geopolitical tensions. Countries that rely on oil imports from the Middle East, particularly the U.S. and European nations, may respond to such actions with diplomatic pressures or even military posturing. The stakes are incredibly high.

Potential Military Responses

Given the strategic importance of the strait, military responses could be on the table. The U.S. has historically maintained a military presence in the region to ensure the free flow of oil and to deter Iranian aggression. If the strait were to close, the U.S. might step up its naval operations to reopen it, leading to potential confrontations.

Impact on Global Alliances

Such a move could also affect global alliances. Countries that are traditionally aligned with Iran may find themselves at odds with Western nations. Additionally, oil-producing countries outside of Iran might see this as an opportunity to increase their market share, possibly leading to more significant geopolitical shifts.

What Can Consumers Do?

So, with all this uncertainty, what can you do as a consumer? Here are a few strategies to consider:

Evaluate Your Spending

If gas prices are likely to rise, now is a good time to evaluate your spending habits. Consider carpooling, using public transportation, or even working from home if possible. Reducing your fuel consumption can save you money in the long run.

Stay Informed

Keep an eye on the news and stay informed about global oil prices and geopolitical developments. Understanding the situation can help you make better financial decisions.

Consider Alternative Energy Sources

With rising oil prices, now might be an ideal time to consider alternative energy options. Whether it’s investing in an electric vehicle or considering solar energy for your home, these choices can help reduce your dependence on fossil fuels and provide long-term savings.

Conclusion: The Road Ahead

The Iranian parliament’s decision to close the Strait of Hormuz presents a complex challenge that goes beyond just oil prices. As global markets react to this news, consumers and governments must prepare for the potential consequences. From rising inflation to increased gas prices, the implications of this decision are far-reaching. By staying informed and adapting to the changing landscape, we can navigate these turbulent waters together.

For more details on the situation, you can check out the original tweet from Brian Krassenstein and stay updated on the developments that will undoubtedly shape our economic future.

BREAKING: Iranian parliament has just voted to close the Strait of Hormuz. – 20% of global oil passes through the Strait HERE’s what to expect if successful: – Oil Prices could spike by 30–50%+ almost immediately – Global Inflation likely Rises – U.S. Gas Prices likely