Senators Push for Bitcoin Exemption: Will This Change How Americans Shop?

Bitcoin payments, tax exemption for cryptocurrency, everyday transactions with Bitcoin

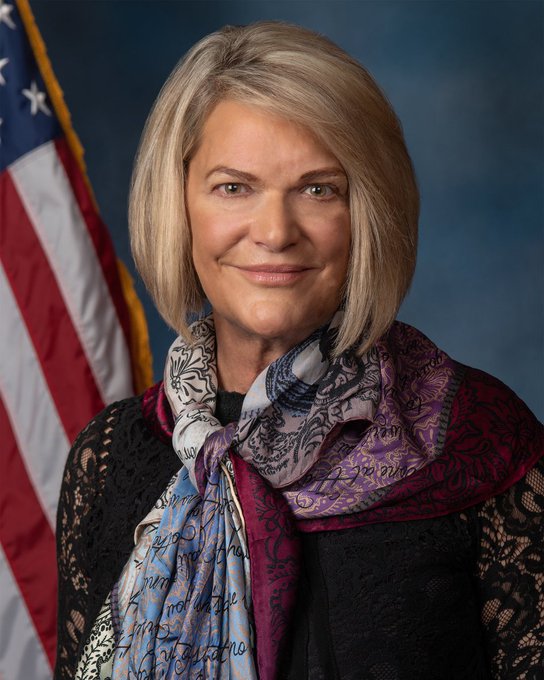

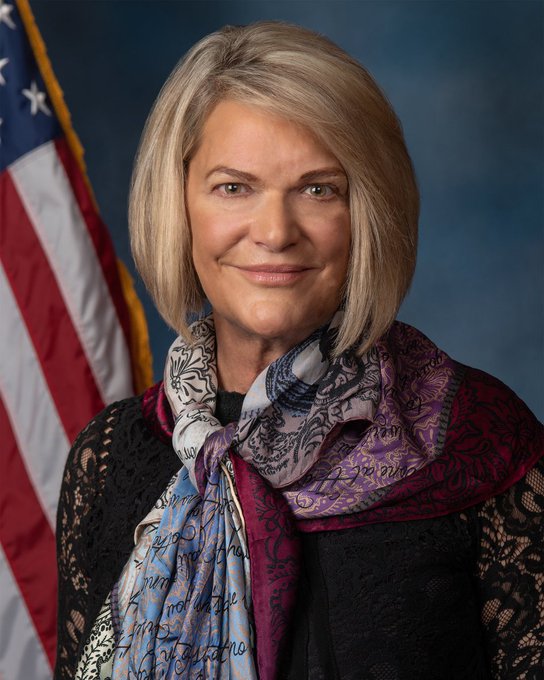

Senator Cynthia Lummis and Former Congressman Mike Rogers Propose Bitcoin Exemption for Everyday Purchases

In a significant development for the cryptocurrency community, Senator Cynthia Lummis and former Congressman Mike Rogers have called for legislation that would allow Americans to use Bitcoin for small everyday purchases without triggering onerous tax reporting requirements. This proposal aims to simplify the use of Bitcoin, promoting its adoption among everyday consumers while addressing some of the complexities surrounding cryptocurrency transactions. The discussion gained traction on June 23, 2025, following a tweet from Bitcoin Magazine, which highlighted the importance of this exemption for fostering a more user-friendly cryptocurrency environment.

The Need for Tax Exemptions in Cryptocurrency Transactions

Currently, the Internal Revenue Service (IRS) treats Bitcoin and other cryptocurrencies as property rather than currency. This classification means that every time an individual uses Bitcoin to purchase goods or services, it can trigger a taxable event. For many users, this translates to the cumbersome requirement of calculating capital gains or losses on each transaction, significantly complicating everyday use. Senator Lummis and Mike Rogers argue that this makes Bitcoin impractical for routine purchases, such as buying coffee or groceries.

The proposed exemption seeks to establish a threshold for Bitcoin transactions under which individuals would not have to report gains or losses. By introducing this legislation, Lummis and Rogers aim to encourage more Americans to use Bitcoin as a form of payment, thereby enhancing its legitimacy and integration into the economy.

Impact on Bitcoin Adoption

The potential for a tax exemption on small Bitcoin purchases could have far-reaching implications for cryptocurrency adoption in the United States. As Bitcoin continues to gain traction as a viable alternative to traditional currencies, easing the tax burden on small transactions could promote greater everyday use. This, in turn, could spur further innovation within the cryptocurrency ecosystem, leading to the development of new services and platforms tailored for users who wish to spend their Bitcoin without the fear of complicated tax implications.

Moreover, the adoption of Bitcoin for everyday transactions could enhance its overall acceptance and trust among consumers and businesses alike. By simplifying the process, more people may feel encouraged to enter the cryptocurrency space, contributing to a broader acceptance of digital currencies in the mainstream economy.

Legislative Landscape for Cryptocurrency in the U.S.

The proposal from Lummis and Rogers comes at a time when cryptocurrency regulation is a hot topic within U.S. politics. Lawmakers are grappling with how to regulate the rapidly evolving digital asset landscape while ensuring consumer protection and fostering innovation. The call for a Bitcoin exemption aligns with a broader movement among some legislators to create a more favorable regulatory environment for cryptocurrencies.

In recent years, several initiatives have emerged aimed at clarifying the regulatory framework for digital assets. The push for an exemption for small transactions could be seen as a step toward a more comprehensive approach to cryptocurrency regulation that balances innovation with the need for oversight.

Public Reception and Future Implications

The response to Lummis and Rogers’ proposal has been largely positive among cryptocurrency advocates and enthusiasts. Many view the exemption as a necessary step in legitimizing Bitcoin as a currency, rather than merely an investment vehicle. This sentiment underscores a growing desire among consumers for more practical applications of cryptocurrencies in their daily lives.

As discussions around the proposal evolve, it will be essential to gauge the public’s reaction and the potential impact on the legislative process. The success of such an exemption will likely depend on bipartisan support and the ability to navigate the complexities of tax law.

Conclusion: A Step Toward Mainstream Cryptocurrency Adoption

In conclusion, Senator Cynthia Lummis and former Congressman Mike Rogers’ proposal for a tax exemption on small Bitcoin purchases represents a significant move toward making cryptocurrency more accessible for everyday Americans. By alleviating the burdensome tax reporting requirements currently associated with Bitcoin transactions, this legislation has the potential to enhance Bitcoin’s viability as a means of payment and encourage broader adoption.

As the cryptocurrency landscape continues to evolve, initiatives like this one will play a crucial role in shaping the future of digital currencies in the United States. The push for a more user-friendly tax framework reflects a growing recognition of the importance of cryptocurrency in the modern economy, paving the way for a new era of financial innovation and consumer empowerment.

For more information on this developing story and to stay updated on the latest in cryptocurrency legislation, follow trusted sources like Bitcoin Magazine and engage in discussions surrounding the future of digital currencies.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.” pic.twitter.com/p0XIZXb1oR

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2025

Senator Cynthia Lummis and Mike Rogers Advocate for Bitcoin Exemption

In a recent announcement, Senator Cynthia Lummis and former Congressman Mike Rogers have made it clear that they believe it’s time to pass an exemption that would allow Americans to use Bitcoin for small everyday purchases without the hassle of triggering burdensome tax reporting. This exciting development has sparked conversations about the future of cryptocurrency in everyday transactions, and it’s something that could change the landscape of how we think about money.

Understanding the Need for a Bitcoin Exemption

So, why do we need a Bitcoin exemption? Currently, using Bitcoin for everyday purchases can lead to complex tax implications. Whenever someone uses Bitcoin as a payment method, it’s often treated as a taxable event. This means if you bought Bitcoin at a low price and used it to buy a coffee, you may be liable for capital gains tax on the difference between the purchase price and the market value at the time of the transaction. Yikes!

Senator Lummis and Mike Rogers are proposing that we create a threshold for small transactions, allowing consumers to use Bitcoin without triggering these tax requirements. This could encourage more people to adopt Bitcoin in their daily lives, making it a more practical payment option.

The Current State of Bitcoin Transactions

As of now, cryptocurrency transactions are growing, but they still face significant hurdles. Many consumers are hesitant to use Bitcoin for purchases due to the fear of tax implications. The proposed exemption could alleviate some of these concerns, making Bitcoin more user-friendly and accessible to the general public.

Moreover, with the increasing popularity of Bitcoin and other cryptocurrencies, we’re seeing a shift in how society views digital currencies. More businesses are beginning to accept Bitcoin as a form of payment, from major retailers to small local shops. But for widespread adoption, we need to simplify the process for consumers.

The Benefits of Using Bitcoin for Everyday Purchases

Using Bitcoin for everyday purchases comes with several advantages:

- Lower Transaction Fees: Compared to traditional banking methods or credit card transactions, Bitcoin often has lower fees, especially for international transactions.

- Decentralization: Bitcoin operates independently of banks and governments, providing users with more control over their funds.

- Security: Transactions made with Bitcoin are secured through blockchain technology, making them less susceptible to fraud.

- Anonymity: While not completely anonymous, Bitcoin transactions can provide a level of privacy that traditional banking does not.

What the Exemption Could Look Like

Imagine a world where you can walk into your favorite coffee shop, buy a latte with Bitcoin, and not have to worry about the tax implications. The proposed exemption by Senator Lummis and Mike Rogers could set a limit, say $200 or less, where transactions in Bitcoin are considered tax-free. This could significantly simplify the process for everyday users.

By establishing such a threshold, the government could encourage more people to embrace cryptocurrency without feeling overwhelmed by tax regulations. It also aligns with the broader goal of promoting financial innovation and inclusivity.

How This Change Could Impact Businesses

If this exemption passes, businesses could see an uptick in Bitcoin transactions. Small businesses, in particular, could benefit from the lower transaction fees associated with Bitcoin, allowing them to save money and offer more competitive pricing.

Moreover, accepting Bitcoin could attract a new customer base—those who prefer to use digital currencies. This not only opens up additional revenue streams but also positions businesses as forward-thinking and innovative.

The Road Ahead: Legislative Challenges and Support

While the idea of a Bitcoin exemption is promising, there are still hurdles to overcome. The legislative process can be slow, and gaining enough support to pass a bill is no small feat. However, with increasing public interest in cryptocurrencies, lawmakers are starting to take notice.

Senator Lummis has been a vocal advocate for Bitcoin and other cryptocurrencies, often highlighting the need for regulatory clarity in the space. Former Congressman Mike Rogers adds weight to this proposal, leveraging his experience in government to push for the necessary changes.

Public Sentiment on Bitcoin Regulation

Public sentiment around Bitcoin and cryptocurrency regulation is mixed. Many people appreciate the need for some regulations to protect consumers, but they also want to ensure that these regulations do not stifle innovation. The proposed exemption could strike a balance, fostering an environment where cryptocurrency can thrive while still providing consumer protections.

The growth of Bitcoin and its acceptance in various sectors indicate a shift in how we view money and transactions. As more people become familiar with digital currencies, the demand for practical solutions, like the exemption proposed by Lummis and Rogers, will likely increase.

Conclusion: A Step Towards Financial Freedom

The proposal for a Bitcoin exemption is a significant step toward creating a more flexible and user-friendly environment for cryptocurrency transactions. It’s about recognizing that Bitcoin isn’t just an investment; it can be a viable currency for daily life. As we move forward, it will be crucial to watch how this proposal unfolds and what it means for the future of Bitcoin in America.

Stay tuned as this story develops, and consider how you might incorporate Bitcoin into your daily transactions. Whether you’re a seasoned crypto enthusiast or just starting to dip your toes into the world of digital currency, changes like these could reshape the financial landscape in exciting ways.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an "exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting."