“Zohran Mamdani’s Bold Tax Proposal: Shifting Burdens to Whiter Areas Sparks Outrage!”

tax policy reform, racial equity in taxation, urban economic disparities

Proposal to Shift Tax Burdens in NYC: A Controversial Plan by Zohran Mamdani

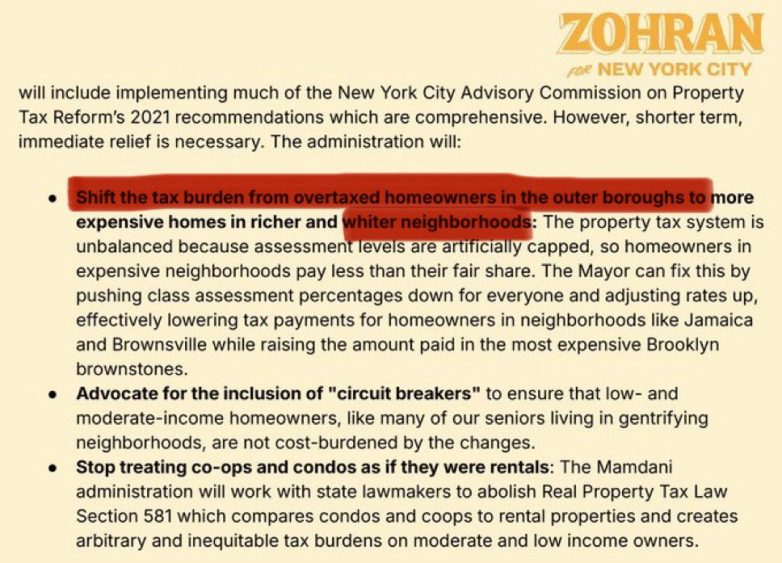

In a recent development that has sparked intense debate, New York City mayoral candidate Zohran Mamdani has brought forth a proposal that suggests shifting tax burdens to predominantly white neighborhoods. This controversial plan aims to address systemic inequalities in the city’s tax structure and redistribute wealth more equitably among its diverse communities. As the conversation surrounding this proposal continues to gain traction, it raises vital questions about race, equity, and fiscal responsibility in one of the nation’s largest cities.

Understanding the Proposal

Zohran Mamdani, a member of the Democratic Party, has emerged as a vocal advocate for social justice and economic equity during his campaign for mayor. His proposal seeks to address the disparities in taxation that often result in wealthier, predominantly white neighborhoods contributing less to the city’s overall revenue compared to lower-income, more diverse areas. The notion of reallocating tax burdens is not entirely new; however, Mamdani’s specific focus on racial demographics has ignited a passionate discussion about the implications of such a shift.

The core of Mamdani’s argument is that the current tax system disproportionately favors affluent neighborhoods while neglecting the needs of lower-income communities, many of which are predominantly inhabited by people of color. By redistributing tax responsibilities, he believes that the city can create a more balanced and fair economic landscape that benefits all residents, regardless of their zip code.

The Rationale Behind the Proposal

Mamdani’s proposal is rooted in the belief that systemic inequalities are perpetuated not only through social policies but also through fiscal policies. He argues that wealthier neighborhoods often enjoy better public services, infrastructure, and amenities, while poorer areas struggle to provide basic necessities. By shifting tax burdens, Mamdani aims to ensure that all neighborhoods have access to equal resources, thereby fostering a more just and equitable city.

Supporters of the proposal highlight the potential benefits of such a plan. They argue that it could lead to increased funding for public schools, affordable housing, and healthcare services in underserved communities. Moreover, proponents contend that by addressing the root causes of economic inequality, the city can create a more cohesive and harmonious social fabric.

The Opposition

Despite its noble intentions, Mamdani’s proposal has faced significant pushback from various segments of the population. Critics argue that shifting tax burdens based on race is not only divisive but also counterproductive. They contend that it could exacerbate tensions between different communities and lead to further polarization in an already complex social landscape.

Opponents also question the practical implications of such a proposal. Concerns have been raised about the potential impact on property values, business development, and overall economic growth in the city. Critics argue that increasing taxes in wealthier neighborhoods may drive residents and businesses away, ultimately undermining the very communities that the proposal aims to support.

The Broader Context of Racial Equity in Taxation

Mamdani’s proposal comes at a time when discussions about racial equity and economic justice are at the forefront of national discourse. The COVID-19 pandemic has further illuminated existing disparities in wealth and access to resources, prompting renewed calls for systemic change across various sectors, including taxation.

In many cities, including New York, discussions surrounding tax reform have increasingly focused on equity. Advocates argue that the current tax system often perpetuates cycles of poverty and inequality, disproportionately affecting communities of color. As a result, proposals like Mamdani’s have gained traction, pushing for a reevaluation of how tax burdens are distributed and who benefits from public services.

The Role of Public Opinion

Public response to Mamdani’s proposal has been mixed. Some residents and community leaders have voiced strong support, seeing it as a necessary step toward rectifying historical injustices. On the other hand, many individuals remain skeptical, arguing that the proposal lacks a concrete implementation plan and could lead to unintended consequences.

Social media has played a significant role in shaping public perception of the proposal. Platforms like Twitter have become battlegrounds for differing viewpoints, with users passionately debating the merits and drawbacks of Mamdani’s approach. This online discourse highlights the complexities of addressing issues of race, class, and taxation in a diverse urban environment.

Looking Ahead: The Future of Tax Equity in NYC

As the debate surrounding Zohran Mamdani’s proposal continues, it is clear that discussions about tax equity will remain a critical issue in New York City and beyond. The 2025 mayoral race is shaping up to be a pivotal moment for the city, with candidates forced to grapple with the realities of economic inequality and the urgent need for meaningful reform.

Regardless of the outcome of Mamdani’s proposal, it has undoubtedly sparked important conversations about the role of taxation in addressing systemic inequities. As voters and policymakers consider the implications of such proposals, it will be essential to prioritize dialogue that fosters understanding, empathy, and collaboration among all communities.

In conclusion, Zohran Mamdani’s proposal to shift tax burdens to whiter neighborhoods is a bold and controversial approach to addressing economic inequality in New York City. While it seeks to promote equity and justice, it also raises complex questions about race, community dynamics, and fiscal responsibility. As the city moves forward, finding a balanced solution that serves all residents will be paramount in creating a more equitable future for New York City.

BREAKING – A proposal by NYC Democrat mayoral candidate Zohran Mamdani to shift tax burdens to “Whiter neighborhoods” has resurfaced. pic.twitter.com/UUcDluxI4A

— Right Angle News Network (@Rightanglenews) June 27, 2025

BREAKING – A Proposal by NYC Democrat Mayoral Candidate Zohran Mamdani

In a bold and controversial move, NYC Democrat mayoral candidate Zohran Mamdani has reignited discussions around taxation and economic equity in New York City. His proposal aims to shift tax burdens to “whiter neighborhoods,” a statement that has sparked intense debate across various platforms. This article will delve into the implications of Mamdani’s proposal, its historical context, and what it means for the residents of New York City.

The Rationale Behind the Proposal

So, what’s the deal with Mamdani’s proposal? To understand it, we need to look at the socio-economic landscape of New York City. Historically, wealthier, predominantly white neighborhoods have benefitted from lower tax rates and have seen significant investment in infrastructure, schools, and public services. Conversely, many minority communities have faced systemic neglect, underfunding, and a lack of resources.

Mamdani argues that shifting some tax burdens to wealthier neighborhoods can create a more equitable system, one that can help fund essential services in underprivileged areas. This approach is rooted in the idea of wealth redistribution, where those with more resources contribute a fair share to support the wider community.

Understanding the Reaction

The reactions to Mamdani’s proposal have been mixed. Some view it as a necessary step towards addressing the long-standing disparities in New York City’s neighborhoods. Others see it as divisive and incendiary, accusing Mamdani of using race as a political tool. The conversation around this proposal is not just about taxation; it’s about social justice, equity, and the role of government in redistributing wealth.

The Historical Context of Taxation in NYC

To fully grasp the implications of Mamdani’s proposal, we should review the history of taxation in New York City. For decades, tax policies have often favored wealthier neighborhoods, enabling them to maintain their status and resources while leaving poorer areas to struggle with inadequate funding. The current tax system has roots in a long history of racial and economic inequality, and many argue that it’s time for a change.

The idea of shifting tax burdens isn’t new. Similar proposals have emerged in various cities across the United States as local governments grapple with how to fund essential services while addressing inequality. However, Mamdani’s proposal is particularly notable due to its explicit focus on race and wealth.

Supporters’ Perspectives

Supporters of Mamdani’s proposal argue that it’s a necessary change that can lead to better outcomes for marginalized communities. They cite examples from other cities where progressive tax policies have resulted in improved public services, education, and housing for lower-income residents. They believe that by redistributing wealth, the city can provide better opportunities for all its residents, regardless of their zip code.

Moreover, advocates point out that this proposal could help combat gentrification, where rising property values push out long-time residents. By ensuring that wealthier neighborhoods contribute more to the city’s coffers, supporters argue that it’s possible to create a more balanced approach to urban development.

Critics’ Concerns

Additionally, critics question whether simply shifting tax burdens is a sustainable solution to the systemic issues present in New York City. They argue that the focus should be on creating new revenue streams, improving economic opportunities, and fostering collaboration among communities rather than pitting one neighborhood against another.

The Broader Implications for NYC

The implications of Mamdani’s proposal extend beyond the immediate tax structure. It raises deeper questions about how New York City envisions its future. Are we moving towards a more equitable system where wealth is shared, or are we reinforcing divisions by making neighborhoods adversaries in a financial tug-of-war?

This proposal also highlights the role of government in redistributing wealth and ensuring that all residents have access to essential services. As discussions unfold, it will be crucial to consider how policies can promote unity and collaboration rather than division.

Public Opinion and the Political Landscape

Public opinion surrounding Mamdani’s proposal reflects the complexities of urban governance. Many New Yorkers are eager for change and are open to exploring new ideas that challenge the status quo. However, the political landscape is also fraught with tension, as various groups voice their concerns and support.

As the mayoral race heats up, Mamdani’s proposal could become a defining issue. Candidates will need to navigate this topic carefully, balancing the needs and desires of their constituents while addressing the city’s broader goals of equity and justice.

Moving Forward: Possible Solutions

With the conversations around this proposal gaining traction, it’s essential to consider what solutions might arise. One possible approach could involve implementing tiered taxation based on income levels, where wealthier individuals contribute a larger percentage of their income towards city services.

Another solution could involve community investment strategies that prioritize funding for education, housing, and healthcare in lower-income neighborhoods. By creating opportunities for economic growth and empowerment, the city can foster a more equitable environment without inciting conflict between neighborhoods.

The Role of Community Engagement

Community engagement will play a vital role in shaping the future of New York City’s tax policies. It’s essential for residents to voice their opinions, share their experiences, and participate in discussions about how to create a fair and just system. Open forums, town halls, and community meetings can provide platforms for dialogue, ensuring that all voices are heard and considered.

Engaging with local organizations and advocacy groups can also amplify the voices of marginalized communities, ensuring that their needs are prioritized in policy discussions. Ultimately, a collaborative approach will be essential in addressing the complex issues surrounding taxation and equity in New York City.

Conclusion

Mamdani’s proposal to shift tax burdens to “whiter neighborhoods” has opened a Pandora’s box of discussions about race, wealth, and fairness in New York City. Regardless of where you stand on the issue, it’s clear that this conversation is necessary and long overdue. As New Yorkers navigate these challenging discussions, the hope is that we can move towards a more equitable city for all.

“`

This article provides an in-depth look at Zohran Mamdani’s proposal while incorporating SEO-friendly elements, relevant links, and a conversational tone.

BREAKING – A proposal by NYC Democrat mayoral candidate Zohran Mamdani to shift tax burdens to “Whiter neighborhoods” has resurfaced.