“NYC Candidate’s Bold Proposal: Tax White Neighborhoods to Combat Inequality!”

NYC tax reform, racial equity in taxation, urban policy proposals

Zohran Mamdani’s Tax Proposal: A Controversial Shift in NYC Politics

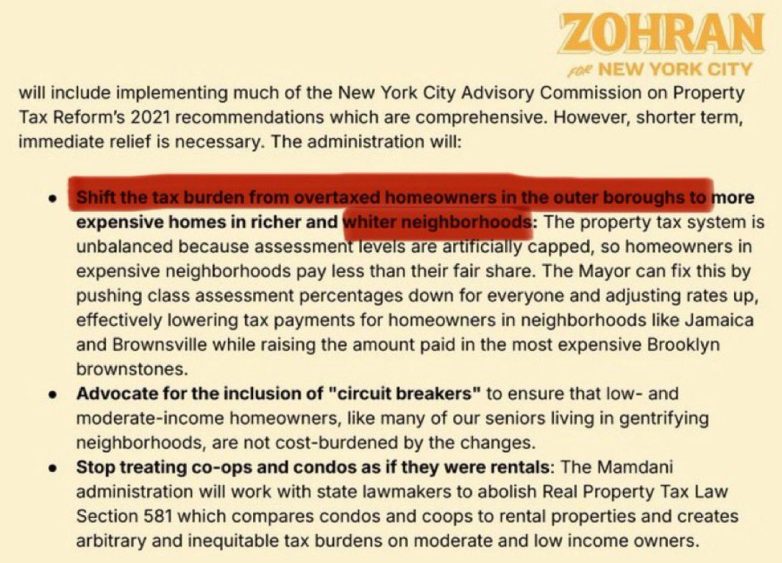

In a bold move that has sparked significant debate, New York City mayoral candidate Zohran Mamdani has proposed a controversial tax initiative aimed at shifting the financial burden towards predominantly white neighborhoods. This proposal has resurfaced recently, igniting discussions around equity in taxation and systemic inequalities in urban settings. As the political landscape evolves, understanding the implications of such proposals is crucial for voters and residents alike.

The Context of the Proposal

Zohran Mamdani, a progressive voice in the NYC mayoral race, is known for his advocacy on social justice issues and economic reform. His proposal seeks to address long-standing disparities in tax burdens that disproportionately affect marginalized communities. By reallocating tax responsibilities to wealthier, predominantly white neighborhoods, Mamdani aims to create a more equitable distribution of resources that could benefit underfunded public services in less affluent areas.

This approach is rooted in the belief that historical injustices have contributed to the current socio-economic landscape of New York City. Mamdani argues that by shifting tax burdens, the city can begin to rectify these disparities and promote a fairer system that prioritizes the needs of all residents, particularly those in historically marginalized communities.

Public Reaction and Debate

The proposal has drawn mixed reactions from various sectors of the public. Supporters argue that it is a necessary step towards achieving social equity and addressing the systemic issues that have plagued urban areas for decades. They believe that wealthier neighborhoods have historically benefited from policies that have marginalized others, and this tax shift could help level the playing field.

Conversely, critics of Mamdani’s proposal express concern about the potential backlash and divisiveness it may create. Some argue that shifting tax burdens based solely on racial demographics could exacerbate tensions between communities rather than foster unity. Detractors worry about the feasibility and effectiveness of such a plan, questioning whether it would truly lead to the desired outcomes in equity and access to resources.

The Importance of Equity in Taxation

Understanding the nuances of taxation and its impact on various communities is essential in the context of urban governance. Taxation is not merely a financial obligation; it reflects societal values and priorities. The debate surrounding Mamdani’s proposal underscores the broader conversation about equity in taxation, which is increasingly relevant in today’s political climate.

Equitable taxation aims to ensure that individuals and communities contribute to public resources in a manner proportional to their capacity to pay. In many cities, including New York, wealth disparities are stark, and the communities that suffer the most often lack adequate investment in essential services such as education, healthcare, and public safety.

By advocating for a tax structure that takes into account historical inequalities, Mamdani’s proposal seeks to challenge the status quo and push for systemic change. This approach could potentially lead to a more balanced distribution of resources, ultimately benefiting a larger segment of the population.

The Role of Mayoral Candidates in Shaping Policy

As the NYC mayoral race heats up, candidates like Zohran Mamdani play a crucial role in shaping discussions around policy and governance. Their proposals not only reflect their individual ideologies but also set the tone for broader debates on social justice, economic reform, and community engagement.

Mamdani’s proposal may resonate with voters who are seeking transformative change, particularly those disillusioned with traditional political platforms that have failed to address systemic issues. As more candidates present their visions for the city’s future, the discourse surrounding taxation and equity will likely remain a focal point of the campaign.

Looking Ahead: Implications for NYC

The implications of Mamdani’s tax proposal extend beyond the electoral process. Should this initiative gain traction, it could pave the way for other progressive reforms aimed at addressing inequalities within the city. The potential for increased funding for public services in underserved neighborhoods could lead to improved outcomes in education, healthcare, and infrastructure.

However, the success of such a proposal hinges on public support and the willingness of city leaders to engage in difficult conversations about race, class, and systemic inequality. As the proposal continues to gain attention, it will be essential for stakeholders—residents, community leaders, and policymakers—to engage in constructive dialogue about the best path forward for New York City.

Conclusion

Zohran Mamdani’s proposal to shift tax burdens to predominantly white neighborhoods has reignited critical discussions about equity, taxation, and systemic inequalities in New York City. As public discourse evolves, it is imperative for voters to consider the broader implications of such policies and how they align with their values and vision for a more equitable city.

As the campaign unfolds, the focus on equitable taxation will likely become a pivotal issue that could shape the future of urban governance in New York City. By addressing these disparities head-on, candidates like Mamdani are challenging the status quo and advocating for a city that prioritizes fairness and justice for all its residents. The coming months will be crucial in determining how these discussions will influence the political landscape and, ultimately, the lives of New Yorkers.

BREAKING: A proposal by NYC Mayoral candidate Zohran Mamdani to shift tax burdens to “White Neighborhoods” has resurfaced. pic.twitter.com/GLLGuj05Yy

— The Patriot Oasis (@ThePatriotOasis) June 27, 2025

BREAKING: A Proposal by NYC Mayoral Candidate Zohran Mamdani to Shift Tax Burdens to “White Neighborhoods”

In a move that has sparked intense debate and discussion, NYC Mayoral candidate Zohran Mamdani has put forth a controversial proposal aimed at addressing systemic inequality in the city. The proposal, which suggests shifting tax burdens to predominantly white neighborhoods, has resurfaced amid ongoing conversations about racial equity and economic justice. This article delves into the implications of Mamdani’s proposal, the reactions it has garnered, and the broader context of tax policy in New York City.

Understanding the Proposal

Mamdani’s proposal is rooted in the belief that wealth and resources in New York City are not distributed equitably. By shifting tax burdens to wealthier, predominantly white neighborhoods, he aims to redistribute funds toward underserved communities that have historically faced economic challenges.

The idea here is to create a more equitable tax system that could potentially fund essential services in areas that need them the most, such as education, healthcare, and infrastructure. However, the proposal has raised eyebrows and fostered heated debate among residents and political analysts alike.

The Rationale Behind the Proposal

Supporters of Mamdani’s plan argue that systemic racism has long influenced tax policies in the U.S. For instance, traditionally marginalized communities often face higher tax rates while receiving fewer services. This inequity perpetuates a cycle of poverty that is hard to break. By shifting the tax burden, Mamdani hopes to address this imbalance and create a more just society.

Moreover, proponents believe that wealthier neighborhoods have the means to contribute more without significantly impacting their residents’ quality of life. The funds generated could be directed toward initiatives that uplift economically disadvantaged areas, ultimately benefiting the city as a whole.

Public Reaction: Support and Opposition

The reaction to Mamdani’s proposal has been mixed, revealing deep divisions in public opinion. Supporters praise his boldness in tackling a sensitive issue, appreciating the potential for transformative change. They argue that such measures are necessary to rectify historical injustices and create a fairer society.

Conversely, opponents of the proposal raise concerns about the implications of targeting specific neighborhoods based on race. Many argue that this approach could lead to further division rather than fostering unity. Critics also worry about the potential backlash from residents in wealthier neighborhoods who may feel unfairly targeted or burdened by the new tax structure.

The Role of Taxation in Social Justice

This proposal brings to light the broader conversation about taxation and social justice. In many cities, tax policies have historically favored affluent communities, allowing them to thrive while neglecting the needs of lower-income areas. The question of how to create a fair tax system that benefits all citizens is increasingly relevant, especially in diverse urban settings like New York City.

Taxation is not just a matter of revenue; it’s also about how societies prioritize their values. Should wealthier neighborhoods shoulder more responsibility for the greater good? And if so, how can this be implemented without causing resentment or division?

Comparative Analysis: Other Cities Tackling Similar Issues

New York City isn’t the only place grappling with these complex issues. Cities across the U.S. are exploring various strategies to address economic inequality through taxation. For example, cities like San Francisco and Seattle have implemented progressive tax structures aimed at alleviating poverty and funding public services.

In San Francisco, the city has introduced taxes on large corporations to fund affordable housing projects. This approach has been met with mixed results, as some argue it stifles business growth while others see it as a necessary step toward equity.

Similarly, Seattle’s income tax on high earners has been both praised and criticized. Supporters argue that it provides essential funding for education and public services, while opponents claim it could drive wealthy residents out of the city.

Looking Ahead: The Future of Mamdani’s Proposal

As the debate over Mamdani’s proposal continues, its future remains uncertain. With the upcoming election, the proposal could become a pivotal issue for voters. How candidates respond to this proposal will likely shape their platforms and influence public perception.

Moreover, this proposal could serve as a litmus test for how serious New Yorkers are about addressing racial and economic disparities within the city. Will voters support a candidate willing to challenge the status quo, or will they lean toward more traditional approaches?

The Importance of Community Engagement

One of the critical aspects of implementing any tax reform is community engagement. For Mamdani’s proposal to be successful, it will require buy-in from residents across the city. This means not only informing the public about the proposal but also involving them in discussions about its implications and potential outcomes.

Public forums, community meetings, and town halls can serve as platforms for dialogue, allowing residents to voice their concerns and suggestions. By fostering open communication, Mamdani could build a coalition of support that transcends racial and economic divides.

Conclusion

As the conversation around Zohran Mamdani’s proposal unfolds, it highlights the urgent need for innovative solutions to address systemic inequality in New York City and beyond. While the idea of shifting tax burdens to wealthier neighborhoods may seem radical to some, it represents a growing movement advocating for a more equitable society.

Ultimately, the success of such proposals will depend on the willingness of communities to engage in meaningful discussions about race, equity, and taxation. As New Yorkers consider the implications of Mamdani’s plan, one thing is clear: the conversation about economic justice is far from over.

“`

This HTML-formatted article provides a comprehensive overview of Zohran Mamdani’s proposal, its rationale, public reaction, and the broader implications of such tax reforms within the context of social justice. The tone is conversational and accessible, making it relatable for readers while incorporating relevant keywords for SEO optimization.

BREAKING: A proposal by NYC Mayoral candidate Zohran Mamdani to shift tax burdens to “White Neighborhoods” has resurfaced.