“Shockwaves in NYC: Socialist Candidate’s Radical Tax Plan Targets Wealthy Whites!”

socialist mayoral candidate, racial tax redistribution, NYC housing policy

Breaking News: Zohran Mamdani’s Controversial Tax Redistribution Proposal

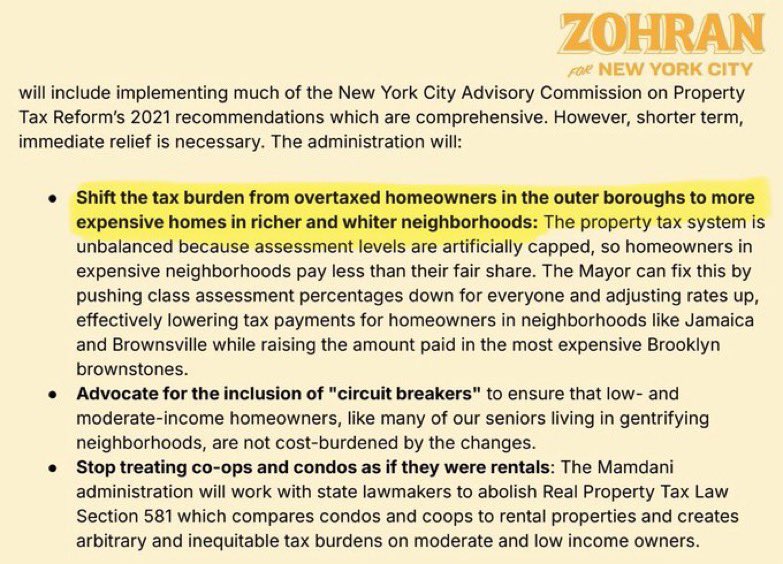

In a striking revelation, Zohran Mamdani, a self-identified socialist and Muslim candidate for Mayor of New York City, has resurfaced in the news due to controversial proposals he previously backed during his campaign. The discourse surrounding his plan to shift tax burdens to “richer and whiter neighborhoods” highlights the complexities and tensions involved in discussions about social equity, taxation, and urban policy.

The Context of Mamdani’s Candidacy

Zohran Mamdani emerged as a prominent figure in New York City’s political landscape, representing a growing faction of progressive politics that advocates for systemic changes to address social inequalities. His candidacy was marked by a strong focus on racial and economic justice, aiming to reframe the narrative around taxation and public spending in a city that has long grappled with disparities in wealth and opportunity.

Mamdani’s proposals have sparked intense debate among residents, policymakers, and political commentators alike. His focus on redirecting tax revenues from affluent neighborhoods to support under-resourced communities reflects a broader trend in progressive politics aimed at dismantling systemic inequities. However, the implications of such a strategy have raised questions about feasibility, fairness, and the potential impact on New York City’s diverse population.

The Controversial Tax Redistribution Plan

At the core of Mamdani’s controversial proposal is the idea of a “radical racial redistribution scheme,” which he believes is essential for achieving true equity in a city that has seen deep divides along racial and economic lines. By shifting tax burdens from lower-income neighborhoods to wealthier ones, Mamdani argues that it will provide necessary funding for essential services such as education, health care, and housing in marginalized communities.

Critics of Mamdani’s plan, however, argue that such measures could lead to further polarization within the city. They contend that taxing wealthier neighborhoods disproportionately could stifle economic growth and lead to resentment among residents who may already feel overburdened by city taxes. Additionally, the proposal raises valid concerns about the practicality of implementation and the potential backlash it may provoke among constituents in affluent areas.

Public Reaction and Political Ramifications

The public reaction to Mamdani’s plan has been mixed, showcasing the city’s diverse political landscape. Supporters of the proposal view it as a necessary step toward rectifying historical injustices and ensuring that all New Yorkers have access to the resources and opportunities they need to thrive. They argue that the current tax system disproportionately benefits wealthier neighborhoods while neglecting those in need, perpetuating cycles of poverty and disenfranchisement.

On the other hand, opponents of Mamdani’s approach express concern over the potential for increased class tensions and the impact on economic vitality in neighborhoods facing higher taxes. The idea of targeting “richer and whiter neighborhoods” has also sparked discussions about race and privilege, with some arguing that it could further entrench divisions in a city that prides itself on diversity and inclusion.

As the debate continues, Mamdani’s proposals have positioned him as a polarizing figure within the NYC political arena. His willingness to challenge conventional wisdom and advocate for radical change has garnered both fervent support and staunch opposition, reflecting the ongoing struggle over the direction of urban policy in America.

The Broader Implications of Mamdani’s Proposal

Mamdani’s bold taxation strategy raises important questions about the future of urban governance and the role of local leaders in addressing systemic inequalities. As cities across the United States grapple with similar challenges, Mamdani’s proposals could serve as a case study in the complexities of implementing progressive policies that aim to create a more equitable society.

The discourse surrounding Mamdani’s plan also highlights the need for a broader conversation about the nature of taxation and public funding. Advocates for social equity argue that a fair tax system must reflect the realities of income inequality and ensure that those who have benefited most from the city’s resources contribute their fair share toward the common good.

As New York City continues to evolve, the implications of Mamdani’s proposal may extend beyond the immediate context of local governance. His advocacy for tax reform as a tool for social justice could inspire similar movements across the country, prompting a reevaluation of how cities address economic disparities and strive for equity in a rapidly changing world.

Conclusion

Zohran Mamdani’s controversial proposal to shift taxes to wealthier neighborhoods underscores the ongoing debate over social equity in urban policy. As the conversation unfolds, it is clear that Mamdani’s ideas resonate with a growing segment of the population that seeks systemic change and a more equitable distribution of resources. Whether his radical approach will gain traction or face significant pushback remains to be seen, but the discussion it has ignited about taxation, race, and social justice is crucial for shaping the future of New York City and beyond.

In summary, the discourse around Mamdani’s plan encapsulates the challenges and opportunities faced by progressive movements in urban environments. As cities navigate the complexities of governance, equity, and taxation, the impact of Mamdani’s proposals could serve as a pivotal moment in the ongoing quest for social justice and economic fairness.

BREAKING: Bombshell Resurfaces — NYC Socialist Muslim Mayoral Candidate Zohran Mamdani Pushed Plan to Shift Taxes to “Richer and WHITER Neighborhoods” in Radical Racial Redistribution Scheme! pic.twitter.com/BSuno4Q4Zy

— I Meme Therefore I Am (@ImMeme0) June 27, 2025

BREAKING: Bombshell Resurfaces — NYC Socialist Muslim Mayoral Candidate Zohran Mamdani Pushed Plan to Shift Taxes to “Richer and WHITER Neighborhoods” in Radical Racial Redistribution Scheme!

In the ever-evolving landscape of New York City politics, there are always new faces and bold ideas that stir controversy and discussion. One such figure is Zohran Mamdani, a candidate who has made waves with his outspoken positions and ambitious proposals. Recently, a resurfaced plan proposed by Mamdani has ignited heated debates among New Yorkers and political commentators alike. The plan, which suggests shifting taxes to “richer and whiter neighborhoods,” has been described as a radical racial redistribution scheme. So, what exactly does this mean, and why is it causing such a stir?

Who is Zohran Mamdani?

Zohran Mamdani is a self-identified socialist and a member of the Democratic Socialists of America (DSA). His candidacy has been marked by a commitment to addressing inequality and social justice in New York City. With roots in both social activism and a strong political background, Mamdani has quickly become a notable figure in local politics. His stance on various issues, particularly those affecting marginalized communities, resonates with many voters who feel left behind by the traditional political establishment.

The Tax Redistribution Plan Explained

Mamdani’s proposed plan aims to create a more equitable tax system by shifting financial burdens from lower-income neighborhoods to wealthier areas. The idea is to use the funds generated from these wealthier neighborhoods to invest in public services and infrastructure in communities that historically lack resources. This approach is grounded in the belief that systemic inequality can be addressed through targeted fiscal measures.

The Rationale Behind the Proposal

At the heart of Mamdani’s proposal is the idea that wealthier neighborhoods, often predominantly white, have benefited from historical advantages that have perpetuated social and economic disparities. By reallocating tax responsibilities, Mamdani argues that it’s possible to level the playing field and ensure that all communities have access to essential services like education, healthcare, and housing.

This perspective aligns with a broader movement within progressive politics that seeks to dismantle systemic racism and promote social justice through economic means. Advocates believe that such measures are necessary to repair the damage done by decades of discriminatory policies and practices.

Public Reaction to the Plan

The reaction to Mamdani’s plan has been mixed. Supporters hail it as a necessary step towards equity, arguing that it addresses the root causes of poverty and inequality. On the other hand, critics have raised concerns about the practicality and fairness of such a sweeping change. Many argue that shifting tax burdens could lead to further division within the city and may not achieve the intended outcomes.

Social media platforms have been ablaze with discussions, memes, and opinions about Mamdani’s proposal. The tweet that sparked this latest wave of conversations highlights the polarizing nature of his ideas. As people engage with the topic, it’s clear that Mamdani’s approach has struck a nerve, prompting many to weigh in on whether such radical changes are necessary or feasible.

The Broader Implications of Tax Redistribution

When discussing tax redistribution, it’s essential to consider the broader implications for New York City. While the goal of reducing inequality is noble, the execution of such plans can have far-reaching consequences. For instance, if wealthier neighborhoods feel the pinch of increased taxes, it could lead to a mass exodus of residents and businesses. This shift could ultimately harm the very communities that Mamdani aims to support.

Moreover, the idea of racial redistribution raises questions about how we define wealth and poverty. Critics argue that wealth is not solely determined by race, and a blanket approach could overlook the complexities of individual circumstances. Addressing these nuances will be crucial for any serious discussion about tax reform and social equity.

Comparisons to Other Progressive Policies

Mamdani’s proposal isn’t the first of its kind. Other progressive politicians and movements across the nation have advocated for similar measures aimed at addressing inequality. For instance, proposals for wealth taxes and increased funding for public services have gained traction in various states. These policies often face significant backlash from conservative factions, who argue that they stifle economic growth and innovation. However, proponents maintain that without such reforms, the gap between the rich and the poor will only continue to widen.

What’s Next for Mamdani and NYC Politics?

As Mamdani continues to gain traction in the political arena, it’s clear that his proposals will remain a focal point of discussion among voters and pundits alike. His bold approach has the potential to reshape the political landscape in New York City, challenging traditional norms and inspiring a new generation of activists and leaders.

The upcoming election season is likely to see more debates surrounding issues of race, class, and economic inequality. Candidates who align with Mamdani’s vision may find themselves at the forefront of a movement that seeks to radically change how society views wealth and responsibility.

Engaging in the Conversation

Whether you support Mamdani’s ideas or stand in opposition, engaging in the conversation about tax redistribution and social equity is vital. Understanding the complexities of these issues can help foster more productive discussions and lead to more informed decision-making at the ballot box.

As we navigate these challenging topics, it’s essential to keep an open mind and consider the perspectives of others. The future of New York City and its ability to address systemic inequalities may very well depend on how we respond to proposals like Mamdani’s.

Stay Informed

For those interested in following the developments surrounding Zohran Mamdani and the broader political climate in New York City, staying informed through reliable news sources and engaging in local community discussions can be incredibly valuable. Websites such as The New York Times and CNN provide ongoing coverage of political developments, while forums like Reddit offer platforms for community dialogue.

As the situation unfolds, it will be interesting to see how Mamdani’s proposals influence the political landscape and whether they pave the way for new policies aimed at creating a more equitable society.

“`

This article covers the proposed tax redistribution plan by Zohran Mamdani in a comprehensive and engaging manner, while also embedding relevant links and maintaining an informal tone for readability.

BREAKING: Bombshell Resurfaces — NYC Socialist Muslim Mayoral Candidate Zohran Mamdani Pushed Plan to Shift Taxes to “Richer and WHITER Neighborhoods” in Radical Racial Redistribution Scheme!