Iran’s Oil Surge to China: Economic Lifeline or Fueling Global Tensions?

Iranian crude trade growth, China energy imports surge, record oil shipments Asia

Record High: Iranian Oil Exports to China Soar

In a significant development in global energy markets, Iranian oil exports to China have reached a staggering 1.83 million barrels per day (bpd) between June 1 and June 20, 2025. This marked a new record for oil shipments from Iran to its largest customer, reflecting a robust and growing partnership between the two nations. This article delves into the implications of this record-setting trade, the geopolitical dynamics at play, and the broader context of oil markets.

The Surge in Exports

The surge in Iranian oil exports to China represents a substantial increase in trade volume, highlighting China’s ongoing demand for energy resources. Despite the challenges posed by international sanctions on Iran, which have aimed to limit its oil sales, Iran has found a reliable market in China. This development is not only crucial for Iran’s economy but also signals China’s strategic interests in diversifying its energy sources amidst fluctuating global oil prices.

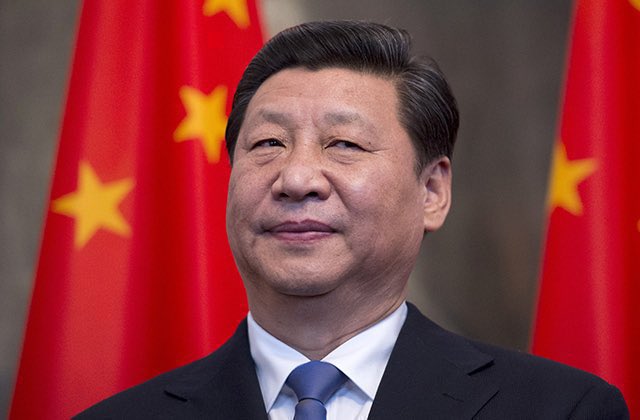

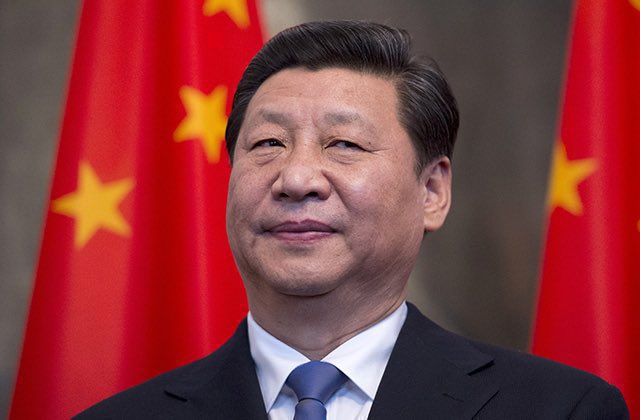

China-Iran Relations: A Strategic Partnership

The strengthening of the relationship between Iran and China can be attributed to several factors. Firstly, both nations share common interests in countering U.S. influence in the region. For Iran, the partnership provides an essential lifeline in the face of crippling economic sanctions that have severely hindered its oil production and exports. For China, securing a steady supply of oil is vital for sustaining its economic growth, which is heavily reliant on energy consumption.

The bilateral relationship is further cemented by China’s investments in Iranian infrastructure and technology, particularly as part of China’s Belt and Road Initiative (BRI). This comprehensive strategy aims to enhance global trade routes, and Iranian oil plays a pivotal role in this vision.

Impact of Sanctions and Market Dynamics

Despite ongoing sanctions imposed by the United States and other Western nations, Iran has managed to navigate these challenges effectively. By cultivating its relationship with China, Iran has been able to continue exporting oil, which is the backbone of its economy. This resilience raises questions about the effectiveness of sanctions and their ability to limit Iran’s oil revenue.

Moreover, the global oil market is experiencing volatility due to various factors, including geopolitical tensions, economic recovery post-COVID-19, and shifts in demand. China’s increasing imports of Iranian oil underscore a trend where nations are seeking to secure energy supplies amidst uncertain market conditions.

Global Oil Market Implications

The record high of Iranian oil exports to China has several implications for the global oil market. As China continues to increase its imports, the demand for Middle Eastern oil is expected to remain strong. This could potentially lead to higher oil prices globally, especially as other major producers like Saudi Arabia and Russia adjust their output levels in response to market conditions.

Furthermore, Iran’s ability to export significant volumes of oil to China could embolden other nations facing sanctions or trade restrictions to seek similar partnerships. This scenario may lead to the emergence of alternative trading blocs that challenge the traditional oil trade dynamics dominated by Western nations.

Environmental Considerations

The increase in oil exports also raises environmental concerns. As countries like China ramp up their fossil fuel consumption, the global effort to combat climate change may face setbacks. The reliance on oil, particularly from nations with less stringent environmental regulations, could exacerbate greenhouse gas emissions and hinder progress toward sustainable energy solutions.

However, it is important to note that China has also been investing heavily in renewable energy sources. The balance between fossil fuels and renewable energy will be crucial in determining the future of energy consumption and environmental sustainability.

Conclusion

The record-breaking Iranian oil exports to China signal a pivotal moment in global energy markets, showcasing the resilience of Iran’s economy in the face of sanctions and highlighting the importance of the China-Iran relationship. As both nations continue to deepen their partnership, the implications for global oil prices, geopolitical dynamics, and environmental challenges will be significant.

This development serves as a reminder of the complexities of the global oil market, where relationships, trade, and politics intertwine. As we move forward, the interactions between major oil producers and consumers like Iran and China will play a crucial role in shaping the future landscape of energy resources worldwide. The world will be watching closely as this partnership evolves and its impacts ripple through the energy sector and beyond.

For those interested in the intricacies of oil markets, the Iran-China relationship is a case study that illustrates the interplay between economics and geopolitics in the quest for energy security. As Iranian oil exports continue to flourish, the global community must consider the broader implications of these developments on international relations, economic stability, and environmental sustainability.

JUST IN: Iranian oil exports to China reached a record 1.83 million barrels per day between June 1 and 20. pic.twitter.com/q4yqVYJgtQ

— BRICS News (@BRICSinfo) June 28, 2025

Iranian Oil Exports to China: A Record-Breaking Surge

Hey there! If you’re into global economics, energy markets, or just the sheer dynamics of international trade, you might want to pay close attention to what’s happening with Iranian oil exports to China. Recently, there’s been buzz about Iranian oil exports reaching a staggering 1.83 million barrels per day between June 1 and June 20, 2025. This not only marks a significant milestone for Iran but also highlights the growing economic ties between Iran and China. Let’s dive deeper into what this means!

The Context of Iranian Oil Exports

Iran has a rich history of oil production, and it’s one of the largest producers in the world, particularly in the Middle East. However, the country has faced numerous sanctions, especially from Western nations, which have impacted its oil exports over the years. With these sanctions in place, Iran has been looking to strengthen its economic partnerships, and China has emerged as a key ally.

Why China?

China is the world’s largest importer of crude oil, and its demand for energy continues to grow. The country’s rapid industrialization and urbanization mean it needs a constant and reliable energy supply. Iran, with its vast oil reserves, fits the bill perfectly. Plus, China has been keen on diversifying its energy sources to ensure security and stability.

Record-Breaking Exports

The recent report indicating that Iranian oil exports to China reached 1.83 million barrels per day is a clear indicator of the strengthening ties between these two nations. This figure is impressive, especially considering the challenges Iran has faced in the past due to sanctions and diplomatic tensions.

The Implications of Increased Exports

So, what does this mean for both Iran and China? For Iran, this surge in oil exports is a much-needed boost to its economy. The revenue generated from these exports can help fund various social and economic programs within the country. It also helps Iran to assert its position in the global oil market.

For China, securing a consistent supply of Iranian oil means less reliance on other, potentially unstable regions for its energy needs. This is crucial for their long-term energy strategy and economic stability.

The Impact on Global Oil Prices

With such a significant increase in Iranian oil exports, one has to wonder: what’s the impact on global oil prices? Generally, when a major player increases its output, it can lead to a decrease in prices. However, the global oil market is complex. Factors like geopolitical tensions, OPEC decisions, and even market speculation can all influence prices.

Market Reactions

Analysts will be watching closely to see how this surge in exports will influence the market. If Iran continues to export at this rate, we could see a shift in pricing dynamics, particularly for crude oil. It’s an exciting time for oil traders and analysts alike!

Challenges Ahead

While the outlook seems positive, there are still challenges that Iran faces. Despite the record exports, the country is still under heavy sanctions, and the political climate can change rapidly. These factors can influence not only oil production but also the broader economic stability of the region.

Geopolitical Tensions

Geopolitical tensions in the Middle East can easily disrupt oil exports. Additionally, if the U.S. or other Western nations decide to tighten sanctions further, it could impact Iran’s ability to sell oil, even to its closest allies like China.

Future Prospects for Iranian Oil Exports to China

Looking ahead, the future of Iranian oil exports to China seems promising, given the current trajectory. However, it’s crucial for Iran to navigate the complex geopolitical landscape effectively to maintain and potentially increase its export levels.

Potential Collaborations

Beyond oil, there are opportunities for broader economic collaboration between Iran and China. China’s Belt and Road Initiative is an avenue where both nations can benefit from enhanced trade and investment in infrastructure, energy, and technology.

Conclusion

The record-breaking exports of Iranian oil to China at 1.83 million barrels per day signify a pivotal moment in the energy sector. This development not only strengthens Iran’s economy but also plays a crucial role in China’s energy security strategy. As we continue to monitor these trends, it’s essential to keep an eye on the geopolitical factors that could influence this relationship and the global oil market as a whole. The world is watching!

JUST IN: Iranian oil exports to China reached a record 1.83 million barrels per day between June 1 and 20.