Crypto Revolution or Risky Gamble? Stablecoin Legislation Nears Final Vote!

stablecoin regulation updates, cryptocurrency market impact, digital currency legislation trends

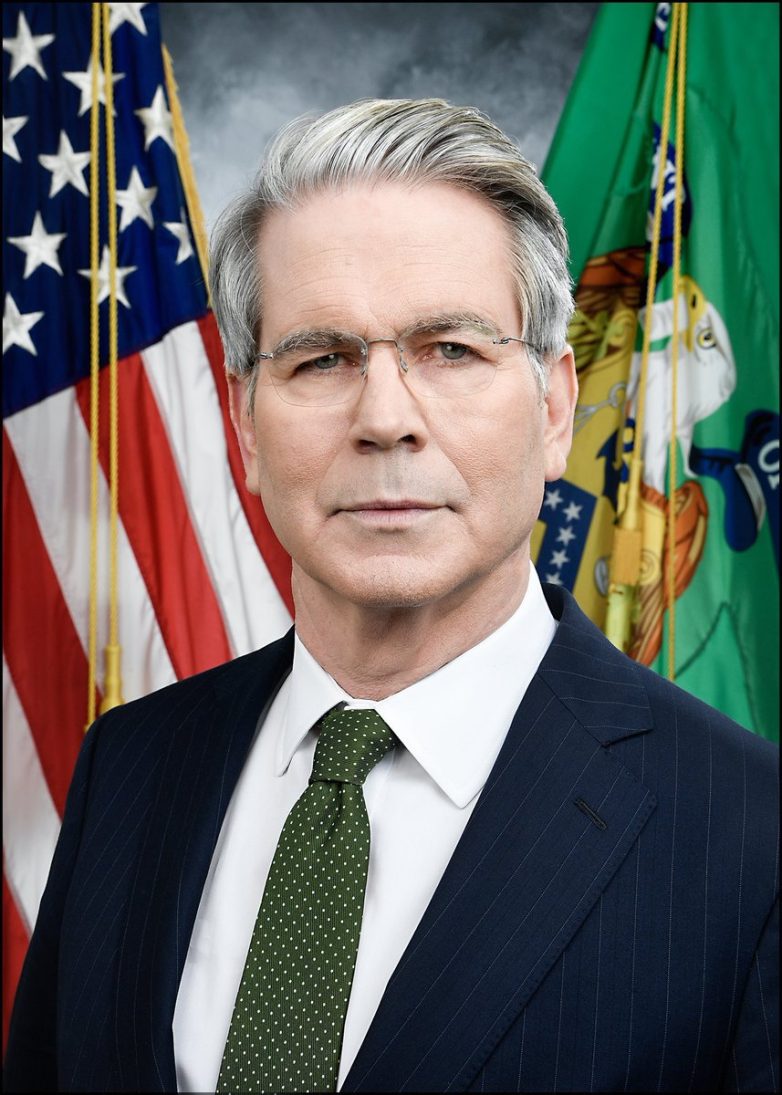

Treasury Secretary Announces Potential Finalization of Crypto Stablecoin Legislation by Mid-July

In a significant development for the cryptocurrency sector, U.S. Treasury Secretary Bessent has announced that legislation concerning crypto stablecoins could be finalized by mid-July 2025. This news has sparked interest among investors, regulators, and technology enthusiasts alike, as the regulation of stablecoins has become a hot topic in the evolving landscape of digital currencies.

What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve of assets, typically fiat currencies like the U.S. dollar or commodities such as gold. They aim to provide the benefits of digital currencies, such as fast transactions and lower fees, while minimizing the volatility commonly associated with cryptocurrencies like Bitcoin and Ethereum. With the increasing adoption of cryptocurrencies for transactions, stablecoins have been positioned as a bridge between traditional finance and the digital currency world.

The Importance of Regulation

The announcement by Secretary Bessent comes amid growing concerns over the stability and security of stablecoins. Recent events in the crypto market have highlighted the risks associated with unregulated digital currencies, leading to calls for comprehensive legislation. Regulatory clarity is crucial for fostering innovation in the cryptocurrency market while ensuring consumer protection and financial stability.

Stablecoins have garnered attention not just for their potential to facilitate everyday transactions but also for their role in decentralized finance (DeFi) ecosystems. However, without proper oversight, there are concerns about issues such as fraud, money laundering, and the potential for economic instability. Thus, the finalization of stablecoin legislation could provide the framework needed to address these challenges.

What to Expect from the Upcoming Legislation

While specific details about the forthcoming legislation have yet to be disclosed, experts anticipate that it will address several key areas:

1. **Consumer Protection**: Ensuring that stablecoin issuers maintain sufficient reserves to back the digital assets, thereby safeguarding users’ investments.

2. **Transparency Requirements**: Mandating regular audits and disclosure of reserves to increase trust and accountability in the stablecoin market.

3. **Operational Standards**: Establishing guidelines for the technological infrastructure that supports stablecoin transactions, focusing on security and reliability.

4. **Licensing and Compliance**: Creating a regulatory framework that requires stablecoin issuers to obtain licenses and comply with existing financial regulations, similar to traditional banks.

5. **Cross-Border Transactions**: Addressing how stablecoins will be treated in international finance, particularly concerning regulations in different jurisdictions.

Implications for Market Participants

The potential finalization of stablecoin legislation is expected to have far-reaching implications for various stakeholders in the cryptocurrency ecosystem. Here are some of the key players who will be impacted:

– **Stablecoin Issuers**: Companies that issue stablecoins will need to adapt to new regulations, which may require significant changes in their operations. This could lead to the consolidation of the market, with only those issuers who can meet regulatory requirements remaining viable.

– **Investors**: Regulatory clarity could instill confidence among investors, leading to increased adoption of stablecoins for transactions and investment purposes. This could also attract institutional investors who have been hesitant to enter the market due to regulatory uncertainties.

– **DeFi Platforms**: Many decentralized finance platforms rely on stablecoins for liquidity and to facilitate transactions. Clear regulations could foster a more robust DeFi ecosystem, potentially leading to innovation and new financial products.

– **Traditional Financial Institutions**: Banks and traditional financial entities may look to integrate stablecoins into their services, particularly as regulations provide a clearer framework for their use. This could lead to increased competition and collaboration between traditional finance and the crypto industry.

Community Reactions and Industry Perspectives

The announcement has elicited mixed reactions from the cryptocurrency community. Some industry leaders and advocates argue that regulatory clarity is essential for the growth and legitimacy of the crypto market. They believe that well-crafted legislation can create a safer environment for consumers and investors, thus promoting wider adoption of digital currencies.

Conversely, others express concerns that overly stringent regulations could stifle innovation and hinder the competitive edge of the U.S. in the global crypto landscape. The balance between regulation and innovation will be a critical topic as discussions around the upcoming legislation unfold.

Conclusion

As the U.S. Treasury Secretary has indicated, the potential finalization of crypto stablecoin legislation by mid-July 2025 represents a pivotal moment for the cryptocurrency industry. With an increasing number of individuals and institutions embracing digital currencies, the need for comprehensive regulation has never been more apparent.

The forthcoming legislation could provide a blueprint for the responsible growth of stablecoins and their integration into the broader financial system. Stakeholders across the spectrum—from issuers to investors—will be closely monitoring developments as the regulatory landscape evolves. As we move closer to the anticipated deadline, the dialogue surrounding stablecoin regulation will undoubtedly shape the future of digital currencies in the United States and beyond.

Stay tuned for updates as more details emerge about the impending legislation and its implications for the cryptocurrency market. The future of stablecoins may very well hinge on the decisions made in the coming months, making it a crucial time for all involved in the ever-evolving world of digital finance.

JUST IN: Treasury Secretary Bessent says crypto stablecoin legislation could be finalized by mid-July. pic.twitter.com/M6LUrJvFkV

— Watcher.Guru (@WatcherGuru) June 30, 2025

JUST IN: Treasury Secretary Bessent Says Crypto Stablecoin Legislation Could Be Finalized by Mid-July

Hey there, crypto enthusiasts! If you’re keeping your ear to the ground in the world of cryptocurrencies, you probably heard the buzz about the recent announcement from Treasury Secretary Bessent. The big news is that crypto stablecoin legislation could be finalized by mid-July. This is a pivotal moment for the cryptocurrency landscape, and it’s got everyone talking!

What Are Stablecoins?

Before diving into the implications of this announcement, let’s quickly recap what stablecoins are. Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve of assets, usually fiat currencies like the US dollar. This stability makes them an attractive option for users who want to avoid the volatility that typically plagues traditional cryptocurrencies like Bitcoin and Ethereum.

For example, a stablecoin like Tether (USDT) is pegged to the US dollar, meaning 1 USDT should always be worth about $1. This makes stablecoins a popular choice for transactions, remittances, and even as a way to store value.

Why Legislation Matters

Now, you might be wondering, why is legislation around stablecoins such a big deal? Well, the regulatory framework surrounding cryptocurrencies has been a hot topic for several years now. With the rise of stablecoins, regulators are keen to establish rules that ensure consumer protection, prevent money laundering, and promote financial stability.

The announcement from Secretary Bessent suggests that the government is taking steps to create a clear and effective regulatory environment for stablecoins. This could provide much-needed clarity for businesses and investors, boosting confidence in the market. Ultimately, effective legislation could lead to broader adoption of stablecoins and cryptocurrencies overall.

The Current Regulatory Landscape

As of now, the regulatory environment for cryptocurrencies is often seen as a patchwork of different rules and regulations. Different countries have taken various approaches to regulate cryptocurrencies, with some being more stringent than others.

In the US, the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) have been actively involved in regulating digital assets. However, when it comes to stablecoins, there hasn’t been a uniform approach. That’s where the new legislation could come in, providing a clear structure and guidelines for stablecoins to operate under.

Potential Impacts of New Legislation

So, what could the impacts of this new legislation be? Here are a few possibilities:

1. Increased Trust and Adoption

With clear regulations in place, users and businesses may feel more secure utilizing stablecoins. Trust plays a crucial role in the adoption of any financial product, and well-defined regulations could lead to increased usage.

2. Enhanced Consumer Protections

Regulations could help protect consumers from fraud and scams that can occur in the crypto space. This is particularly important given the explosive growth of this market and the increasing number of participants.

3. Innovation and Growth in the Market

Clear regulations could encourage innovation. Companies looking to create new financial products using stablecoins would have a clearer path forward, potentially leading to significant advancements in the financial technology space.

What’s Next for Crypto and Stablecoins?

As we look forward to the mid-July deadline for the finalization of crypto stablecoin legislation, the crypto community is buzzing with anticipation. It’s a waiting game now as we watch how this legislation will unfold and what it will mean for the future of stablecoins and cryptocurrencies as a whole.

For those of you actively investing or considering investing in stablecoins, it’s crucial to stay informed about this developing situation. Follow credible news sources and consider how the upcoming legislation could impact your investment strategy.

Final Thoughts

In the fast-paced world of cryptocurrency, keeping up with news and developments is key. The potential legislation around stablecoins is an exciting step forward that could bring a new era of stability and trust to the crypto market. Whether you’re a seasoned investor or just starting out, this is a story worth following closely. Stay tuned, folks, because the world of crypto is about to get even more interesting!

JUST IN: Treasury Secretary Bessent says crypto stablecoin legislation could be finalized by mid-July.