Trump Demands Immediate Resignation of Fed Chair Powell: Shocking Twist Ahead!

Trump criticism of Federal Reserve, Jerome Powell resignation demand, monetary policy controversy

Trump Calls for Federal Reserve Chair Jerome Powell’s Immediate Resignation

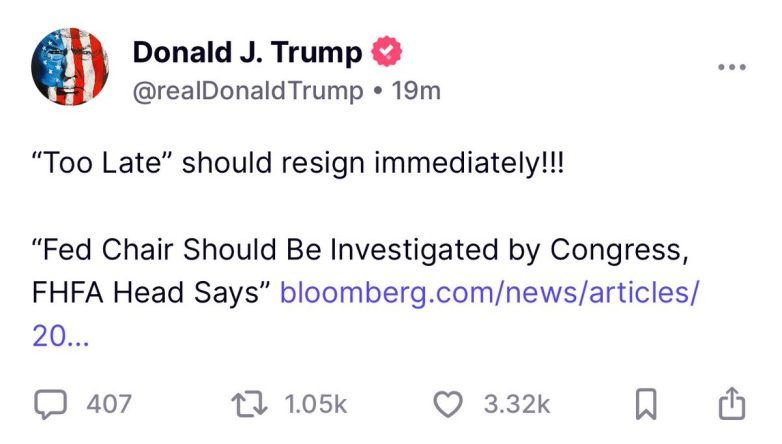

In a surprising turn of events, former President Donald Trump has publicly called for the resignation of Federal Reserve Chair Jerome Powell. This statement has stirred significant debate among economists, financial analysts, and political commentators alike. Trump’s remarks, made via a social media post, have reignited discussions surrounding the Federal Reserve’s role in managing the economy and its impact on inflation, interest rates, and overall economic growth.

The Context of Trump’s Statement

Trump’s demand for Powell to resign comes amidst ongoing concerns about the current state of the U.S. economy. With inflation rates soaring and the stock market experiencing volatility, many are questioning the effectiveness of the Federal Reserve’s monetary policy. The Fed’s strategies, particularly its approach to interest rates, have been a focal point of criticism from various sectors, including former President Trump.

During his presidency, Trump was vocal about his dissatisfaction with the Fed’s decisions, often advocating for lower interest rates to stimulate economic growth. His recent call for Powell’s resignation indicates a continuation of this trend, as Trump blames the Fed chair for what he perceives as economic mismanagement.

The Implications of Trump’s Call to Action

Trump’s call for Powell to resign could have far-reaching implications for both the political and economic landscapes in the United States. If Powell were to step down, it would open the door for a new Fed chair who may align more closely with Trump’s economic philosophies, which could include a more aggressive stance on interest rates and a focus on fostering economic growth.

Moreover, such a significant leadership change at the Federal Reserve could inject uncertainty into financial markets. Investors often rely on the stability and predictability of the Fed’s policies. A sudden shift in leadership could lead to fluctuations in market confidence, impacting everything from stock prices to mortgage rates.

The Reaction from Economists and Analysts

The economic community has responded with a mix of concern and skepticism regarding Trump’s statement. Many economists argue that Powell has taken a cautious and measured approach to monetary policy, especially in light of the complex economic challenges posed by the COVID-19 pandemic and subsequent recovery phases. They point out that raising interest rates too quickly could stifle growth and lead to a recession.

Additionally, some analysts emphasize the importance of the Federal Reserve’s independence from political pressure. They argue that Trump’s comments risk undermining this independence, which is crucial for maintaining investor confidence and ensuring sound economic policy. The Fed’s ability to operate free from political influence is seen as vital for effective monetary policy, particularly in times of economic uncertainty.

The Broader Political Landscape

Trump’s comments also reflect broader trends within the Republican Party and American politics at large. The call for Powell’s resignation can be seen as part of a growing populist sentiment that questions established institutions and advocates for dramatic change. This sentiment has gained traction in recent years, especially among Trump’s base, who view traditional economic policies as failing to address their concerns.

As the political landscape continues to evolve, Trump’s call to action may resonate with voters who feel disenfranchised by the current economic situation. This could influence the Republican Party’s stance on economic issues moving forward, particularly as the nation approaches the next election cycle.

What Comes Next?

As the situation unfolds, many are left wondering what the future holds for both Jerome Powell and the Federal Reserve. Should Powell choose to ignore Trump’s call for resignation, it will be imperative for him to communicate effectively with the public to reassure them of the Fed’s commitment to managing inflation and supporting economic growth.

On the other hand, if Powell does step down or is replaced, the implications for U.S. monetary policy could be significant. A new chair could shift the Fed’s focus and strategies, potentially leading to new policies that could either stabilize or further destabilize the economy.

Conclusion

Donald Trump’s call for Federal Reserve Chair Jerome Powell’s immediate resignation has sparked a lively debate about the future of U.S. monetary policy and the role of the Federal Reserve. As various stakeholders weigh in on the implications of this statement, it is clear that the dialogue surrounding economic management and political influence is far from over. The situation serves as a reminder of the delicate balance between political pressures and economic stability, a balance that will continue to be tested in the coming months and years.

As the economic landscape continues to evolve, it will be crucial for both policymakers and the public to remain informed about the Federal Reserve’s actions and the broader implications for the economy. Whether Trump’s call for Powell’s resignation will lead to significant changes in U.S. monetary policy remains to be seen, but it undoubtedly highlights the ongoing challenges and discussions surrounding economic management in an increasingly complex world.

JUST IN: Trump calls on FED chair Jerome Powell to RESIGN immediately pic.twitter.com/bxBzMDyguL

— Libs of TikTok (@libsoftiktok) July 2, 2025

Trump Calls on FED Chair Jerome Powell to Resign Immediately

In a bold move that has sent ripples through financial circles and beyond, former President Donald Trump has publicly called for Federal Reserve Chair Jerome Powell to resign immediately. This statement, made on July 2, 2025, has sparked a flurry of discussions and debates among economists, politicians, and the general public alike. Trump’s criticism of Powell is not new, but the timing and urgency of this call for resignation have raised eyebrows and prompted questions about the future direction of U.S. monetary policy.

The Context of Trump’s Statement

To fully understand why Trump made this call, we need to look at the backdrop of the current economic landscape. The Federal Reserve has been navigating a complex set of challenges, including inflationary pressures, employment rates, and ongoing global economic uncertainties. Many believe that the Fed’s policies under Powell have not effectively addressed these issues, leading to criticism from various quarters, including Trump.

Trump’s relationship with the Federal Reserve has been tumultuous. During his presidency, he often pressured the Fed to lower interest rates, arguing that such moves would stimulate economic growth. However, Powell’s cautious approach to monetary policy—particularly concerning inflation—has not sat well with Trump, who feels that the Fed needs to adopt a more aggressive stance.

What Triggered Trump’s Demand?

The recent uptick in inflation and the perceived sluggishness in economic recovery post-pandemic might have triggered this latest demand. Inflation has been a hot topic, and many Americans are feeling the pinch in their wallets. With rising costs for everyday items, there’s a growing sentiment that the Fed is not doing enough to combat inflation. Trump’s call for Powell to resign can be seen as a reflection of this public frustration.

Furthermore, political dynamics play a significant role in this situation. Trump has consistently positioned himself as a champion of the American worker, and by calling for Powell’s resignation, he aligns himself with those who feel left behind by current economic policies. It’s a strategic move that resonates with his base while also putting pressure on the Biden administration to respond.

The Reaction to Trump’s Call

As expected, Trump’s statement has elicited a wide range of reactions. Supporters of Trump have rallied behind his call, echoing concerns about inflation and the Fed’s policies. Many argue that fresh leadership at the Fed could bring about necessary changes in monetary policy that would ultimately benefit the economy.

On the other hand, critics of Trump’s demand caution against politicizing the Federal Reserve. The Fed is designed to operate independently of political influence, which is crucial for maintaining economic stability. Many economists stress that Powell, despite any shortcomings, has navigated the Fed through unprecedented challenges and should be allowed to continue his work without political interference.

The Implications of a Fed Chair Resignation

If Powell were to resign, it would not only create a significant vacancy but also potentially alter the trajectory of U.S. monetary policy. The appointment of a new Fed chair could lead to shifts in interest rates and inflation control measures, profoundly affecting the economy. Investors, businesses, and consumers alike are watching closely, as any changes in leadership could impact market confidence and economic growth.

Moreover, a resignation could set a precedent for future administrations to exert influence over the Fed, undermining its independence. This is a critical concern for many who believe that an independent Fed is vital for maintaining economic stability in the long run.

What’s Next for Jerome Powell?

As of now, Powell has not indicated any intention to resign. He remains committed to his role, focusing on navigating the challenges ahead. In fact, he has previously stated that the Fed will do what is necessary to ensure economic stability, which could include tightening monetary policy if inflation continues to rise.

It will be interesting to see how this situation evolves. Will Powell remain at the helm, or will the pressure from Trump and others lead to a change in leadership? This question looms large as the economic climate continues to shift.

Why This Matters to You

For the average American, the implications of Trump’s call for Powell’s resignation are significant. Changes in the Fed’s leadership or policy directions can directly impact interest rates on loans, mortgages, and even credit cards. If inflation continues to rise without adequate measures to control it, consumers may find themselves paying more for basic necessities.

Additionally, the stock market is sensitive to changes in the Fed. Any uncertainty regarding leadership or policy can lead to market volatility, affecting retirement accounts and investments. Keeping an eye on these developments is crucial for anyone who wants to safeguard their financial future.

Final Thoughts on the Fed and Economic Policy

The relationship between political figures and economic institutions like the Federal Reserve is complex and often fraught with tension. Trump’s call for Jerome Powell to resign highlights the ongoing debate about the Fed’s role in managing the economy and the influence of politics on economic policy.

As we move forward, it’s essential to stay informed about these developments. Whether you agree or disagree with Trump’s demand, understanding the implications for monetary policy and economic stability is vital for making informed financial decisions.

So, what do you think? Is it time for a change at the Federal Reserve, or should Powell be given the chance to continue his work? The conversation is just beginning, and your voice matters in shaping the future of economic policy in the United States.

“`

This article has been crafted to be SEO-optimized, with relevant headings and a conversational tone, providing valuable insights into the implications of Trump’s call for Jerome Powell’s resignation as the Federal Reserve Chair.

JUST IN: Trump calls on FED chair Jerome Powell to RESIGN immediately