US Inflation Plummets to 1.66%: Experts Clash Over Rate Cuts and Consequences!

US economic outlook, inflation reduction strategies, interest rate adjustments

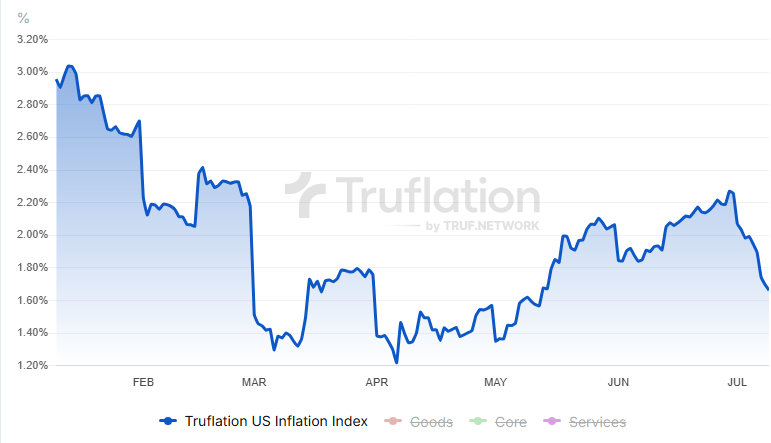

US Inflation Index Drops to 1.66%: Implications and Reactions

In a surprising turn of events, the US Inflation Index has dropped to 1.66%, raising eyebrows across financial markets and prompting urgent calls from experts for a reduction in interest rates. This significant change in inflation metrics has sparked widespread discussion, with many analysts and economists expressing their concerns and opinions on what this means for the broader economy.

What Does the Drop in Inflation Mean?

The recent decline in the US Inflation Index reflects a notable shift in the economic landscape. A lower inflation rate typically indicates that prices for goods and services are stabilizing or even declining, which can have both positive and negative implications for various sectors. For consumers, a lower inflation rate can lead to increased purchasing power, as the cost of living may stabilize or decrease. However, for businesses, particularly those in sectors sensitive to interest rates, this news can be a double-edged sword.

Expert Reactions

Following the announcement of the 1.66% inflation rate, experts and analysts have voiced their opinions, many of whom are advocating for a cut in interest rates. Lower interest rates can stimulate economic growth by encouraging borrowing and spending. This is especially pertinent in a climate where consumers are cautious about their spending habits due to previous inflation spikes. As Eric Daugherty tweeted, the reaction from experts has been one of urgency, emphasizing the need for the Federal Reserve to consider a rate cut to support economic recovery and growth.

The Impact on Consumer Spending

Consumer spending is a critical component of the US economy, accounting for a significant portion of economic activity. With inflation rates declining, consumers may feel more confident in their financial situations, leading to increased spending. This potential uptick in consumer demand could be a vital factor in driving economic growth, particularly in sectors such as retail, hospitality, and services.

However, it’s essential to balance this optimism with caution. While a lower inflation rate can boost consumer confidence, any adjustments in interest rates by the Federal Reserve will also play a crucial role in shaping economic dynamics. If interest rates remain high, it could dampen the positive effects of lower inflation, as consumers may be deterred from making significant purchases or investments.

Implications for Businesses

Businesses, particularly small and medium enterprises, are closely monitoring these inflation changes and the potential for interest rate adjustments. A lower inflation rate may provide some relief in terms of pricing pressures, allowing businesses to stabilize their operations and potentially pass on savings to consumers. However, the anticipated interest rate cuts could also significantly influence business strategies moving forward.

For instance, businesses may feel encouraged to invest in expansion or new projects if borrowing becomes cheaper due to lower interest rates. This could lead to job creation and increased economic activity, fostering a positive cycle of growth. On the other hand, businesses that rely heavily on credit may face challenges if the Federal Reserve decides to maintain or increase interest rates in response to other economic indicators.

The Federal Reserve’s Dilemma

The Federal Reserve finds itself at a crossroads. The decision to cut interest rates in response to declining inflation must be weighed against other economic indicators, such as employment rates, wage growth, and global economic conditions. While a lower inflation rate may warrant a rate cut, the Fed must also consider the potential long-term effects on the economy.

Moreover, the Fed’s credibility is at stake. Frequent adjustments to interest rates can lead to market volatility and uncertainty, which can undermine consumer and investor confidence. As such, the Federal Reserve may opt for a cautious approach, monitoring inflation trends and other economic indicators before making significant changes to interest rates.

Conclusion

The recent drop in the US Inflation Index to 1.66% has generated significant discussion among economists, analysts, and policymakers. As experts call for a reduction in interest rates to stimulate economic growth, the implications for consumers and businesses become increasingly important. While lower inflation can bolster consumer confidence and spending, the Federal Reserve’s response will ultimately shape the economic landscape moving forward.

In these uncertain times, staying informed about inflation trends, interest rates, and their potential impacts on the economy is crucial for both consumers and businesses. As the situation evolves, monitoring expert opinions and economic indicators will be essential for making informed decisions in a rapidly changing economic environment.

BREAKING: US Inflation Index drops to 1.66%.

The experts are fuming.

Cut interest rates. pic.twitter.com/zdZbyKJUOd

— Eric Daugherty (@EricLDaugh) July 9, 2025

US Inflation Index Drops to 1.66%: What You Need to Know

Hey there! If you’ve been following the news lately, you might have come across a startling announcement about the US Inflation Index. According to a tweet by Eric Daugherty, the index has plummeted to an astonishing 1.66%. This has sparked quite a bit of chatter among economists and everyday folks alike. So, what does this mean for you, the average American? Let’s dive into it!

The Current State of the US Inflation Index

The US Inflation Index is a crucial economic indicator that measures the average change over time in the prices paid by consumers for goods and services. When it drops to 1.66%, it indicates a significant decrease in inflation rates, which can have ripple effects across the economy. This figure is particularly interesting because it suggests that the cost of living may not be rising as rapidly as it has in recent years.

Why Are Experts Fuming?

Now, you might be wondering, why are experts so upset about this drop? The reason lies in the delicate balance of the economy. Generally, a low inflation rate can be a sign of a struggling economy, leading to concerns about economic growth and consumer spending. If people are not spending money, businesses can suffer, potentially resulting in layoffs and a less vibrant economy. This concern is what’s driving the conversation around interest rate cuts.

What Does a Drop in Inflation Mean for Interest Rates?

With the US Inflation Index falling, many experts are calling for the Federal Reserve to consider cutting interest rates. Lower interest rates typically make borrowing cheaper, which can encourage spending and investment. If the Fed decides to lower rates, it could stimulate the economy by making it easier for consumers to take out loans for homes, cars, and other big purchases. However, it’s a bit of a double-edged sword; while lower rates can boost spending, they can also lead to concerns about inflation returning in the future.

What Should You Do in Response?

So, how should you respond to this news? First off, keep an eye on any announcements from the Federal Reserve regarding interest rates. If they do decide to cut rates, it could be a great time to consider refinancing your mortgage or taking out a loan for that new car you’ve been eyeing. Also, remember that a stable inflation rate is generally good for your purchasing power, meaning your dollar can stretch a bit further.

The Broader Economic Context

To truly understand the implications of a 1.66% inflation rate, it’s important to look at the broader economic context. The pandemic has significantly impacted the economy, and various sectors are still recovering. For instance, the supply chain issues that have plagued many industries may still be affecting prices. A lower inflation rate could indicate that these issues are beginning to resolve, leading to a more stable economic environment.

The Historical Perspective on Inflation Rates

Looking back, the US Inflation Index has fluctuated quite a bit over the years. For example, after the 2008 financial crisis, inflation rates remained relatively low for an extended period. This period of low inflation was a significant concern for economists, as it can lead to deflationary pressures, which are even more problematic for an economy. By contrast, the inflation rates experienced during the pandemic were significantly higher, leading to the current scrutiny of how we manage inflation.

Implications for Investors

If you’re an investor, this drop in the US Inflation Index could impact your strategy. Lower inflation can lead to lower yields on bonds, which may push investors to seek higher returns in stocks or alternative investments. Additionally, sectors such as real estate may see increased interest if borrowing costs decrease. It’s always a good idea to consult with a financial advisor to understand how these changes could affect your investment portfolio.

The Global Impact of US Inflation Rates

Believe it or not, the US Inflation Index doesn’t just affect Americans. The global economy is intricately linked, and changes in US inflation rates can have far-reaching consequences. For instance, a decrease in inflation might lead to a stronger dollar, which could impact exports. Countries that rely on US imports might experience shifts in their economies depending on how US monetary policy adapts to the inflation landscape.

Consumer Sentiment and Spending

Consumer sentiment often mirrors inflation rates. When inflation is low, consumers are generally more confident about their financial situations, which can lead to increased spending. This is crucial for businesses, particularly in the retail and hospitality sectors. If people feel good about their finances, they are more likely to spend money, which propels economic growth. So, keep an eye on how consumer sentiment shifts in response to this change in the US Inflation Index.

Looking Ahead: What’s Next?

As we look ahead, it will be fascinating to see how the Federal Reserve responds to this new inflation data. Will they cut interest rates? Or will they maintain the current rates in hopes of stabilizing the economy? Whatever happens, it’s essential to stay informed and adapt your financial strategies accordingly. The economic landscape is always changing, and being proactive can help you navigate these fluctuations.

Wrapping Up the Discussion

In summary, the drop in the US Inflation Index to 1.66% has stirred quite a bit of discussion among experts and consumers alike. While it can be seen as a sign of economic stability, it also raises concerns about growth and spending. For individuals, this may be an excellent time to consider financial decisions such as refinancing loans or investing in new opportunities. Stay informed, keep an eye on the Federal Reserve’s actions, and adapt your financial strategies as needed!

For ongoing updates, make sure to follow trusted news sources and financial analysts who can provide insights into how this change in the US Inflation Index will shape the economy in the months to come.

BREAKING: US Inflation Index drops to 1.66%. The experts are fuming. Cut interest rates.