Controversial “No Tax on Home Sales Act” Sparks Fierce Debate in Congress!

capital gains tax elimination, home sales tax relief, property investment incentives

Rep. Marjorie Taylor Greene Introduces “No Tax on Home Sales Act”

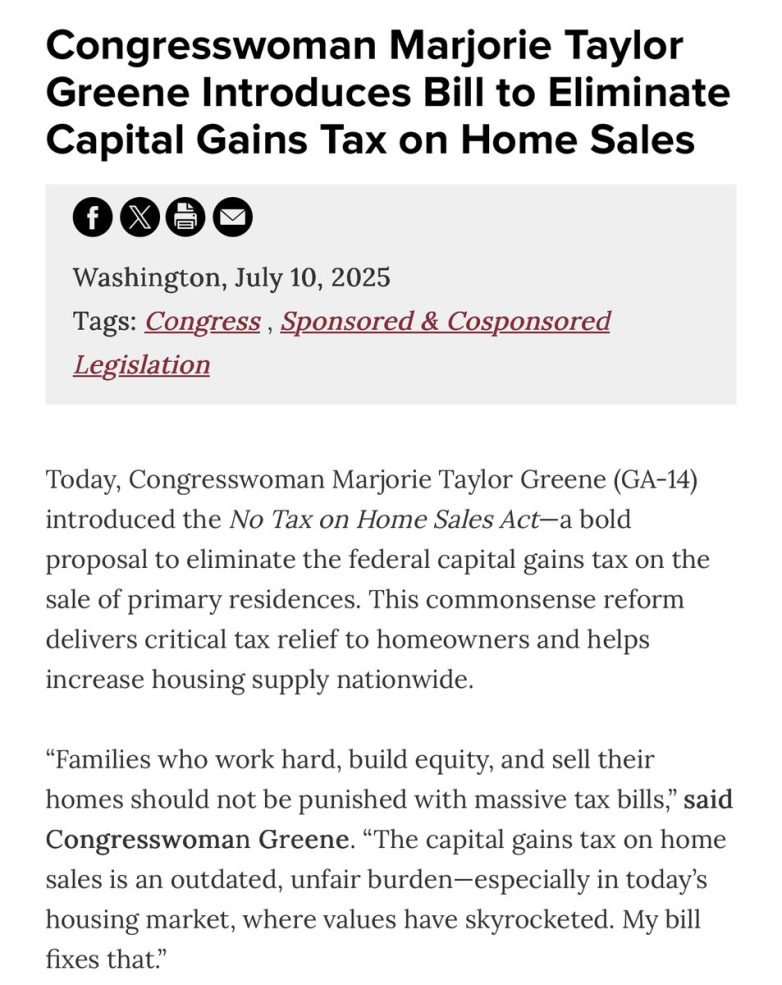

In a bold legislative move that could reshape the landscape of real estate in the United States, Representative Marjorie Taylor Greene has introduced the “No Tax on Home Sales Act.” This proposed legislation aims to eliminate the capital gains tax on home sales, a move that Greene argues will allow American homeowners to retain more of their hard-earned money. The act has already generated considerable buzz, prompting discussions about its potential impact on taxpayers and the housing market.

The Essence of the “No Tax on Home Sales Act”

The core objective of the “No Tax on Home Sales Act” is straightforward: to exempt homeowners from paying capital gains taxes when they sell their property. Typically, when a homeowner sells their home for more than they purchased it, they are liable for capital gains tax on the profit made from the sale. Greene’s proposal seeks to alleviate this financial burden, positioning it as a way to empower homeowners and stimulate the housing market.

In her announcement, Greene emphasized that the act is about letting the “American people KEEP what they’ve earned.” This sentiment resonates with many who view homeownership as a significant part of the American dream. By removing the capital gains tax, Greene argues that the legislation would encourage more individuals to buy and sell homes without the fear of incurring hefty tax liabilities.

The Potential Impact on the Housing Market

Eliminating the capital gains tax on home sales could have profound implications for the housing market. Many potential sellers may be deterred from listing their homes due to the tax implications of a profitable sale. By removing this obstacle, the “No Tax on Home Sales Act” could lead to an increase in homes on the market, potentially addressing the inventory shortages that have plagued many regions.

More homes on the market could also contribute to stabilizing home prices, which have seen significant appreciation in recent years. As supply increases, prices may become more affordable for first-time buyers and those looking to upgrade their living situations. This could create a more dynamic and competitive market, benefiting buyers and sellers alike.

Support and Opposition

While the “No Tax on Home Sales Act” has garnered support from some conservative circles who advocate for lower taxes and less government intervention, it is not without its critics. Opponents of the legislation argue that eliminating the capital gains tax could disproportionately benefit wealthier homeowners, further widening the gap between different socioeconomic classes. They contend that the revenue generated from capital gains taxes is crucial for funding essential public services and infrastructure.

The debate surrounding the bill is likely to intensify as it moves through the legislative process. Greene’s supporters are calling for Speaker of the House Johnson to prioritize the act and ensure it reaches the President’s desk. However, the road to passage may be fraught with challenges, as lawmakers from both sides of the aisle weigh the potential benefits and drawbacks of such a significant tax reform.

What Homeowners Need to Know

For homeowners and potential sellers, the introduction of the “No Tax on Home Sales Act” represents a significant opportunity. If passed, homeowners could find themselves in a more advantageous position, enabling them to capitalize on their investments without the looming concern of capital gains taxes. This could encourage more people to enter the real estate market, fostering a sense of confidence in homeownership as a viable financial strategy.

Homeowners should stay informed about the progress of this legislation, as its implications could directly affect their financial planning and decision-making processes regarding property sales. Engaging with local representatives and expressing support for or concerns about the act can also be a crucial part of the democratic process, ensuring that their voices are heard as this significant piece of legislation moves forward.

Conclusion

Rep. Marjorie Taylor Greene’s “No Tax on Home Sales Act” is a bold proposal aimed at eliminating the capital gains tax on home sales, a move that could empower homeowners and invigorate the housing market. While the potential benefits are significant, the act also faces scrutiny from critics concerned about its implications for wealth disparity and public funding. As the legislation progresses, it will be essential for homeowners and stakeholders to remain engaged and informed about its potential impact. Whether this act will make it to the President’s desk remains to be seen, but its introduction has undoubtedly sparked important conversations about taxation, homeownership, and the future of the American housing market.

BREAKING: Rep. Marjorie Taylor Greene just introduced the “No Tax on Home Sales Act” that would ELIMINATE the Capital Gains tax on home sales!

“Let the American people KEEP what they’ve earned!”

Johnson needs to do everything possible to get this to the President’s desk! pic.twitter.com/JlMsvEGAD3

— Gunther Eagleman (@GuntherEagleman) July 10, 2025

BREAKING: Rep. Marjorie Taylor Greene Just Introduced the “No Tax on Home Sales Act”

In a bold move that’s sending ripples through the political landscape, Representative Marjorie Taylor Greene has just introduced the “No Tax on Home Sales Act.” This proposed legislation aims to eliminate the capital gains tax on home sales, an initiative that many homeowners and real estate investors have been eagerly waiting for. The essence of the act is straightforward: it allows homeowners to sell their properties without the burden of capital gains tax, essentially letting them keep more of what they’ve earned from their investments.

What Does the “No Tax on Home Sales Act” Mean for Homeowners?

For many Americans, selling a home is not just a financial transaction; it’s a significant life milestone. The current capital gains tax can take a hefty chunk out of the profits from a home sale, especially in a booming real estate market. By proposing this act, Greene is advocating for a system where homeowners can fully benefit from the appreciation of their property value without the government taking a slice.

Imagine selling your home for a great profit only to discover that a significant portion of that profit is going to taxes. It’s frustrating, right? Greene’s act aims to change that narrative, allowing homeowners to reap the full rewards of their investments. The idea is clear: let the American people keep what they’ve earned!

The Implications of Eliminating Capital Gains Tax on Home Sales

Now, you might be wondering, “What are the broader implications of this act?” Well, eliminating the capital gains tax on home sales could encourage more people to buy and sell homes. When potential sellers know they won’t be taxed on their profits, it may motivate them to enter the market. This could lead to increased competition, driving up home sales and stimulating the economy.

On the flip side, there are concerns about how this might affect government revenue. The capital gains tax is a significant source of income for federal and state governments. By removing it, there could be potential shortfalls in funding for essential services. However, proponents argue that the boost in economic activity could offset these losses.

How Will This Bill Progress?

Now that the “No Tax on Home Sales Act” has been introduced, what’s next? The bill must go through the legislative process, which involves debates, revisions, and votes. Greene emphasized the importance of getting this act to the President’s desk, urging fellow lawmakers to support the initiative. It’s a call to action for those who believe in empowering homeowners and stimulating the economy.

Keep an eye on how this bill progresses. With so many homeowners awaiting relief from capital gains tax, there’s a significant interest in the outcome of this legislation. If you’re passionate about homeownership and property investment, your voice matters. Engaging with your representatives and expressing support for this act could be crucial in pushing it forward.

Public Response to the “No Tax on Home Sales Act”

Public reaction to Greene’s announcement has been largely positive, especially among homeowners and real estate professionals. Many see this as a long-overdue change that aligns with the principles of free enterprise and individual prosperity. The sentiment is captured perfectly in Greene’s own words: “Let the American people keep what they’ve earned!”

However, there are critics who argue that this act could disproportionately benefit wealthier individuals who own more valuable properties. The debate around tax reform is always complex, and proposals like this one often come with varied opinions. The key will be finding a balance that encourages home sales while also considering the implications for tax equity across different income levels.

The Bigger Picture: Tax Reform and Homeownership

The introduction of the “No Tax on Home Sales Act” fits into a larger conversation about tax reform in the United States. As housing prices continue to rise, many are questioning the fairness of existing tax structures. Homeownership is a significant part of the American Dream, and policies that support it can have lasting benefits for society as a whole.

Tax reform, particularly in relation to real estate, has become a hot topic over the past few years, especially as more millennials and younger generations enter the housing market. If you’re interested in real estate, understanding the implications of tax laws like the capital gains tax is essential for making informed decisions.

What Should Homeowners Do Now?

As the “No Tax on Home Sales Act” progresses through Congress, homeowners should stay informed and consider their options. If you’re thinking about selling your home, now might be a good time to evaluate your situation. Keep an eye on the news for updates regarding this legislation, as it could impact your financial outcomes significantly.

Additionally, it’s wise to consult with real estate professionals and tax advisors. They can provide insights into how the potential changes in tax law could affect your sale and overall financial strategy. Don’t hesitate to reach out to experts who can guide you through this evolving landscape.

Conclusion: A Step Towards Empowering Homeowners

In summary, the introduction of the “No Tax on Home Sales Act” by Rep. Marjorie Taylor Greene represents a pivotal moment for homeowners across the United States. By eliminating the capital gains tax on home sales, this act could empower individuals to keep more of their hard-earned money while stimulating the housing market.

As this legislation moves forward, it’s crucial for homeowners and real estate investors to stay engaged and informed. Whether through direct advocacy or simply by staying updated on the latest developments, your involvement can make a difference.

So, what do you think about the “No Tax on Home Sales Act”? Are you excited about the potential changes, or do you have concerns? Share your thoughts and let’s keep the conversation going!

“`

BREAKING: Rep. Marjorie Taylor Greene just introduced the "No Tax on Home Sales Act" that would ELIMINATE the Capital Gains tax on home sales! "Let the American people KEEP what they've earned!" Johnson needs to do everything possible to get this to the President's desk!