“Marjorie Taylor Greene’s Bold Move: Should We Abolish Home Sale Taxes?”

capital gains elimination, home equity tax reform, real estate tax relief

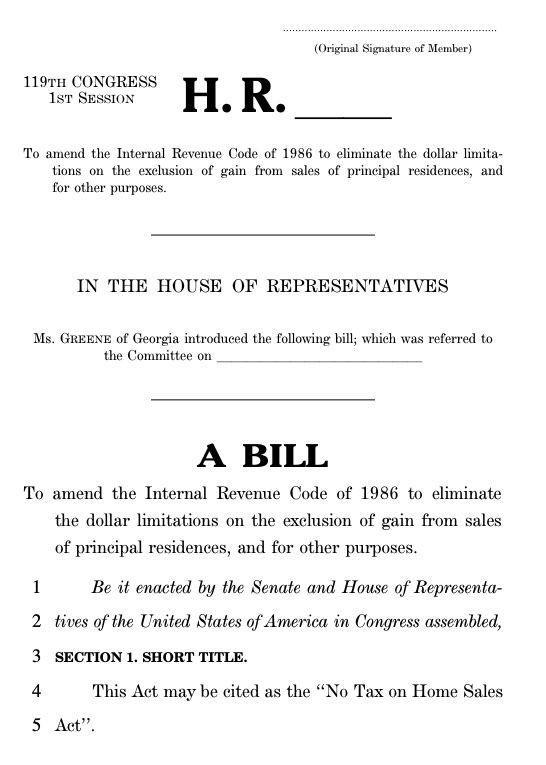

Marjorie Taylor Greene Proposes Bill to Eliminate Capital Gains Tax on Home Sales

In a significant move that has garnered attention across the political spectrum, Representative Marjorie Taylor Greene has introduced a bill aimed at eliminating the capital gains tax on home sales. This proposal is rooted in the belief that American families who invest time and effort into building equity in their homes should not face hefty tax bills when they decide to sell. The announcement was made via a post on social media, where Greene emphasized the importance of supporting hardworking families.

Understanding Capital Gains Tax

Capital gains tax is a tax imposed on the profit realized from the sale of non-inventory assets, such as real estate, stocks, and bonds. In the context of home sales, homeowners are often required to pay taxes on the profit made from the sale of their property, which can significantly reduce the financial benefits of selling a home. Greene’s bill seeks to address this issue by proposing the complete elimination of this tax for home sales, which she argues will empower families to make more financially sound decisions without the fear of a punitive tax burden.

The Rationale Behind the Bill

Greene’s proposal aligns with a broader conversation about tax reform in the United States, particularly in how taxes impact middle-class families. The representative argues that families who work hard to build equity in their homes should not be penalized when they choose to sell. This perspective resonates with many homeowners who view their homes as not just a place to live, but also as a significant financial investment.

By eliminating the capital gains tax on home sales, Greene believes that families would have more freedom to relocate for job opportunities, downsize as their children move out, or upgrade to larger homes without the fear of incurring a substantial tax liability. This could potentially stimulate the housing market by encouraging more transactions and allowing families to make decisions that align with their personal and financial goals.

The Political Landscape

The introduction of this bill comes at a time when the United States is grappling with various economic challenges, including rising inflation and fluctuating housing market conditions. Greene’s proposal may be viewed as a strategic move to appeal to constituents who are feeling the pinch of economic pressures. By focusing on tax relief for homeowners, she aims to position herself as a champion for middle-class families.

However, the bill may face significant opposition from lawmakers who argue that eliminating the capital gains tax could lead to a substantial loss of revenue for the federal government. Critics may contend that this tax relief disproportionately benefits wealthier individuals who are more likely to own and sell homes for profit. As the debate unfolds, it will be crucial to examine the potential economic implications of such a policy change.

Implications for Homeowners

For homeowners, the elimination of the capital gains tax could mean a more favorable financial landscape when selling their properties. Many individuals and families have felt trapped by the tax implications of home sales, often leading them to delay selling their homes or making less favorable financial decisions. Without the looming threat of a capital gains tax, homeowners might feel more empowered to enter the real estate market, thereby increasing overall market activity.

Moreover, this proposal could encourage first-time homebuyers to enter the market, as the potential for future appreciation without the burden of a capital gains tax may make homeownership a more attractive option. This shift could lead to a more dynamic housing market, benefiting both sellers and buyers.

Public Response

The public response to Greene’s proposal has been mixed. Supporters applaud the initiative as a much-needed reform that prioritizes the interests of everyday Americans. They argue that tax relief for homeowners is essential for fostering economic growth and stability within communities.

Conversely, critics express concern over the potential long-term effects on government revenue and the fairness of the tax system. Some argue that eliminating the capital gains tax could disproportionately benefit wealthier individuals and exacerbate existing inequalities in the housing market.

The Future of the Bill

As Greene’s bill moves forward, it will be important to monitor the legislative process and public discourse surrounding the proposal. The success of the bill will depend on various factors, including bipartisan support, public opinion, and the broader economic context. If passed, this legislation could mark a significant shift in how capital gains are taxed in the United States, particularly concerning real estate transactions.

Conclusion

Rep. Marjorie Taylor Greene’s introduction of a bill to eliminate the capital gains tax on home sales represents a bold stance in the ongoing conversation about tax reform and economic policy. By advocating for the interests of homeowners, Greene aims to alleviate the financial burdens associated with selling property, thereby empowering families to make decisions that benefit their long-term financial health.

As discussions surrounding this proposal unfold, it will be crucial to examine its potential impacts on the housing market, government revenue, and the overall economy. Whether this bill will gain traction in Congress remains to be seen, but its introduction undoubtedly adds an important voice to the ongoing dialogue about tax policy in America.

Stay informed about developments related to this bill and other significant legislative initiatives as they unfold in the coming months.

BREAKING: Rep. Marjorie Taylor Greene Introduces Bill to ELIMINATE Capital Gains Tax on Home Sales

“Families who work hard, build equity, and sell their homes shouldn’t be punished with a massive tax bill.” –@RepMTG pic.twitter.com/REs0LXlvo1

— Libs of TikTok (@libsoftiktok) July 10, 2025

BREAKING: Rep. Marjorie Taylor Greene Introduces Bill to ELIMINATE Capital Gains Tax on Home Sales

In a bold move that’s already sparking conversations across the political spectrum, Representative Marjorie Taylor Greene has introduced a bill aimed at eliminating the capital gains tax on home sales. This proposal is capturing attention, not just because of its potential impact on American families but also due to the broader implications it may have on the real estate market and the economy.

Understanding Capital Gains Tax on Home Sales

Before diving into the implications of this new bill, let’s break down what the capital gains tax is and how it affects homeowners. Essentially, the capital gains tax is a tax on the profit made from the sale of an asset, in this case, your home. When you sell your home for more than you originally paid, the profit is considered a capital gain.

For many families, their home is one of the largest investments they’ll ever make. Building equity through mortgage payments, home improvements, and market appreciation can lead to significant profits when it’s time to sell. However, the capital gains tax can eat into those profits, sometimes leaving sellers feeling like they’ve been shortchanged after all their hard work.

What Marjorie Taylor Greene Says

Rep. Greene argues that “families who work hard, build equity, and sell their homes shouldn’t be punished with a massive tax bill.” This statement resonates with many homeowners who feel that the current tax structure disproportionately penalizes them for their successes. By eliminating the capital gains tax on home sales, Greene believes that families can retain more of their hard-earned money, allowing them to reinvest it into their communities or secure their financial futures.

The Potential Benefits of Eliminating Capital Gains Tax

There are several potential benefits to eliminating the capital gains tax on home sales. Here are a few key points to consider:

- Increased Home Sales: Without the burden of a capital gains tax, homeowners may be more inclined to sell their homes, leading to a more dynamic real estate market.

- Greater Financial Security: Homeowners can pocket more of their sale profits, which can be used for retirement, education, or purchasing a new home.

- Encouragement to Downsize: Older homeowners may find it easier to downsize without worrying about hefty taxes, thus freeing up larger family homes for younger families.

Criticism and Concerns

Of course, not everyone is on board with this proposal. Critics argue that eliminating the capital gains tax could lead to a significant loss in tax revenue, which funds essential public services. Some economists warn that this could exacerbate wealth inequality, as wealthier individuals are more likely to own multiple properties and benefit from the tax elimination.

Furthermore, there are concerns about the long-term impact on housing affordability. If more homes are sold without the capital gains tax, the influx of buyers could drive prices up even further, making it harder for first-time buyers to enter the market.

The Broader Economic Implications

The decision to eliminate the capital gains tax on home sales could have ripple effects throughout the economy. By potentially increasing disposable income for homeowners, we may see a boost in consumer spending, which is a key driver of economic growth.

Additionally, if homeowners feel more secure in their financial standing, they may be more likely to invest in home improvements or take on other investments, further stimulating the economy.

Public Response and Reactions

Public response to Rep. Greene’s proposal has been mixed. Supporters praise the idea as a common-sense approach to help families retain their wealth. However, opponents are raising red flags about the potential consequences on public funding and housing affordability.

Social media platforms have become a battleground for these discussions. Many are voicing their opinions on platforms like Twitter, where Greene’s announcement has sparked debates among constituents and political commentators alike. You can check out the original announcement from Libs of TikTok [here](https://twitter.com/libsoftiktok/status/1943404174994972754?ref_src=twsrc%5Etfw).

What’s Next for the Bill?

As this bill moves through the legislative process, it will undoubtedly face scrutiny from various stakeholders. It will be interesting to see how lawmakers respond and whether any amendments are made to address the concerns raised by critics.

For homeowners, it’s essential to stay informed about this bill’s progress and how it might affect your financial situation. Keeping an eye on local and national news sources can help you stay in the loop.

Conclusion: A Step Towards Financial Freedom?

Rep. Marjorie Taylor Greene’s bill to eliminate the capital gains tax on home sales is stirring up a whirlwind of conversation about taxes, homeownership, and economic policy. As families navigate the complexities of the housing market, the potential for change could either pave the way for greater financial freedom or raise new challenges in the realm of public funding and housing affordability. Whether you’re a homeowner, a potential buyer, or simply interested in economic policy, this is certainly a topic worth following.

BREAKING: Rep. Marjorie Taylor Greene Introduces Bill to ELIMINATE Capital Gains Tax on Home Sales "Families who work hard, build equity, and sell their homes shouldn’t be punished with a massive tax bill." -@RepMTG