“ProShares XRP ETF Launch Sparks Heated Debate: A Game-Changer or Risky Gamble?”

XRP investment opportunities, cryptocurrency exchange listing, blockchain ETF trends

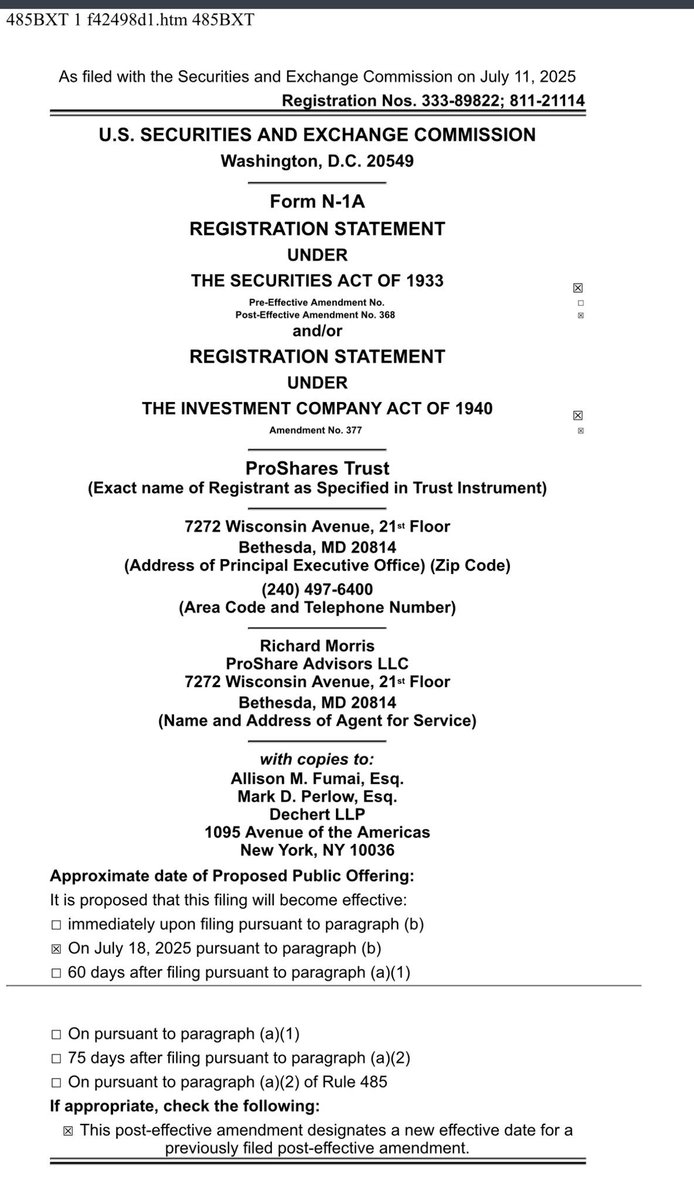

ProShares XRP ETF Set to Launch on July 18, 2025

In a significant development for the cryptocurrency market, ProShares has announced that its much-anticipated XRP Exchange Traded Fund (ETF) is scheduled to begin trading on July 18, 2025. This news was shared by prominent crypto influencer JackTheRippler via Twitter, generating excitement and speculation among investors and cryptocurrency enthusiasts alike.

### What is an ETF?

An ETF, or Exchange Traded Fund, is a type of investment fund that is traded on stock exchanges, much like stocks. ETFs typically hold a collection of assets, such as stocks, commodities, or cryptocurrencies, allowing investors to gain exposure to these assets without having to buy them outright. The introduction of an XRP ETF is particularly noteworthy as it provides a regulated avenue for investors to participate in the XRP market, which has been a topic of interest and controversy in the crypto space.

### Why is the XRP ETF Important?

The launch of the ProShares XRP ETF is significant for several reasons:

1. **Mainstream Acceptance**: The approval and launch of an XRP ETF can be seen as a step towards mainstream acceptance of cryptocurrencies. It validates XRP as a legitimate investment vehicle, potentially attracting traditional investors who have been hesitant to enter the crypto market.

2. **Increased Liquidity**: An ETF can provide increased liquidity to the XRP market. By allowing investors to buy and sell shares of the ETF, it can facilitate easier access to XRP, leading to potentially higher trading volumes and price stability.

3. **Regulatory Clarity**: The introduction of an ETF suggests that regulatory bodies are becoming more comfortable with cryptocurrencies. This can lead to further regulatory developments that might benefit the entire crypto ecosystem.

4. **Diversification**: For investors looking to diversify their portfolios, an ETF offers a straightforward way to invest in XRP alongside other assets, reducing the risks associated with holding a single cryptocurrency.

### The Role of ProShares

ProShares is a well-known asset management firm that specializes in ETFs. They have been a pioneer in the ETF space and are recognized for their innovative approaches to investment products. By launching an XRP ETF, ProShares aims to tap into the growing interest in digital assets, particularly those associated with blockchain technology.

### Impact on the Cryptocurrency Market

The announcement of the ProShares XRP ETF is expected to have a ripple effect on the broader cryptocurrency market. Here are some potential impacts:

– **Market Sentiment**: The news could bolster market sentiment, leading to increased confidence among investors. A positive reception to the XRP ETF could catalyze investments in other cryptocurrencies and related assets.

– **Price Movements**: Historical data shows that the announcement of ETFs correlated with price surges for cryptocurrencies. As investors anticipate the launch, we may see speculative buying leading up to July 18, 2025.

– **Competitive Landscape**: With more ETFs entering the market, competition will likely increase. Other asset management firms might seek to launch their own cryptocurrency ETFs, further expanding options for investors.

### Potential Challenges

While the launch of the ProShares XRP ETF brings many benefits, there are challenges that could arise:

– **Regulatory Scrutiny**: As with any cryptocurrency-related investment, regulatory scrutiny is a significant concern. The SEC and other regulatory bodies may impose restrictions that could impact the ETF’s operation and its market performance.

– **Market Volatility**: The cryptocurrency market is known for its volatility. While an ETF can provide a more stable investment vehicle, the underlying asset—XRP—can still experience significant price swings, which may affect investor sentiment and ETF performance.

– **Investor Education**: As with any new financial product, educating potential investors about the risks and benefits of the XRP ETF will be crucial. ProShares will need to ensure that investors understand how the ETF works and the implications of investing in cryptocurrencies.

### Conclusion

The ProShares XRP ETF is set to make waves in the financial world when it launches on July 18, 2025. This development represents a crucial moment for the cryptocurrency market, as it aligns with the growing trend of institutional adoption and regulatory acceptance of digital assets.

As the ETF prepares to hit the market, investors will be watching closely, eager to see how it might shape the future of XRP and the broader cryptocurrency landscape. The launch of this ETF could pave the way for other similar products, further solidifying the place of cryptocurrencies in traditional finance.

For those interested in investing in XRP, the ProShares ETF could represent a unique opportunity to gain exposure while benefiting from the regulatory oversight that comes with ETF structures. Whether you’re a seasoned crypto investor or new to the space, this development is certainly one to keep an eye on as we approach the launch date.

Stay tuned for more updates on the ProShares XRP ETF and its potential implications for the cryptocurrency market!

BREAKING: ProShares #XRP ETF is set to start trading on July 18, 2025! pic.twitter.com/Ff8Yefsz64

— JackTheRippler © (@RippleXrpie) July 11, 2025

ProShares XRP ETF Set to Start Trading: What You Need to Know

Hey there, crypto enthusiasts! If you’re into the world of digital currencies, you’ve probably heard the buzz surrounding the ProShares XRP ETF that’s making headlines. Mark your calendars for July 18, 2025, because that’s when this ETF is set to start trading! But what does this mean for investors and the broader market? Let’s dive into the details.

What is an ETF?

Before we get into the specifics of the ProShares XRP ETF, let’s take a moment to understand what an ETF (Exchange-Traded Fund) is. An ETF is a type of investment fund that is traded on stock exchanges, much like stocks. It holds a collection of assets, which can include stocks, commodities, or bonds, and it typically aims to track the performance of a specific index.

In the case of the ProShares XRP ETF, this fund is designed to track the performance of XRP, which is a digital currency created by Ripple Labs. By investing in this ETF, you’re essentially gaining exposure to the cryptocurrency market without having to buy and manage the digital coins yourself.

Why is the ProShares XRP ETF Significant?

The launch of the ProShares XRP ETF is significant for several reasons:

- Increased Legitimacy: The introduction of ETFs for cryptocurrencies adds a layer of legitimacy to the market. It signals that mainstream financial institutions are willing to embrace digital currencies.

- Accessibility for Investors: ETFs provide a simpler way for retail investors to gain exposure to cryptocurrencies without the complexities of wallets, exchanges, and private keys.

- Potential for Price Stability: As more investors enter the market through ETFs, it could lead to increased liquidity and potentially stabilize prices over time.

What to Expect from the ProShares XRP ETF?

When the ProShares XRP ETF starts trading on July 18, 2025, here’s what you might expect:

- Market Reactions: Initial trading could be volatile as investors react to the news. Keep an eye on market trends and sentiment.

- Institutional Investment: With the ETF structure, institutional investors may feel more comfortable allocating funds to XRP, which could drive demand and influence price.

- Regulatory Scrutiny: Given the ongoing regulatory discussions surrounding cryptocurrencies, the ProShares XRP ETF may attract attention from regulators, which could affect its operation.

How Will This Impact XRP’s Price?

One of the biggest questions on everyone’s mind is how the launch of the ProShares XRP ETF will impact the price of XRP itself. Historically, the introduction of ETFs has led to price increases in various assets, including Bitcoin and Ethereum. However, it’s crucial to remember that past performance isn’t always indicative of future results.

Factors that could influence XRP’s price include:

- Market Demand: Increased demand from investors seeking exposure to XRP through the ETF could drive the price up.

- Overall Crypto Market Trends: The price of XRP will also be influenced by broader trends in the cryptocurrency market. If Bitcoin and Ethereum are performing well, it could lift XRP as well.

- News and Developments: Any new developments regarding Ripple Labs, regulatory changes, or technological advancements could impact XRP’s price.

How to Invest in the ProShares XRP ETF

If you’re excited about investing in the ProShares XRP ETF when it launches, here’s how you can prepare:

- Open a Brokerage Account: Ensure you have a brokerage account that supports ETF trading. Many popular brokerages will likely offer access to the ProShares XRP ETF.

- Research: Stay informed about the cryptocurrency market, Ripple, and the potential risks and rewards associated with investing in digital currencies.

- Plan Your Investment Strategy: Decide how much you’re willing to invest and consider your overall financial goals. Diversifying your portfolio can also help mitigate risks.

What Are the Risks of Investing in an XRP ETF?

Like all investments, there are risks associated with investing in the ProShares XRP ETF. Here are some key risks to consider:

- Volatility: The cryptocurrency market is known for its price volatility. While an ETF may provide some stability, the underlying asset (XRP) can still experience dramatic price swings.

- Regulatory Risks: The regulatory environment for cryptocurrencies is still evolving. Changes in regulations could impact the ETF and XRP’s price.

- Market Sentiment: Investor sentiment can change rapidly based on news, developments, or market trends, which can affect the ETF’s performance.

Conclusion: The Future of XRP and ETFs

The launch of the ProShares XRP ETF is an exciting development in the cryptocurrency space. It opens the door for more investors to gain exposure to XRP and could potentially lead to increased interest and legitimacy for cryptocurrencies as a whole.

As we approach the launch date of July 18, 2025, keep an eye on market developments, regulatory updates, and the overall sentiment surrounding XRP. Whether you’re a seasoned investor or just starting out, understanding the dynamics of the ETF can help you make informed decisions.

Are you excited about the ProShares XRP ETF? What are your thoughts on the impact it might have on the cryptocurrency market? Share your opinions in the comments below!

“`

This article provides a comprehensive overview of the upcoming ProShares XRP ETF, discussing its significance, potential impacts, and investment strategies in a conversational tone that engages readers.

BREAKING: ProShares #XRP ETF is set to start trading on July 18, 2025!