US Treasury Chief Declares “No Default” on $36 Trillion Debt—Is This Reckless?

US government debt outlook, Treasury Secretary statements on default, economic impact of national debt

The Assurance of Stability: U.S. Treasury Secretary’s Commitment on National Debt

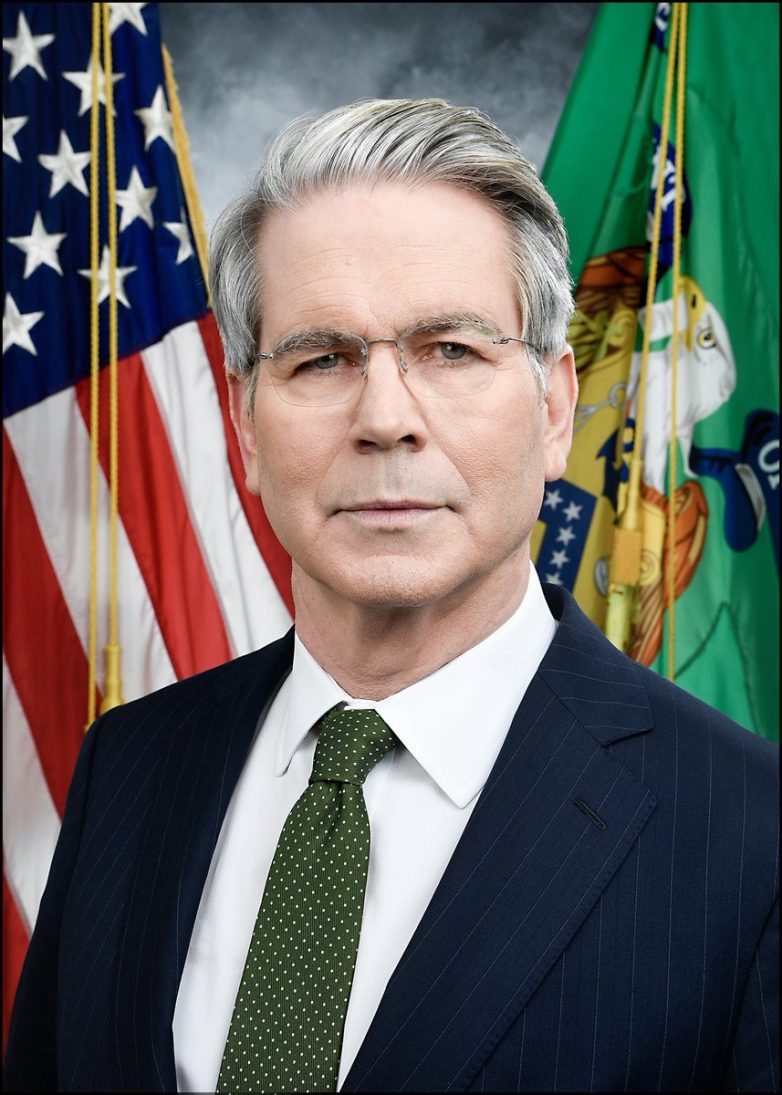

In a recent statement that echoes confidence and stability in the U.S. financial landscape, Treasury Secretary Bessent declared, “The U.S. is never going to default” on its staggering $36 trillion national debt. This proclamation, made public on June 2, 2025, has significant implications for both domestic and international investors, as well as for the economy at large. Understanding the context and ramifications of this assertion is crucial for anyone interested in the dynamics of U.S. fiscal policy and its global impact.

The Context of U.S. National Debt

As of mid-2025, the United States is grappling with one of the highest levels of national debt in its history, currently standing at $36 trillion. This debt has been a point of contention among policymakers, economists, and citizens alike. The reasons for this unprecedented level of borrowing include economic stimulus measures during crises, tax cuts, and increased public spending. Despite the concerns surrounding this debt, Secretary Bessent’s assurance aims to mitigate fears of a potential default, which could have catastrophic consequences for the U.S. economy and financial markets globally.

The Implications of a Default

A default by the U.S. government would not only undermine the country’s creditworthiness but also lead to a rise in interest rates, increased borrowing costs, and a potential recession. Furthermore, it could shake global financial markets, as U.S. Treasury securities are considered one of the safest investments worldwide. A default could spark widespread panic among investors and lead to a loss of confidence in the U.S. dollar, which serves as the world’s primary reserve currency.

Secretary Bessent’s strong statement serves to reassure both domestic and international stakeholders that the government is committed to fulfilling its obligations. This commitment is pivotal in maintaining the trust that investors have in U.S. financial instruments. Her remarks highlight a proactive approach to managing the nation’s debt and ensuring that the government has the necessary strategies in place to prevent any defaults in the future.

Strategies to Manage National Debt

The U.S. government employs several strategies to manage its national debt effectively. These include:

1. **Monetary Policy Adjustments**: The Federal Reserve plays a crucial role in managing inflation and interest rates, which can influence the cost of servicing national debt.

2. **Fiscal Responsibility**: Implementing prudent fiscal policies that focus on balanced budgets and controlling spending can help stabilize the debt levels.

3. **Economic Growth**: Fostering economic growth through investments in infrastructure, education, and technology can increase tax revenues, thereby helping to pay down debt.

4. **Debt Restructuring**: In some cases, restructuring existing debt to take advantage of lower interest rates can also alleviate some of the financial burdens.

The Importance of Investor Confidence

Investor confidence is paramount in maintaining the stability of the U.S. economy. Secretary Bessent’s statement is designed to bolster this confidence, reassuring investors that the U.S. government is committed to meeting its financial obligations. This assurance can lead to more stable markets and lower borrowing costs for both the government and businesses.

In addition, government bonds are a cornerstone of many investment portfolios, providing a reliable source of income. If investors believe that a default is possible, they may seek alternative investments, which could lead to increased volatility in financial markets.

The U.S. economy significantly influences global markets, and any sign of instability can have far-reaching effects. Countries that hold U.S. Treasury bonds, including China and Japan, are closely monitoring the situation. A default could lead to a sell-off of these bonds, impacting the value of the U.S. dollar and potentially triggering a global financial crisis.

Conversely, Secretary Bessent’s commitment to avoiding default and managing debt responsibly could help maintain the dollar’s status as the world’s reserve currency. This status is crucial for the U.S. economy, as it allows the government to borrow at lower costs and promotes economic stability.

Looking ahead, the U.S. government must focus on creating a sustainable fiscal future. This involves addressing underlying issues that contribute to rising debt levels, including entitlement spending, healthcare costs, and tax reform. By tackling these challenges head-on, the government can pave the way for a more balanced and sustainable economic environment.

In conclusion, Secretary Bessent’s assurance that the U.S. will never default on its $36 trillion debt is a critical message to both national and international audiences. It reflects a commitment to fiscal responsibility and the importance of maintaining investor confidence in U.S. financial markets. As the government navigates the complexities of national debt, the focus must remain on sustainable policies that promote economic growth and stability. Ultimately, ensuring that the U.S. meets its financial obligations is not just about avoiding default; it is about preserving the economic integrity and future prosperity of the nation and its global partners.

By fostering an environment of trust and stability, the U.S. government can continue to play a vital role in the global economy, reassuring investors and citizens alike that the nation is on a path toward fiscal health and resilience.

JUST IN: Treasury Secretary Bessent says US is “never going to default” on its $36 trillion debt. pic.twitter.com/JwnsBKIcCh

— Watcher.Guru (@WatcherGuru) June 2, 2025

US Treasury Secretary Bessent Declares: “Never Going to Default” on $36 Trillion Debt

It’s a hot topic among economists, politicians, and everyday citizens alike: the U.S. national debt, currently standing at a staggering $36 trillion. Recently, Treasury Secretary Bessent made headlines by confidently stating, “We’re never going to default.” But what does that really mean for the economy and for you? In this article, we’ll unpack the implications of this bold claim, explore the broader context of U.S. debt, and discuss what it all means for everyday Americans.

The Reality of a $36 Trillion Debt

When we hear the figure $36 trillion, it’s easy to get lost in the zeros. But let’s break it down. The U.S. national debt is essentially the total amount of money that the government owes to creditors. This debt accumulates through various means, mainly through issuing treasury bonds, which investors buy as a safe way to invest their money.

According to US Debt Clock, the U.S. debt is primarily made up of two components: public debt and intragovernmental holdings. Public debt is what the government owes to outside investors, while intragovernmental holdings represent money owed to various government agencies, like Social Security. As the debt climbs, so do concerns about its sustainability. So, when Secretary Bessent says the U.S. will never default, it raises questions about how that’s possible.

What Does “Never Going to Default” Mean?

When a government defaults, it fails to meet its debt obligations—essentially, it can’t pay back what it owes. This could lead to a financial crisis, increased borrowing costs, and a loss of confidence in the government’s ability to manage its finances. However, Bessent’s statement is reassuring for many. So, how can the U.S. maintain this stance?

The U.S. dollar is the world’s primary reserve currency, which means that many countries hold dollars as part of their foreign exchange reserves. This status gives the U.S. a unique advantage, making it easier to borrow money. Additionally, the U.S. government can print more money, a tactic it has employed in times of crisis. While this isn’t without risks—like inflation—it does provide a cushion against default.

The Economic Implications of High National Debt

You might be wondering, “Isn’t a $36 trillion debt concerning?” Absolutely, and many economists are keeping a close eye on it. A high national debt can lead to several economic challenges:

- Increased Interest Rates: As the government borrows more, it may need to raise interest rates to attract buyers for its debt. This can lead to higher borrowing costs for individuals and businesses, slowing economic growth.

- Inflation: If the government prints more money to cover its debts, it can lead to inflation, diminishing the purchasing power of the dollar.

- Future Generations: A growing debt puts pressure on future generations, potentially leading to higher taxes or reduced government services as the debt needs to be managed.

While Bessent’s statement may provide assurance in the short term, the long-term implications of such a high debt cannot be ignored.

How Does the U.S. Plan to Manage its Debt?

The question on everyone’s mind is: how does the U.S. plan to manage this colossal debt without defaulting? Here are a few strategies that the government employs:

- Economic Growth: The government hopes to boost economic growth through job creation, infrastructure projects, and other initiatives. A growing economy increases tax revenues, which can help pay down the debt.

- Tax Reforms: Adjustments to the tax code can increase revenue. This could involve eliminating tax loopholes or adjusting tax rates for higher income brackets.

- Spending Cuts: Reducing government spending in certain areas can help manage the debt. However, this is often politically unpopular and can have significant social implications.

These strategies reflect a complex balancing act between stimulating economic growth and managing debt levels.

Public Perception of National Debt

While economists and policymakers discuss the technicalities of national debt, the general public often feels the effects in their wallets. Rising debt can lead to higher taxes, reduced government services, and a lower quality of life. But what do people really think about this $36 trillion figure?

Surveys often show that many Americans are concerned about the national debt and its potential impact on future generations. However, there’s also a sense of resignation. Many people feel powerless to effect change in government spending or debt management. Understanding the implications of government debt on personal finances can empower citizens to advocate for responsible fiscal policies.

The Global Perspective on U.S. Debt

It’s not just Americans who are concerned about the national debt; it’s a global issue. The U.S. dollar’s role as the world’s reserve currency means that other countries are invested in the health of the U.S. economy. If the U.S. were to default or significantly devalue the dollar, it could have ripple effects around the world.

Countries that hold large amounts of U.S. debt, like China and Japan, may begin to diversify their reserves if they lose confidence in the U.S. economy. This scenario could lead to a decline in the dollar’s value and potentially trigger a global financial crisis.

What Can You Do About It?

As an individual, it can feel overwhelming to think about the national debt. However, there are steps you can take to prepare yourself financially:

- Educate Yourself: Understanding how national debt works can empower you to make informed financial decisions.

- Diversify Investments: If you’re concerned about inflation, consider diversifying your investments to include assets that traditionally hold their value better during economic downturns.

- Advocate for Change: Engage with your local representatives about fiscal responsibility and advocate for policies that prioritize sustainable economic growth.

By taking proactive steps, you can better navigate the complexities of the economy and safeguard your financial future.

Final Thoughts on U.S. Debt and Economic Stability

With Secretary Bessent’s declaration, it’s clear the U.S. government is committed to ensuring it doesn’t default on its staggering $36 trillion debt. While this may provide some reassurance, the implications of such high debt levels warrant serious consideration. As citizens, it’s crucial to stay informed and engaged with economic policies that could shape our financial landscape for years to come.

Whether you’re an investor, a taxpayer, or just someone trying to make sense of the economy, understanding the dynamics of national debt is essential. So, let’s keep the conversation going and hold our leaders accountable for responsible fiscal management.

“`

JUST IN: Treasury Secretary Bessent says US is "never going to default" on its $36 trillion debt.