“Europe Slashes Rates 9 Times While Fed Defies Trump: Political Sabotage?”

interest rate policies, Federal Reserve criticism, economic impact of interest rates

Understanding the Current Interest Rate Landscape: Europe vs. the United States

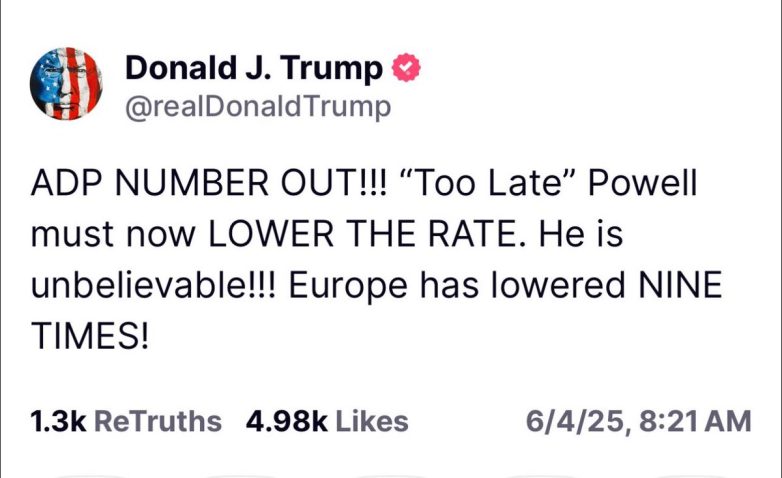

In recent discussions surrounding global financial policies, a striking contrast has emerged between Europe and the United States regarding interest rates. A notable tweet from Wall Street Apes highlights this disparity, stating that Europe has lowered interest rates nine times, while the Federal Reserve, led by Jerome Powell, has yet to make any reductions. This situation raises important questions about the implications of these policies for the economies involved and the political motives behind them.

The European Approach to Interest Rates

In Europe, the European Central Bank (ECB) has implemented a series of interest rate cuts in response to economic challenges. By lowering rates, the ECB aims to stimulate borrowing and investment, thereby fostering economic growth. This approach is particularly crucial in times of economic uncertainty, as lower interest rates can lead to increased consumer spending and business investment. The nine reductions demonstrate a proactive stance aimed at supporting a struggling economy and mitigating the risks of recession.

The Federal Reserve’s Stance: A Political Perspective

Conversely, the Federal Reserve’s refusal to lower interest rates under Jerome Powell’s leadership has sparked significant debate. Critics argue that this inaction is not merely a matter of economic policy but is intertwined with political motives. The assertion that this reluctance to lower rates is a form of sabotage against President Trump’s agenda, which focuses on lowering costs for Americans, indicates a deeper political narrative at play. The Federal Reserve’s independence is crucial for maintaining economic stability, but the perception of political influence can undermine public trust in its decisions.

The Impact on American Consumers

Higher interest rates can have a direct impact on American consumers, particularly in terms of borrowing costs. When rates remain elevated, individuals may face higher costs for mortgages, car loans, and credit cards. This can hinder consumer spending, which is a vital component of economic growth. The decision to keep rates unchanged may be seen as detrimental to the average American, especially in a climate where lowering costs is a primary concern for many households.

The Broader Economic Implications

The divergence in interest rate policies between Europe and the United States raises broader questions about global economic dynamics. A lack of alignment in monetary policies can create challenges, especially in an interconnected global economy. If the U.S. maintains higher interest rates while Europe lowers them, it could lead to capital outflows from the U.S. to Europe, impacting the dollar’s strength and potentially leading to further economic complications.

Calls for Reform: Ending the Federal Reserve?

The tweet concludes with a provocative call to “END THE FEDERAL RESERVE,” reflecting growing frustration among certain segments of the population regarding the central bank’s policies. This sentiment is not new; calls for reform or abolition of the Fed have surfaced periodically throughout history, often during times of economic distress. While the Fed plays a crucial role in managing monetary policy and ensuring financial stability, the debate surrounding its effectiveness and political independence remains highly contentious.

Navigating the Future of Interest Rates

As we look to the future, the path of interest rates in both Europe and the United States will be critical in shaping economic landscapes. Policymakers must weigh the benefits of stimulating growth through lower rates against the risks of inflation and financial instability. Additionally, the political implications of these decisions will continue to influence public perception and trust in financial institutions.

Conclusion: A Complex Interplay of Economics and Politics

In summary, the current discourse on interest rates reveals a complex interplay of economics and politics. The differing approaches taken by Europe and the United States highlight the challenges of navigating monetary policy in a rapidly changing global environment. As consumers and investors alike closely monitor these developments, the ultimate decisions made by central banks will have far-reaching consequences for economic growth, consumer behavior, and political landscapes. Whether or not the Federal Reserve will adjust its stance remains to be seen, but the ongoing debate underscores the importance of transparency and accountability in financial policymaking.

The implications of these policies extend beyond the realm of economics, touching on the very fabric of political discourse and public trust in institutions. For now, stakeholders will continue to advocate for policies that prioritize economic stability and growth, while also demanding greater accountability from those who shape our financial systems.

– Europe has lowered interest rates 9 TIMES

– Jerome Powell and the Federal Reserve refuse to lower them for the United States even onceThis isn’t financial policy it’s sabotage of Trump’s agenda of lowering costs for Americans. This is 100% political

END THE FEDERAL RESERVE pic.twitter.com/vNjzx3lRPs

— Wall Street Apes (@WallStreetApes) June 4, 2025

Europe Has Lowered Interest Rates 9 TIMES

Have you ever wondered how interest rates affect your daily life? Well, if you’re living in Europe, you might have noticed a significant change lately—interest rates have been lowered not once, not twice, but nine times! This move has created a ripple effect throughout the European economy, and it’s essential to understand what it means for you, the average consumer.

Lower interest rates can lead to cheaper loans, making it easier for individuals and businesses to borrow money. This can stimulate spending and investment, ultimately helping the economy grow. With Europe taking this bold step, many are left asking: What’s happening in the United States?

Jerome Powell and the Federal Reserve Refuse to Lower Rates for the United States Even Once

Meanwhile, over in the United States, Jerome Powell and the Federal Reserve have been holding steady. Despite the global trend of lowering interest rates, the Fed has not budged even once. This has sparked a lot of debate and frustration among the populace.

You might be thinking, “Why on Earth would they do that?” The answer is complicated and involves various economic indicators, inflation rates, and the overall economic climate. But what it boils down to is a stark contrast between Europe and the U.S. when it comes to monetary policy.

Some believe that this inaction from the Federal Reserve is not just a matter of economic strategy but something much more political. The argument is that by keeping rates high, the Fed is sabotaging economic growth and hindering lower costs for Americans—a key part of Trump’s agenda during his presidency.

This Isn’t Financial Policy; It’s Sabotage of Trump’s Agenda of Lowering Costs for Americans

This statement is pretty bold, right? But it reflects a growing sentiment among a segment of the population who feel like the Federal Reserve is playing politics instead of focusing on financial policy. Many argue that lowering interest rates could make life easier for Americans by reducing borrowing costs for homes, cars, and education. So why the resistance?

Some analysts believe that the Fed is concerned about inflation and wants to maintain control over it. Others think that they are looking at long-term economic health rather than short-term gains. But for many everyday Americans, it feels like they’re being left in the lurch.

This is 100% Political

The political undertones in this situation are hard to ignore. With the backdrop of recent elections and ongoing debates about economic policies, it’s easy to see how monetary policy can become a pawn in a larger political game. For instance, if the Federal Reserve were to lower interest rates, it could be seen as a win for the sitting administration—something that might not sit well with opposing political factions.

Furthermore, the narrative that the Fed’s actions (or lack thereof) are politically motivated has gained traction across social media platforms and news outlets. It’s a conversation that is not going away anytime soon, especially as the economic landscape continues to evolve.

END THE FEDERAL RESERVE

This phrase has been echoed by various groups and individuals who believe that the Federal Reserve is no longer serving the best interests of the American people. The idea is that an independent central bank may be out of touch with the realities faced by everyday Americans.

Critics argue that the Federal Reserve’s policies can disproportionately affect lower and middle-income families, who struggle with rising costs, stagnant wages, and limited access to credit. Ending the Federal Reserve, however, is a radical idea that would fundamentally change how the U.S. manages its monetary policy.

Supporters of this movement point to historical instances where central banks have failed to effectively manage economies, leading to disastrous consequences. The fear is that a lack of accountability and transparency can lead to policies that are more about sustaining power than serving the public good.

The Impact of Interest Rates on Everyday Life

So, why should you care about interest rates? They affect so much more than just loans; they influence the cost of living, savings accounts, and even job growth. When interest rates are low, it can encourage spending, which stimulates job creation. Conversely, high rates can stifle economic activity and lead to a sluggish job market.

Understanding how these factors play into your daily life can empower you to make better financial decisions. Whether it’s buying a home, investing in the stock market, or saving for retirement, interest rates are a key component of the economic puzzle.

What Can Americans Do?

If you’re feeling frustrated about the current economic situation, you’re not alone. But what can you do about it? Here are a few actionable steps:

- Stay Informed: Knowledge is power. Keep up with economic news to understand how interest rates and other policies impact your finances.

- Advocate for Change: Engage in conversations about economic policy with friends, family, and on social media. Your voice matters!

- Make Smart Financial Decisions: Regardless of what the Fed decides, you can control your spending, saving, and investing habits.

The Future of Monetary Policy in the U.S.

As we look to the future, it’s clear that monetary policy will continue to be a contentious issue in American politics. Whether or not the Federal Reserve decides to lower interest rates remains to be seen, but one thing is certain: the conversation around economic policy is far from over.

Will the Fed change its stance? Will political pressure lead to a shift in monetary policy? Only time will tell. But as consumers, we need to stay vigilant and engaged in the conversation.

Final Thoughts

Interest rates may seem like a dry topic, but they have real implications for our lives. From housing costs to job growth, understanding the dynamics at play can help you navigate the complexities of the economy. As Europe takes bold steps to lower rates, the U.S. remains at a crossroads, and how we respond could shape our economic future.

In the end, we all want a stable economy where costs are manageable, and opportunities are available. Whether you support the Federal Reserve or believe it’s time for a change, staying informed and engaged is essential. The more we discuss these issues, the better equipped we are to advocate for policies that benefit everyone.

– Europe has lowered interest rates 9 TIMES This isn’t financial policy it’s sabotage of Trump’s agenda of lowering costs for Americans. This is 100% political END THE FEDERAL RESERVE

– Jerome Powell and the Federal Reserve refuse to lower them for the United States even once