“Shocking Discovery: George Soros’ Secret Tax Returns Unveiled for First Time!”

historical tax documents, nonprofit financial transparency, digital archival research

Historic Tax Returns of George Soros’ Open Society Foundations Now Digitized

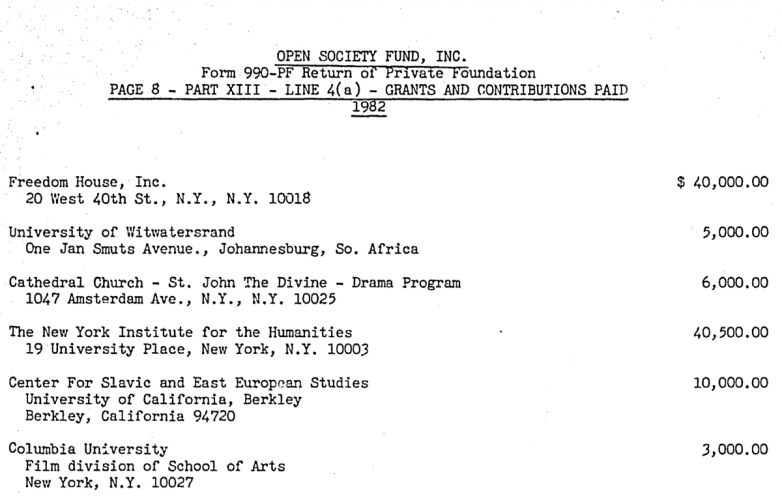

In a groundbreaking development, the Indiana University librarian team has successfully scanned and digitized the historical 990-PF tax returns of George Soros’ Open Society Foundations (OSF). This monumental achievement represents the first time that these never-before-digitized documents have been made available online, allowing greater public access to vital financial information about one of the most influential philanthropic organizations in the world.

The Significance of 990-PF Tax Returns

Form 990-PF is a tax return that private foundations, like the Open Society Foundations, must file annually with the IRS. These documents provide a wealth of information about the foundation’s finances, including its revenue sources, expenditures, and grants made to various organizations. By examining these tax returns, researchers, journalists, and interested citizens can gain insights into the foundation’s activities, priorities, and the impact of its charitable contributions.

Historically, access to such documents has been limited, often requiring researchers to visit physical archives or request copies directly from the foundations. The digitization of these tax returns marks a significant shift towards transparency and accessibility, allowing anyone with an internet connection to explore the financial workings of the Open Society Foundations.

The Role of Indiana University Librarians

The successful digitization project was made possible thanks to the dedicated efforts of the Indiana University librarian team. Their expertise in archival science and digital preservation played a crucial role in ensuring that these historical documents were scanned, processed, and made available in a user-friendly format. This collaboration highlights the importance of librarians in preserving historical records and enhancing public access to information.

What This Means for Public Discourse

The release of these tax returns is likely to generate significant public interest and discussion surrounding the activities of the Open Society Foundations. Founded by George Soros in 1993, OSF has been at the forefront of various social, political, and economic initiatives worldwide. The foundation focuses on promoting democracy, human rights, and social justice, often funding projects that challenge the status quo.

By providing access to the financial records of the OSF, the digitized tax returns will enable individuals to scrutinize how the foundation allocates its funds and which causes it supports. This level of transparency can foster informed discussions about philanthropy and the role of wealthy individuals and organizations in shaping public policy and societal change.

Implications for Philanthropy and Transparency

The digitization of the Open Society Foundations’ tax returns is part of a broader movement toward greater transparency in philanthropy. As organizations and individuals increasingly recognize the importance of accountability, more philanthropic groups may follow suit by making their financial records available online. This trend can empower stakeholders, including the general public, to engage with philanthropic organizations more critically and meaningfully.

Moreover, the digitization of these tax returns aligns with the growing demand for transparency in various sectors. In an age where information is readily available, stakeholders expect organizations to be open about their financial practices and the impact of their contributions. By making these documents accessible, the Open Society Foundations can enhance its credibility and further its mission in an increasingly scrutinizing environment.

Future Research Opportunities

The newly available 990-PF tax returns present a wealth of opportunities for researchers, journalists, and students. Scholars interested in philanthropy, public policy, and social justice can utilize these documents to analyze trends in funding, assess the effectiveness of various initiatives, and explore the intersection of wealth and influence.

Journalists can delve into the financial details of the foundation to uncover stories that highlight the impact of OSF’s contributions on communities and causes. Furthermore, students and educators can use these resources as case studies in discussions about philanthropy, ethics, and the role of money in social change.

Conclusion: A Step Towards Increased Accessibility

The digitization of George Soros’ Open Society Foundations’ historical 990-PF tax returns is a landmark moment in the realm of philanthropy and public access to information. By making these vital documents available online for the first time, the Indiana University librarian team has contributed significantly to the transparency and accountability of one of the world’s leading philanthropic organizations.

As more foundations embrace similar initiatives, the landscape of philanthropy may undergo a transformative shift, characterized by increased scrutiny and engagement from the public. This development not only benefits researchers and journalists but also empowers citizens to participate in discussions regarding the role of philanthropy in society.

In conclusion, the digitization of these tax returns marks a pivotal moment in enhancing transparency within the philanthropic sector. By providing access to critical financial information, organizations like the Open Society Foundations can foster greater trust and engagement with the communities they aim to serve. This initiative not only underscores the importance of transparency in philanthropy but also sets a precedent for future efforts in making crucial information accessible to all.

Just in! With major thanks to the amazing @IndianaUniv librarian team…

We’ve now scanned never-before-digitized historical 990-PF tax returns of George Soros’ Open Society Foundations.

This is a first. These documents have never been available on the Internet …… pic.twitter.com/QW1c8uD84H

— DataRepublican (small r) (@DataRepublican) June 13, 2025

Just In: Historical 990-PF Tax Returns of George Soros’ Open Society Foundations Digitized!

Hey there! Have you heard the buzz? The Indiana University librarian team just made a monumental leap in transparency and accessibility by scanning the historical 990-PF tax returns of George Soros’ Open Society Foundations. This is a big deal, especially since these documents have never been available online before!

What Are 990-PF Tax Returns?

Great question! A 990-PF tax return is a form that private foundations in the United States must file annually with the IRS. It provides a detailed account of a foundation’s financial activities, including its income, expenditures, and charitable contributions. In simpler terms, it’s like a financial report card for non-profit organizations.

This specific form is crucial because it promotes transparency regarding how foundations operate and distribute their funds. By making these documents available online, it allows the public to better understand the workings of influential organizations like Soros’ Open Society Foundations.

Why Is This Digitization Important?

The digitization of these historical documents is not just a technical achievement; it has broader implications for society. Here’s why:

1. Increased Transparency

In an age where transparency is more important than ever, having access to these tax returns allows the public to scrutinize how funds are allocated and what initiatives are being funded. This opens the door for conversations about accountability in philanthropy.

2. Preservation of Historical Data

By digitizing these records, Indiana University is preserving a piece of history. Historical documents can deteriorate over time, and digitization ensures that future generations can access and learn from them.

3. Enhanced Research Opportunities

Researchers, journalists, and students now have a treasure trove of information at their fingertips. These documents provide insights into the philanthropic landscape, social movements, and even political influences over the years.

Who Is George Soros and Why Do His Foundations Matter?

George Soros is a Hungarian-American investor, philanthropist, and political activist known for his significant contributions to various causes through his Open Society Foundations (OSF). Founded in 1993, OSF aims to promote democracy, human rights, and social justice around the world.

Soros has been both praised and criticized for his philanthropic efforts. Supporters laud his commitment to liberal democratic principles, while detractors often paint him as a controversial figure in political discourse. Regardless of perspective, his foundations undeniably play a significant role in global philanthropy.

The Impact of Open Society Foundations

The Open Society Foundations have funded initiatives across a myriad of sectors, including education, public health, and government reform. Some notable areas of impact include:

1. Education and Youth Development

OSF has invested heavily in educational programs aiming to offer quality education to marginalized communities. This includes scholarships, mentorship programs, and even funding for educational institutions.

2. Refugee and Immigrant Rights

Soros’ foundations have been at the forefront of advocating for the rights of refugees and immigrants. Their funding has supported various NGOs that work to provide legal assistance, healthcare, and integration programs for displaced individuals.

3. Criminal Justice Reform

OSF has also taken a strong stance on criminal justice reform, advocating for policies that address systemic inequalities. This includes funding initiatives that aim to dismantle mass incarceration and promote fair sentencing.

What’s Next for Open Society Foundations?

With the digitization of these tax returns, one can only wonder how this will affect the future of the Open Society Foundations. Here are some potential outcomes:

1. Increased Scrutiny and Accountability

As more people gain access to these documents, it’s likely that OSF will face increased scrutiny regarding their funding decisions. This could lead to a higher level of accountability as stakeholders demand answers about how funds are being utilized.

2. Enhanced Public Engagement

Having these documents available online can encourage public engagement. Individuals interested in philanthropy may dive deeper into understanding how foundations like OSF operate, fostering a more informed citizenry.

3. New Research and Analysis

Academics and analysts will undoubtedly seize this opportunity to conduct research on the impact of Soros’ philanthropic efforts. Expect to see an increase in publications that explore the influence of OSF on various social issues.

How to Access the Digitized 990-PF Tax Returns

If you’re itching to dive into these historical documents yourself, you can access them through the Indiana University Libraries. They have made the digitized records available for public viewing, and it’s a fantastic resource for anyone interested in philanthropy, social issues, or the financial workings of non-profits.

What This Means for the Future of Philanthropy

The digitization of George Soros’ Open Society Foundations’ 990-PF tax returns might be a game changer in the world of philanthropy. By making these documents accessible, we’re witnessing a shift towards greater transparency in the sector.

As the philanthropic landscape continues to evolve, we can expect more organizations to follow suit, recognizing the importance of transparency and public engagement. This could lead to a more informed public and, ultimately, a more accountable philanthropic sector.

Final Thoughts

The digitization of these historical tax returns is a significant step towards greater transparency and accountability in philanthropy. It opens the door for discussions about the role of foundations in society and how they can impact positive change.

Thanks to the hard work of the Indiana University librarian team, we now have access to these invaluable documents. So, whether you’re a researcher, student, or just someone interested in the workings of philanthropy, this is an exciting time to dive into the world of Open Society Foundations!

Just in! With major thanks to the amazing @IndianaUniv librarian team… We've now scanned never-before-digitized historical 990-PF tax returns of George Soros' Open Society Foundations. This is a first. These documents have never been available on the Internet …