US Moves to Allow Bitcoin as Mortgage Collateral: A Game-Changer or Risky Gamble?

mortgage cryptocurrency acceptance, digital assets home financing, blockchain property transactions

US Federal Housing Finance Agency Recognizes Bitcoin and Crypto as Mortgage Assets

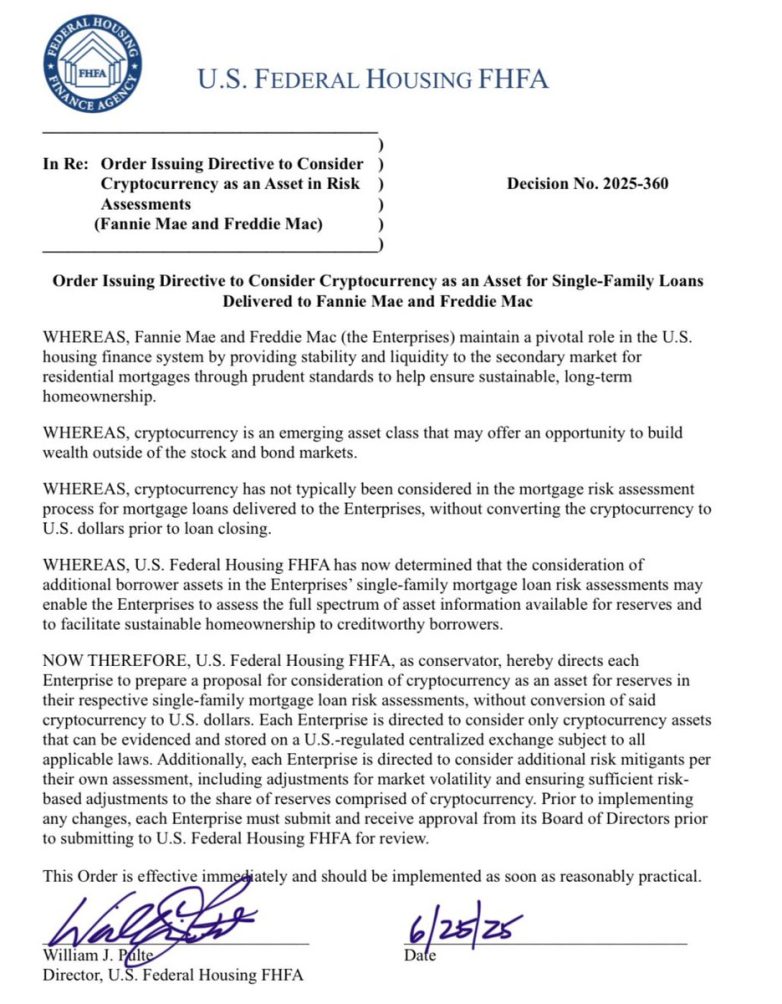

In a groundbreaking decision, the US Federal Housing Finance Agency (FHFA) has officially issued an order to recognize Bitcoin and other cryptocurrencies as valid assets for securing mortgages. This significant development, reported by Bitcoin Magazine on June 25, 2025, marks a pivotal moment in the intersection of digital currencies and traditional real estate financing.

The Implications of Recognizing Crypto as an Asset

The FHFA’s decision to allow Bitcoin and cryptocurrencies to be counted as assets for mortgage applications is expected to revolutionize the way individuals qualify for home loans. Traditionally, mortgage lenders have relied on conventional assets such as cash savings, stocks, and bonds to assess a borrower’s financial stability. However, as the popularity of cryptocurrencies continues to rise, this new policy acknowledges the growing importance of digital currencies in modern financial portfolios.

For potential homebuyers, this change could provide greater access to funding. Many individuals who possess substantial wealth in cryptocurrencies may have previously struggled to secure mortgages due to the lack of recognition of digital assets. By allowing these assets to be considered in the mortgage application process, the FHFA opens the door for a new demographic of borrowers who can now leverage their crypto holdings to achieve homeownership.

How This Change Affects Mortgage Lenders

Mortgage lenders will need to adapt to this new landscape by developing protocols for evaluating and validating cryptocurrency assets. The FHFA’s order implies that lenders will be required to incorporate methods of assessing the value of digital currencies, which can be volatile. This could involve tracking real-time market data, establishing guidelines for acceptable crypto holdings, and possibly requiring borrowers to provide proof of ownership and liquidity.

Lenders may also need to educate their staff and develop specialized teams to handle the influx of applications that include cryptocurrencies as part of the borrower’s financial profile. This will not only enhance the borrower experience but also ensure that lenders remain compliant with evolving regulations pertaining to digital assets.

The Role of Cryptocurrency in Today’s Economy

The recognition of cryptocurrencies as legitimate assets aligns with a broader trend of increasing acceptance of digital currencies in mainstream finance. Over the past few years, cryptocurrencies have gained traction as an investment vehicle, with many individuals viewing them as a hedge against inflation and economic uncertainty. As more people invest in Bitcoin and other cryptocurrencies, their influence on the financial landscape continues to grow.

This decision by the FHFA is indicative of a larger shift towards integrating digital currencies into traditional financial systems. As financial institutions and government agencies begin to recognize the value of cryptocurrencies, we can expect to see further innovations in areas such as payment processing, investment strategies, and even regulatory frameworks.

Potential Challenges and Considerations

While the FHFA’s decision is a step forward, there are several challenges that both borrowers and lenders may face as they navigate this new landscape. One major concern is the volatility of cryptocurrency values. The price of Bitcoin, for example, can fluctuate dramatically within short periods. Lenders will need to consider this volatility when assessing the value of a borrower’s crypto assets and determining loan amounts.

Additionally, the regulatory environment surrounding cryptocurrencies is still evolving. As governments and regulatory bodies continue to develop guidelines and frameworks, both borrowers and lenders must stay informed about any changes that could impact the use of digital currencies in the mortgage process.

Conclusion: A New Era for Homebuyers and Lenders

The FHFA’s recognition of Bitcoin and cryptocurrencies as valid assets for mortgages signals a new era in the real estate and financial industries. This decision not only empowers a broader range of potential homebuyers but also encourages lenders to innovate and adapt to the changing landscape of finance. As cryptocurrencies continue to gain acceptance, their integration into the mortgage process represents a significant step towards a more inclusive and modern financial system.

As we look ahead, it will be fascinating to see how this decision influences the housing market, lending practices, and the overall perception of cryptocurrencies as legitimate financial assets. With the potential for increased homeownership and a more diverse array of financial products, the future of real estate financing looks promising for both borrowers and lenders alike.

This transformative moment invites all stakeholders—homebuyers, lenders, and investors—to reassess their strategies and embrace the opportunities presented by the evolving role of cryptocurrencies in the economy.

JUST IN: US Federal Housing Finance Agency issues order to count Bitcoin & crypto as an asset for a mortgage. pic.twitter.com/tzRZeJb1tq

— Bitcoin Magazine (@BitcoinMagazine) June 25, 2025

US Federal Housing Finance Agency Issues Order to Count Bitcoin & Crypto as an Asset for a Mortgage

Hey there! If you’ve been following the world of finance and cryptocurrency, you probably heard some buzz about the recent decision made by the US Federal Housing Finance Agency (FHFA). They just announced that Bitcoin and other cryptocurrencies can now be counted as assets when applying for a mortgage. This is a game-changer for many, and it’s worth diving deeper into what this means for potential homeowners and the housing market as a whole.

What Does This Mean for Homebuyers?

So, what does it really mean to count Bitcoin and crypto as an asset for a mortgage? Well, traditionally, when lenders assess a borrower’s financial health, they look at things like income, credit history, and tangible assets like cash and real estate. But now, with this new directive, cryptocurrencies can also be included in that mix.

This means that if you have a significant amount of Bitcoin or other cryptocurrencies in your digital wallet, you might be able to use that as a part of your financial portfolio when applying for a mortgage. If you’re someone who has invested in crypto and has seen your assets grow, this could open up new doors for you in the housing market.

The Impact on the Housing Market

You might be wondering how this change will affect the housing market overall. The inclusion of cryptocurrencies as valid assets can potentially increase the pool of buyers. Many crypto investors have amassed wealth during the recent crypto boom, and allowing them to leverage their digital assets could lead to more transactions in the housing sector.

Moreover, this could encourage more people to invest in cryptocurrencies, knowing that they could use these assets in real-world applications such as buying a home. Picture this: a young tech-savvy individual who made a fortune in Bitcoin can now confidently approach a lender, knowing that their digital assets are taken into account.

Challenges Ahead

While this development is exciting, it’s important to recognize that there are challenges ahead. The cryptocurrency market is notoriously volatile, and the value of Bitcoin and other cryptocurrencies can fluctuate wildly. Lenders will have to navigate this volatility and assess how they can fairly evaluate these digital assets.

For example, how do lenders determine the value of a cryptocurrency at the time of loan approval? Will they require borrowers to convert their crypto into cash, or can they maintain their digital assets? These questions are still up in the air, and it might take some time for the mortgage industry to adapt to this new way of evaluating assets.

What Homebuyers Should Consider

If you’re a potential homebuyer looking to utilize your crypto assets, there are a few things you should keep in mind:

- Consult with a mortgage expert: Before jumping into the process, talk to a mortgage professional who understands the implications of using cryptocurrencies as assets. They can help guide you through the new landscape.

- Document your crypto holdings: Make sure you have proper documentation of your cryptocurrency holdings, including transaction history and current valuations. Lenders will want to see proof of your assets.

- Be prepared for volatility: Since crypto values can change rapidly, be aware that your asset value may fluctuate by the time you finalize your mortgage.

How Will Lenders Adapt?

As the FHFA’s decision starts to take effect, lenders will need to adapt to this new reality. They’ll likely have to develop new guidelines for assessing crypto assets. This could include employing new technologies or collaborating with firms specializing in cryptocurrency valuation.

Some lenders might even start offering specific mortgage products that cater to crypto investors. This could be a win-win situation: borrowers get to use their digital assets, and lenders attract a new segment of the market.

Regulatory Considerations

With any significant change comes regulatory considerations. The integration of cryptocurrencies into traditional finance is still a relatively new concept, and various regulatory bodies will likely weigh in on how this process should work.

For instance, the FHFA’s order may spur discussions in Congress about the regulation of digital assets in the mortgage space. It’s crucial to keep an eye on any legislative developments that might arise as this new practice begins to unfold.

Real-World Examples

While the concept of using Bitcoin and crypto for mortgages is still fresh, there are already companies and lenders testing the waters. For instance, some innovative mortgage companies have started accepting cryptocurrency as a form of down payment or collateral. These pioneers are paving the way for what could become a more widespread practice in the future.

Additionally, international markets have seen similar trends. In countries where cryptocurrencies are more widely accepted, some real estate transactions have already been completed using Bitcoin. This provides a glimpse into a future where digital currencies play an integral role in real estate transactions.

The Future of Mortgage Financing

As we move forward, the integration of cryptocurrencies into mortgage financing could lead to significant changes in how we view assets and investments. It’s an exciting time for both the cryptocurrency and real estate markets, and those who adapt quickly may find themselves at a significant advantage.

The future could see a shift towards a more decentralized financial system, where digital assets become a common part of our everyday transactions. It’s not just about buying a house; it’s about redefining what it means to be a homeowner in a digital age.

Conclusion

The US Federal Housing Finance Agency’s recent order to count Bitcoin and crypto as assets for mortgages is a monumental step towards integrating digital currencies into mainstream finance. As a prospective homeowner, this could provide you with new opportunities to leverage your investments. However, it’s essential to stay informed and consult with professionals to navigate this evolving landscape effectively.

So, whether you’re a seasoned crypto enthusiast or just curious about how this change impacts the housing market, one thing is clear: we’re witnessing a pivotal moment in the intersection of technology and finance. Keep an eye on this space, as it’s bound to evolve in fascinating ways!

JUST IN: US Federal Housing Finance Agency issues order to count Bitcoin & crypto as an asset for a mortgage.