“Breaking: Housing Chair Demands Congress Probe Powell’s Rate Manipulation!”

federal housing policy, interest rate impact, congressional investigation

US Federal Housing Chair Calls for Investigation into Jerome Powell

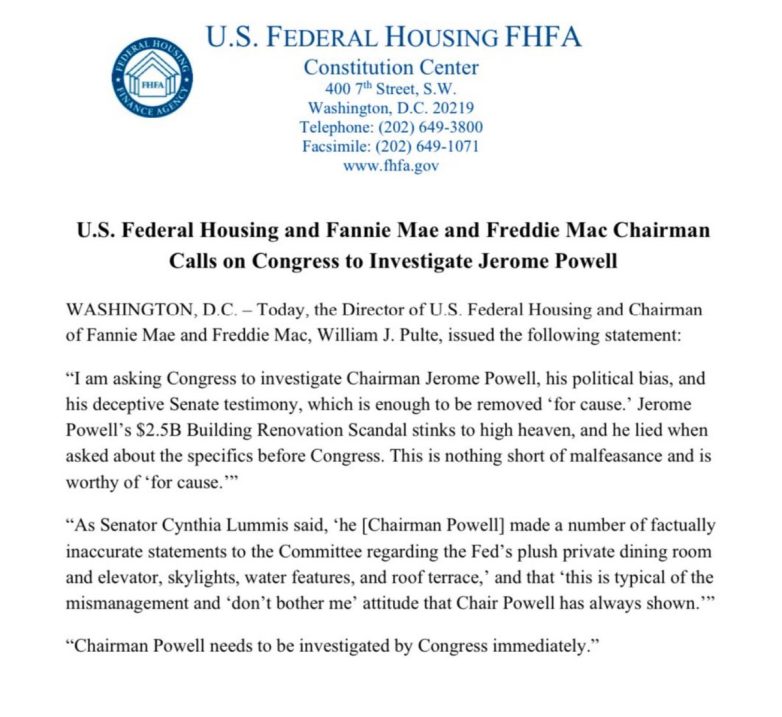

In a significant development within the financial landscape, Bill Pulte, the US Federal Housing Chair, has publicly urged Congress to launch an investigation into Jerome Powell, the current Chair of the Federal Reserve. This call for action comes amidst rising concerns about the impact of Powell’s monetary policies on the housing market and broader economy, particularly in relation to former President Donald Trump.

The Context of the Call for Investigation

The statement made by Pulte highlights a growing frustration with the current state of the housing market, which has been significantly affected by the Federal Reserve’s interest rate policies. Pulte accuses Powell of maintaining artificially high interest rates, suggesting that these measures are politically motivated and detrimental to millions of homeowners and prospective buyers across the nation.

According to Pulte, this situation has resulted in increased financial strain for Americans, making it increasingly difficult for individuals and families to secure affordable housing. The Federal Reserve’s decision to keep interest rates elevated is seen as a direct response to political tensions rather than a strategy aimed at fostering economic stability.

The Implications of High Interest Rates

High interest rates have a cascading effect on the economy, particularly in the housing sector. When interest rates rise, borrowing costs increase, making mortgages more expensive for potential buyers. This leads to decreased demand for homes, which can stall economic growth and hinder the recovery of the housing market. Furthermore, current homeowners may feel trapped, unable to sell their properties and move due to higher borrowing costs for new mortgages.

Pulte’s remarks resonate with many Americans who are struggling to navigate this challenging economic environment. The call for Congress to investigate Powell underscores the growing sentiment that the Federal Reserve’s policies may not be in the best interest of the general public, particularly those looking to enter the housing market.

The Political Landscape

Pulte’s statement is not just a call for economic reform but also reflects the intricate relationship between politics and monetary policy. By suggesting that Powell’s actions are motivated by a desire to undermine President Trump, Pulte introduces a political dimension to the discussion that complicates the narrative around the Federal Reserve’s decisions. This accusation raises questions about the independence of the Federal Reserve and the extent to which political considerations can influence economic policy.

Moreover, this situation presents an opportunity for Congress to assert its oversight responsibilities. If lawmakers choose to investigate Powell, it could lead to significant debates over the Federal Reserve’s role, its governance, and the political implications of its actions. Such investigations could also prompt discussions about the need for reforms within the Federal Reserve system itself, potentially leading to changes in how monetary policy is formulated and implemented.

The Public’s Response

The public reaction to Pulte’s announcement has been mixed. Many homeowners and potential buyers express support for the investigation, hoping it will lead to changes in the Federal Reserve’s policies that will ease their financial burdens. On the other hand, some economic experts caution against politicizing the Federal Reserve, arguing that its independence is crucial for effective monetary policy. They warn that investigations could undermine public confidence in the institution and lead to further economic uncertainty.

As the housing market continues to face challenges, the dialogue surrounding interest rates and their impact on everyday Americans is likely to intensify. Pulte’s call for investigation could catalyze broader discussions about economic policy and the responsibilities of federal institutions in promoting economic stability.

Conclusion: A Pivotal Moment for Housing Policy

The call for an investigation into Jerome Powell by Bill Pulte represents a critical moment in the ongoing discourse about the intersection of politics, economics, and housing policy. As the landscape evolves, it remains to be seen how Congress will respond to these calls and what implications this might have for the future of the Federal Reserve and its influence over the economy.

As we move forward, the importance of maintaining a dialogue about the effects of monetary policy on the housing market cannot be overstated. The actions taken by Congress in response to Pulte’s call could have far-reaching consequences for millions of Americans who are navigating the complexities of homeownership in an increasingly challenging economic environment. The outcome of this situation will not only affect current homeowners but also shape the future of housing accessibility and affordability in the United States.

In summary, the intersection of monetary policy and political motivations raises critical questions about the role of the Federal Reserve and its impact on everyday Americans, making it essential for stakeholders to engage in constructive discussions that prioritize the well-being of the public.

BREAKING: US Federal Housing Chair Bill @Pulte calls for Congress to INVESTIGATE Jerome Powell

Powell has kept rates artificially high to spite President Trump, causing MILLIONS of homeowners and buyers great harm.

DO YOUR JOB, CONGRESS! Investigate Powell! pic.twitter.com/H9dS7sNPkZ

— Nick Sortor (@nicksortor) July 2, 2025

BREAKING: US Federal Housing Chair Bill Pulte Calls for Congress to Investigate Jerome Powell

Hey there! If you’ve been keeping an eye on the financial news, you might have come across some pretty intense discussions surrounding the Federal Reserve and its chair, Jerome Powell. Just recently, Bill Pulte, the US Federal Housing Chair, made headlines by urging Congress to investigate Powell. So, what’s the deal here? Let’s dive into the details and understand why this investigation could be a big deal for homeowners and buyers across the nation.

Who is Jerome Powell?

Before we get into the nitty-gritty, let’s talk about who Jerome Powell is. Appointed as the Chair of the Federal Reserve in 2018, Powell plays a crucial role in shaping the country’s monetary policy. He’s responsible for setting interest rates, which directly impacts everything from mortgage rates to credit card interest. In essence, his decisions can make or break the housing market, which is why his actions are always under the microscope.

Why the Call for an Investigation?

According to Bill Pulte, Powell has been keeping interest rates artificially high, which he claims is a political move aimed at undermining former President Trump. Pulte argues that this decision has harmed millions of homeowners and potential buyers, making homeownership less attainable for many. The call for Congress to investigate comes from a place of concern for the average American, who is feeling the squeeze of high borrowing costs.

Understanding the Impact of High Interest Rates

So, why should we care about interest rates? Well, when the Federal Reserve keeps rates high, it affects everything. Mortgages become more expensive, which means higher monthly payments for homeowners. For potential buyers, it can mean the difference between affording a home or being priced out of the market entirely. High rates can also lead to a slowdown in housing sales, impacting the overall economy.

The Political Angle: Is It Personal?

Now, let’s address the elephant in the room: the alleged personal motivations behind Powell’s decisions. Pulte’s accusation that Powell is acting out of spite towards Trump has sparked a lot of debates. While it’s essential to scrutinize the motivations behind policy decisions, it’s also crucial to focus on the broader implications for the economy and everyday Americans. Regardless of the political backdrop, the impact of these high rates is undeniably real.

What Could an Investigation Mean?

If Congress goes ahead with an investigation into Powell, it could open a can of worms. The inquiry could look into the Federal Reserve’s decision-making processes and whether political influences have played a role. More transparency could either vindicate Powell or reveal a troubling trend in monetary policy. Either way, it’s likely to be a hot topic in financial circles and beyond.

The Reactions from the Public and Lawmakers

Reactions to Pulte’s call for an investigation have been mixed. Some people are rallying behind him, expressing frustration over the high costs of living and the challenges of homeownership. Others, however, view the call for an investigation as a distraction from the real issues facing the housing market. It’s a divisive topic, and it’s clear that emotions run high on both sides.

What Homeowners and Buyers Should Know

If you’re a homeowner or someone looking to buy, it’s essential to stay informed about these developments. Here are a few key points to keep in mind:

- Monitor Interest Rates: Keep an eye on the Fed’s announcements and how they might affect your mortgage or home-buying plans.

- Stay Engaged: Follow the news around the investigation and any changes in policy that might arise from it.

- Consider Your Options: If rates remain high for an extended period, explore different mortgage options or consider waiting to buy until the market stabilizes.

The Bigger Picture: Housing Market Trends

While the investigation into Powell may dominate the headlines, it’s worth looking at the broader trends in the housing market. Factors like job growth, consumer confidence, and even global economic conditions play a significant role in shaping the market. Understanding these trends can help you navigate the complexities of buying or selling a home.

What’s Next for Jerome Powell?

So, what’s next for Jerome Powell? If Congress decides to proceed with an investigation, he’ll likely have to defend his decisions and the rationale behind them. This could lead to heightened scrutiny of the Federal Reserve’s practices and potentially shift the way monetary policy is conducted in the future.

In Conclusion

The call for Congress to investigate Jerome Powell is more than just a political maneuver; it has real implications for millions of Americans. Whether you agree with Pulte or not, it’s essential to stay informed and engaged with these developments. After all, the decisions made by the Federal Reserve can have a profound impact on our lives, especially when it comes to homeownership.

As we await further developments, one thing is clear: the housing market is in a state of flux, and understanding the forces at play is crucial for anyone looking to buy or sell a home. Keep your eyes peeled for updates and stay proactive in your approach to navigating the market!

BREAKING: US Federal Housing Chair Bill @Pulte calls for Congress to INVESTIGATE Jerome Powell Powell has kept rates artificially high to spite President Trump, causing MILLIONS of homeowners and buyers great harm. DO YOUR JOB, CONGRESS! Investigate Powell!