Trump’s Tax Cuts: A Game-Changer or a Recipe for Economic Disaster?

tax reform initiatives, economic growth strategies, Republican legislative agenda

President Trump’s Remarks on Upcoming House Vote

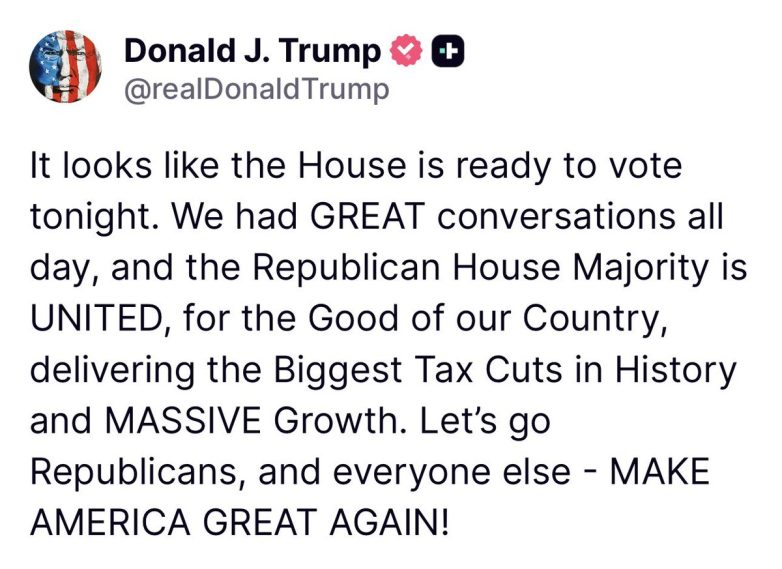

On July 3, 2025, President Donald Trump expressed optimism regarding a significant legislative event taking place in the House of Representatives. In a tweet shared by Dan Scavino, a close aide to Trump, the President indicated that the House was prepared to vote on a crucial piece of legislation that has the potential to reshape the nation’s economy. This pivotal vote was characterized by Trump as a critical step towards delivering “the Biggest Tax Cuts in History” and fostering “MASSIVE Growth” for the country.

Context of the Announcement

The context of President Trump’s remarks is rooted in the ongoing discussions and negotiations among Republican lawmakers. Earlier that day, Trump noted that the Republican House Majority was “UNITED” in their efforts, signaling a rare moment of consensus among party members. This unity is particularly significant given the often contentious nature of political discourse in Washington, especially when it comes to fiscal policy and tax reform.

The announcement comes at a time when the American economy is facing various challenges, including inflationary pressures and fluctuating job markets. In light of these economic conditions, the proposed tax cuts are seen as a strategy to stimulate growth, increase consumer spending, and ultimately drive economic recovery.

The Proposed Tax Cuts

The tax cuts being discussed aim to lower tax rates for individuals and businesses alike. While specific details regarding the cuts were not extensively outlined in Trump’s tweet, prior discussions among Republican lawmakers have included significant reductions in corporate tax rates and potential increases in tax credits for middle-class families. The overarching goal is to create a more favorable economic environment that encourages investment and job creation.

With a focus on pro-growth policies, Trump’s administration has consistently advocated for tax reform as a means to bolster the economy. The proposed cuts are positioned as a vehicle for achieving broader economic objectives, including enhancing job opportunities and increasing wages for American workers.

Political Implications of the Vote

The impending vote in the House carries considerable political implications, both for the Republican Party and for President Trump’s standing among constituents. A successful passage of the tax cuts could serve as a significant legislative victory for the administration, reinforcing its commitment to economic growth and fiscal responsibility.

Conversely, the vote also poses risks. Should the legislation fail to pass, it may indicate divisions within the Republican Party and raise questions about the effectiveness of Trump’s leadership. As the midterm elections approach, the success or failure of this vote could influence voter sentiment and impact electoral outcomes.

Public Reaction and Future Projections

Public reaction to the proposed tax cuts is likely to be mixed, with supporters praising the potential for economic growth and critics expressing concerns about the long-term impact on the national deficit and wealth inequality. Analysts and economists will closely monitor the outcomes of the vote, as well as the broader economic indicators that follow.

If the tax cuts are enacted, the administration will need to effectively communicate the benefits to the American public, emphasizing the positive outcomes projected in terms of job creation and economic expansion. On the other hand, if the cuts do not materialize, the administration will face increased scrutiny and pressure to propose alternative measures to address economic challenges.

Conclusion

President Trump’s tweet on July 3, 2025, captures a pivotal moment in American politics as the House prepares to vote on what he describes as the “BIGGEST Tax Cuts in History.” With the Republican House Majority united in their efforts, the outcome of this vote could have far-reaching implications for the economy and the political landscape in the United States.

As the nation awaits the results, the focus remains on whether these tax cuts will be successful in driving economic growth and improving the financial well-being of American families. With the midterm elections on the horizon, the stakes are high for both the administration and the Republican Party. The coming days will reveal not only the fate of the proposed tax cuts but also the potential trajectory of the U.S. economy in the years to come.

In summary, President Trump’s remarks highlight the significance of the House vote, the proposed tax cuts, and the broader economic implications for the country. The unity among Republican lawmakers, as well as the potential consequences of the vote, underscore the importance of this moment in American political history. As discussions unfold, all eyes will be on Capitol Hill to see if the anticipated changes will come to fruition.

From President Trump: “It looks like the House is ready to vote tonight. We had GREAT conversations all day, and the Republican House Majority is UNITED, for the Good of our Country, delivering the Biggest Tax Cuts in History and MASSIVE Growth…” @HouseGOP pic.twitter.com/2zjLSw2vrC

— Dan Scavino (@Scavino47) July 3, 2025

From President Trump: “It Looks Like the House is Ready to Vote Tonight”

Hey there! Today, we’re diving into an exciting moment in American politics as shared by President Trump. He tweeted about the House being ready to vote on significant legislation that promises to impact our economy profoundly. With a focus on delivering the biggest tax cuts in history and driving massive growth, this announcement has stirred up a lot of conversations and anticipation. So, let’s unpack what this means for the country and what you should know about these developments.

Great Conversations and a United Republican House Majority

According to Trump, there were “GREAT conversations all day,” signaling that the Republican House Majority is coming together for the good of the country. This unity is crucial for any legislation to pass, especially when it comes to significant tax reforms. When the party aligns on a common goal, it often results in smoother discussions and, ultimately, successful outcomes. But what does this mean for average Americans?

The Significance of Tax Cuts

Tax cuts are a hot topic in any political landscape. But when we talk about the “biggest tax cuts in history,” we need to consider the implications carefully. Tax cuts can lead to more take-home pay for individuals and businesses, encouraging spending and investment. This can stimulate economic growth, create jobs, and increase consumer confidence. However, it’s essential to balance these benefits against potential downsides, such as increased budget deficits or cuts to essential services.

MASSIVE Growth: What Does It Look Like?

When Trump mentions “MASSIVE Growth,” he’s referring to the potential economic expansion that could result from these tax cuts. But what does “massive growth” actually mean? Typically, it translates into increased GDP, lower unemployment rates, and a surge in business investments. For example, after the Tax Cuts and Jobs Act of 2017, we saw a temporary boost in economic activity. Could this new set of tax cuts pave the way for similar results?

What’s on the Table? Proposed Changes and Impacts

As the House prepares to vote, it’s crucial to understand what specific changes are being proposed. Various tax reform plans often include lowering corporate tax rates, increasing the standard deduction for individuals, and eliminating certain deductions. Each of these changes has its ripple effects, impacting everything from small businesses to middle-class families.

Lowering Corporate Tax Rates

One of the most discussed components of tax reform is lowering corporate tax rates. The idea is that by reducing the tax burden on corporations, they will have more capital to invest in their businesses, hire more employees, and increase wages. However, critics argue that these benefits may not always trickle down to the average worker. Economists often debate whether these measures genuinely lead to widespread economic growth.

Increasing the Standard Deduction

Another significant change could involve raising the standard deduction. This means that individuals can deduct a larger portion of their income before taxes are applied, potentially reducing their overall tax liability. For many families, this could translate into substantial savings each year, allowing for more disposable income to spend on necessities or savings.

The Role of the House GOP

The House GOP plays a critical role in shaping these tax policies. With their majority, they have the power to push through legislation that aligns with their economic vision. Keeping track of their discussions and strategies can give us insight into how these tax cuts may unfold. Their unity, as Trump mentioned, is vital for moving forward with any substantial reform.

Public Response and Economic Sentiment

The public’s response to tax cuts can vary widely. Some Americans are excited about the prospect of more money in their pockets, while others are concerned about how these cuts might affect government services and programs. For example, if tax cuts lead to increased deficits, there could be future cuts to education, healthcare, or infrastructure funding. It’s a complicated balancing act that lawmakers must navigate.

Looking Ahead: What’s Next for the Economy?

As we await the House’s vote, many are curious about the broader implications of these tax cuts on the economy. Will they lead to the massive growth that Trump envisions? Or will there be unforeseen consequences that could hinder progress? These are the questions that economists and citizens alike are pondering.

Economic Indicators to Watch

Once the vote occurs, there are several economic indicators to keep an eye on. These include GDP growth rates, employment figures, and stock market performance. A positive response in these areas could indicate that the tax cuts are having the desired effect. On the other hand, if we see stagnation or downturns, it may prompt a reevaluation of the current tax strategy.

The Global Perspective

Tax cuts don’t exist in a vacuum; they are part of a global economy. As other countries also make changes to their tax structures, the competitiveness of the U.S. economy can be affected. We need to consider how these cuts will position the U.S. in relation to other economies. For example, if other countries lower their tax rates as well, it could negate some of the advantages gained from U.S. tax cuts.

Your Voice Matters: Engaging with the Process

As these discussions unfold, it’s essential for citizens to engage with their representatives and share their views on tax reform. Whether you’re in favor or against the proposed changes, your voice can shape the conversation. Contacting your local representatives, participating in community discussions, or using social media platforms can help amplify your opinions and experiences.

Staying Informed

Staying updated on the latest news regarding tax policy is crucial. Reliable sources like The New York Times or The Washington Post often provide in-depth analysis and commentary on these issues. Engaging with various viewpoints can help you form a well-rounded understanding of the implications of tax reform.

Final Thoughts: The Future of Tax Reform

As the House prepares for this pivotal vote, the anticipation is palpable. The potential for significant tax cuts and massive growth is exciting, but it’s essential to consider the broader implications for the economy and everyday Americans. By staying informed and engaged, we can all play a part in shaping the future of tax policy in our country.

Whether you’re a supporter or a skeptic, understanding the nuances of these discussions will empower you to make informed decisions and advocate for what you believe is best for the nation. Keep the conversation going, and let’s see where this journey takes us!

From President Trump: “It looks like the House is ready to vote tonight. We had GREAT conversations all day, and the Republican House Majority is UNITED, for the Good of our Country, delivering the Biggest Tax Cuts in History and MASSIVE Growth…” @HouseGOP