Trump’s Bold Challenge: Are GOP Tax Cuts Costing Votes and Trust?

tax policy impact, economic growth strategies, voter sentiment analysis

Trump’s Bold Statement on Tax Cuts and Economic Performance

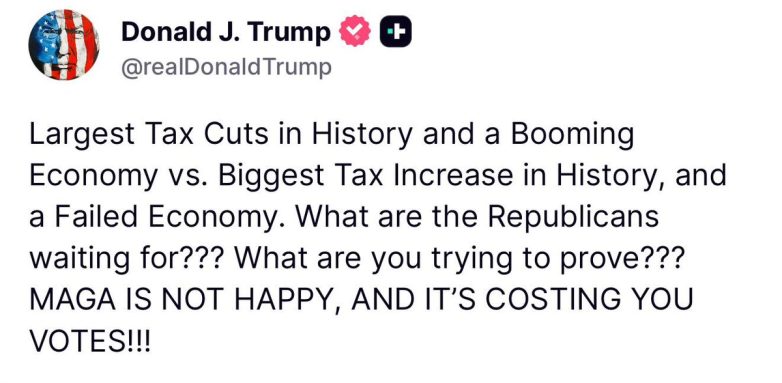

In a recent tweet, President Donald J. Trump delivered a powerful message regarding the contrasting approaches of Republicans and Democrats towards taxation and economic management. The tweet, shared by The White House on July 3, 2025, highlights what Trump refers to as the “Largest Tax Cuts in History” during his administration, juxtaposed with the current administration’s policies, which he claims are leading to the “Biggest Tax Increase in History” and a failing economy. This stark comparison aims to rally support for the Republican Party and underscores the importance of tax policies in shaping the economic landscape.

The Impact of Tax Cuts on Economic Growth

Trump’s assertion that his administration implemented the largest tax cuts in history is rooted in the significant tax reforms enacted during his presidency. The Tax Cuts and Jobs Act of 2017, for instance, reduced the corporate tax rate from 35% to 21%, aimed at stimulating economic growth and encouraging businesses to reinvest in the U.S. economy. This policy is credited with contributing to a booming economy characterized by low unemployment rates, rising stock markets, and increased consumer spending.

In contrast, Trump’s critique of the opposing party suggests that their current economic policies could lead to higher taxes and a downturn in economic performance. He implies that the Democrats’ approach could stifle growth by increasing the tax burden on individuals and businesses, potentially leading to job losses and economic stagnation.

The Economic Debate: Taxation vs. Growth

The debate over taxation and its effects on economic growth is not new. Economic theories vary on the optimal tax rates and their implications for the overall economy. Proponents of lower tax rates argue that they foster an environment conducive to investment, job creation, and overall economic prosperity. Critics, however, often cite the need for higher taxes to fund essential services and reduce federal deficits.

Trump’s statements resonate with many Americans who feel the pinch of economic pressures and are seeking policies that prioritize growth and job creation. His call to action for Republicans to unite and advocate for tax cuts speaks to the sentiments of his base, known as MAGA (Make America Great Again) supporters, who expect the party to uphold the principles of lower taxation and fiscal responsibility.

Political Ramifications and Voter Sentiment

Trump’s message is not just an economic argument; it’s a political strategy aimed at energizing the Republican base. By framing the current administration’s policies as detrimental to economic health, he seeks to galvanize support for the Republican Party ahead of upcoming elections. The phrase “MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES” underscores the urgency of addressing voter concerns regarding economic conditions and tax policies.

The political landscape is often shaped by public sentiment, and as economic challenges arise, voters tend to lean towards candidates who promise solutions. Trump’s tweet reflects a broader anxiety among many Americans about rising costs of living and job security. By appealing to these emotions, he aims to solidify his influence within the party and attract undecided voters who may feel disenfranchised by current economic policies.

The Importance of Tax Policy in Elections

Tax policy is a critical issue in any election cycle. Voters are increasingly concerned about how government decisions impact their financial well-being. As such, candidates who articulate clear and effective tax strategies are more likely to resonate with constituents. Trump’s emphasis on tax cuts serves as a reminder that economic issues can often be decisive factors in electoral outcomes.

Moreover, the conversation around taxes and the economy is intertwined with broader themes of governance and accountability. Voters are not just looking for promises of lower taxes; they want assurances that their government is effectively managing resources and fostering an environment where businesses can thrive. As the Republican Party navigates these complex dynamics, Trump’s statements serve as a rallying cry for a renewed focus on tax policy as a cornerstone of their platform.

Conclusion: The Future of Taxation and Economic Policy

In conclusion, President Trump’s tweet encapsulates a pivotal discussion about taxation and its role in shaping the economy. By emphasizing the stark contrast between his administration’s tax cuts and the current administration’s approach, he aims to mobilize support for the Republican Party and address the concerns of voters who prioritize economic growth and stability.

As the political landscape evolves, the debates surrounding tax policy will remain central to the American electorate. Voters will continue to scrutinize the implications of tax increases or cuts on their daily lives, making it essential for political leaders to articulate clear and compelling economic strategies. Whether the Republicans will heed Trump’s call to action remains to be seen, but the interplay between taxation and voter sentiment will undoubtedly influence the trajectory of future elections.

By understanding the significance of tax policies and their impact on the economy, voters can make informed decisions that align with their values and financial interests. The ongoing discourse initiated by Trump reflects a broader need for accountability and effective governance in addressing the economic challenges facing Americans today.

“Largest Tax Cuts in History and a Booming Economy vs. Biggest Tax Increase in History, and a Failed Economy. What are the Republicans waiting for??? What are you trying to prove??? MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!!” —President Donald J. Trump pic.twitter.com/FNG9rvHOl2

— The White House (@WhiteHouse) July 3, 2025

Largest Tax Cuts in History and a Booming Economy

When you hear President Donald J. Trump declare, “Largest Tax Cuts in History and a Booming Economy,” it stirs up a mix of emotions and thoughts. This bold statement encapsulates a significant economic narrative that many Americans have witnessed firsthand. The tax cuts implemented during Trump’s administration were designed to stimulate economic growth by putting more money back into the hands of individuals and businesses. But what does this really mean for the average American?

The tax cuts, passed in late 2017, aimed to reduce the corporate tax rate from 35% to 21%, and for individuals, it adjusted tax brackets that resulted in lower rates for many. This ambitious tax reform was touted as a way to drive growth and create jobs.

But did it deliver on those promises? According to the U.S. Bureau of Economic Analysis, the economy did indeed see significant growth in the years following the tax cuts. The GDP grew, unemployment rates hit record lows, and consumer confidence surged. Many Americans felt the effects in their paychecks, which saw increases thanks to the lower tax rates.

However, the narrative isn’t without its critics. Opponents argue that the benefits were disproportionately skewed towards the wealthy, leading to increased income inequality. This debate continues to be a hot topic in American politics.

Biggest Tax Increase in History and a Failed Economy

On the flip side, we have the warning about the “Biggest Tax Increase in History, and a Failed Economy.” This is a phrase that resonates with many Americans who are concerned about the future of the economy under policies that might reverse Trump-era tax cuts.

As various states and even federal proposals have suggested tax increases to address budgetary shortfalls and social programs, the fear of sliding into a high-tax environment looms large. Increased taxes can stifle economic growth, as individuals have less disposable income to spend, and businesses may hesitate to invest if they face higher tax burdens.

The fear of a failing economy is palpable among many voters. The aftermath of economic downturns often leads to job losses and reduced consumer spending, creating a vicious cycle that can be hard to break. Many argue that tax increases during such fragile economic times could exacerbate existing issues and lead to a recession.

What are the Republicans Waiting For?

This question, posed by Trump, highlights a crucial point of contention within the GOP. Many true-blue supporters of Trump and the MAGA movement feel that their leaders should prioritize maintaining the tax cuts and pushing back against any proposed tax increases. They believe that acting decisively could secure their base and attract undecided voters who are concerned about economic stability.

The sentiment among many conservatives is that the party needs to unify and take a stronger stance against tax increases that could undermine the economic gains made in recent years. The Republican Party is at a crossroads, facing internal pressures and the need to appeal to a broader electorate. The question remains: will they act, and if so, how?

MAGA is Not Happy, and It’s Costing You Votes!

In the political arena, voter sentiment is everything. When Trump says, “MAGA IS NOT HAPPY,” he’s tapping into the frustration felt by many of his supporters. They want to see action, not just rhetoric. For many, the promise of a booming economy is tied directly to tax policies that favor growth and job creation.

The dissatisfaction of the MAGA base can have serious implications for the Republican Party, especially as elections approach. Voter turnout is crucial, and if the base feels neglected or abandoned, it could lead to a loss of votes.

Historically, midterm elections have been a referendum on the sitting president’s policies, and the current political climate suggests that if Republicans do not address the concerns of their base, they risk losing significant ground.

Understanding the Economic Landscape

To fully grasp the implications of tax cuts and increases, it’s essential to understand the broader economic landscape. The U.S. economy is influenced by a myriad of factors including global trade, consumer confidence, job creation, and wage growth. Tax policies play a critical role in shaping this landscape, but they are not the sole determinant of economic health.

For instance, the COVID-19 pandemic drastically altered economic dynamics, leading to unprecedented government spending and shifts in consumer behavior. As the economy rebounds, the focus on tax policy becomes even more critical.

Maintaining a balance between essential services funded by taxes and fostering an environment conducive to economic growth is a tightrope walk for policymakers. As citizens, it’s vital to stay informed and engaged in these discussions to advocate for policies that align with our values and economic interests.

Moving Forward: What Can Voters Do?

As voters, the power lies in our hands. Engaging with representatives, staying informed about tax policy changes, and actively participating in the electoral process can help shape the future of tax policy in the U.S.

Here are a few steps voters can take:

1. **Educate Yourself**: Understanding the implications of tax cuts and increases is crucial. Resources like the IRS and reputable financial news websites can provide valuable insights.

2. **Engage with Local Representatives**: Reach out to your local representatives to express your views on tax policies. Personal stories can make a significant impact on decision-making.

3. **Stay Informed on Elections**: Keep track of upcoming elections and the candidates’ positions on tax policies. Voting can influence the direction of economic policies at both state and federal levels.

4. **Join Community Discussions**: Engaging in community forums and discussions can help raise awareness about tax issues and mobilize collective action.

5. **Support Advocacy Groups**: Many organizations focus on economic policies and lobbying for favorable tax legislation. Supporting these groups can amplify your voice.

The Takeaway

The dichotomy of “Largest Tax Cuts in History and a Booming Economy” versus “Biggest Tax Increase in History, and a Failed Economy” paints a vivid picture of the ongoing economic debate in America. As voters navigate this complex landscape, it’s essential to remain engaged and informed.

The economic success of any country heavily relies on sound fiscal policies that promote growth while ensuring that funding for essential services is not compromised. It’s a challenging balance, but one that is worth striving for.

In the end, understanding the stakes and advocating for the policies that align with our economic vision can help shape a brighter future for all Americans.

“Largest Tax Cuts in History and a Booming Economy vs. Biggest Tax Increase in History, and a Failed Economy. What are the Republicans waiting for??? What are you trying to prove??? MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!!” —President Donald J. Trump