Ghanaian Con Artist Scams 300 Americans Out of $250 Million with Bold Lie!

Ghanaian financial scams, international money laundering schemes, diplomatic passport fraud

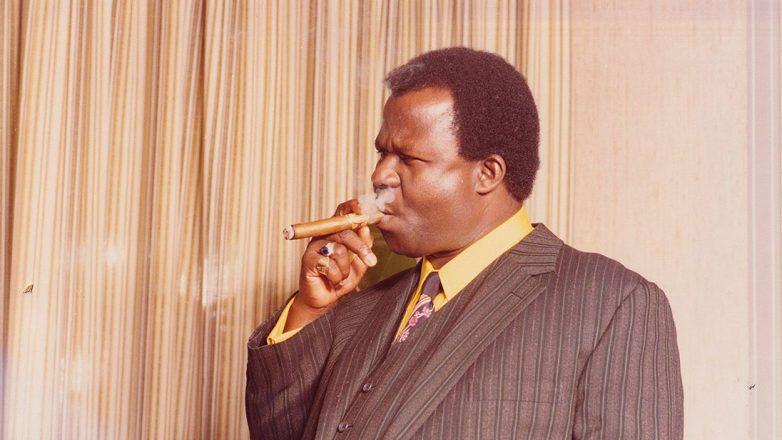

The Astonishing Case of John Ackay Blay-Miezah: A $250 Million Scam

In a tale that seems almost too incredible to be true, Ghanaian national John Ackay Blay-Miezah orchestrated one of the most audacious scams in history, defrauding over 300 Americans of a staggering $250 million. This article delves into the details of his elaborate scheme, his initial arrest, and how he managed to escape prosecution.

The Scam Unveiled

John Ackay Blay-Miezah’s scam began with a seemingly innocuous proposition. He claimed to have access to a bond worth an astronomical $27 billion and sought assistance in unlocking it. This claim was bolstered by a veneer of legitimacy, as he convinced numerous unsuspecting victims that their investment would yield astronomical returns. By exploiting the trust of his victims, Blay-Miezah successfully swindled them out of vast sums of money, ultimately accumulating a staggering total of $250 million.

This scam was not just about money; it was a psychological operation that preyed on the hopes and dreams of ordinary people. Blay-Miezah’s ability to weave a compelling narrative around his supposed financial windfall captivated many, leading them to invest their hard-earned savings in his fraudulent scheme.

The Arrest and Escape

Blay-Miezah’s criminal activities did not go unnoticed. In 1975, he was arrested in Ghana for his fraudulent actions. However, his charisma and persuasive abilities came to the forefront during his time in custody. Rather than facing the consequences of his actions, he managed to talk his way out of the situation, showcasing his exceptional ability to manipulate those around him.

Following his release, Blay-Miezah obtained a diplomatic passport, which allowed him to evade further scrutiny. With this passport in hand, he fled to Europe, where he continued to live a life of luxury, all funded by the money he had stolen from his victims.

The Impact of the Scam

The ramifications of Blay-Miezah’s scam were profound. Over 300 Americans found themselves financially devastated, having lost their investments in what they believed was a legitimate opportunity. This case serves as a stark reminder of the vulnerabilities individuals face in the age of complex financial schemes and the lengths some will go to exploit trust.

Moreover, the case highlights the need for heightened awareness and education regarding investment opportunities. Individuals must approach proposals that seem too good to be true with skepticism and conduct thorough research before committing their resources.

The saga of John Ackay Blay-Miezah underscores the critical importance of vigilance in financial dealings. Here are some key takeaways:

1. **Research Thoroughly**: Always investigate investment opportunities. Look for red flags, such as promises of high returns with little risk.

2. **Verify Credentials**: Ensure that anyone you deal with is legitimate. Check for licenses, registrations, and reviews from past clients or investors.

3. **Consult Professionals**: If you’re unsure about an investment, consult a financial advisor. Their expertise can help you navigate potential pitfalls.

4. **Trust Your Instincts**: If something feels off or too good to be true, it probably is. Trust your instincts and be cautious.

Conclusion

The story of John Ackay Blay-Miezah is not just a tale of deceit; it is a cautionary reminder of the potential dangers lurking in the world of investments. As technology evolves and financial schemes become more sophisticated, the need for vigilance and education is more crucial than ever. By learning from past mistakes and staying informed, individuals can protect themselves from falling victim to similar scams in the future.

Understanding the complexities of financial fraud can empower individuals to make informed decisions and safeguard their assets. As we reflect on Blay-Miezah’s audacious scheme, let it serve as a beacon for awareness and education in financial literacy, ensuring that such scams become less common in our increasingly interconnected world.

Ghanaian man, John Ackay Blay-Miezah scammed over 300 Americans of $250 million.

He told them he had $27 billion in a bond, but needed help to unlock it.

He was arrested in Ghana in 1975, but talked his way out of it.

He got a Diplomatic passport and moved to Europe. pic.twitter.com/WdSCsxBVd7

— Africa Facts Zone (@AfricaFactsZone) July 6, 2025

Who is John Ackay Blay-Miezah?

Have you ever heard of a man named John Ackay Blay-Miezah? If not, you’re in for quite a story. This Ghanaian man made headlines for scamming over 300 Americans out of an astonishing $250 million. How did he pull off such an outrageous scheme? Well, buckle up as we dive into the details of this fascinating tale.

The Grand Scam: How It All Started

Blay-Miezah’s scam revolved around a tale so outlandish that it could easily fit into a Hollywood script. He claimed to have $27 billion tied up in bonds, but, like any good con artist, he needed help to “unlock” this vast fortune. This is where things got interesting. With charm and a silver tongue, he convinced many unsuspecting victims that they could be a part of this incredible opportunity. For those who believed him, the allure of quick riches was too tempting to resist.

Targeting Americans: The Victims

Over 300 Americans fell victim to Blay-Miezah’s elaborate scheme. These weren’t just random individuals; they were often everyday people looking for financial security or a way to invest in something promising. The American Dream can make people susceptible to such scams, especially when they come wrapped in the shiny package of a seemingly legitimate investment opportunity.

The Arrest and the Great Escape

In 1975, Blay-Miezah’s fraudulent activities caught up with him, leading to his arrest in Ghana. However, in a twist that would make any movie buff raise an eyebrow, he managed to talk his way out of his predicament. How did he do it? This is where his skills as a smooth talker came into play. His charm and eloquence once again paved the way for his escape from justice.

A Diplomatic Passport: A Ticket to Freedom

After talking his way out of trouble, Blay-Miezah managed to secure a diplomatic passport. This little piece of paper was his golden ticket, allowing him to move freely across borders and even relocate to Europe. It’s wild to think about how a simple passport can grant someone the freedom to continue their deceitful ways, don’t you think?

The Impact of the Scam

Blay-Miezah’s deception had significant implications, not just for the victims but also for the broader conversation around scams and fraud. It raised awareness about the dangers of investment scams and how even the most seemingly credible offers can be too good to be true. The fallout from this scam rippled through communities, leaving many people financially devastated and emotionally scarred.

Lessons Learned from the Blay-Miezah Case

So, what can we learn from the tale of John Ackay Blay-Miezah? First and foremost, it’s essential to approach investment opportunities with a healthy dose of skepticism. If something sounds too good to be true, it probably is. Always do your due diligence, research the people and companies involved, and consult with financial experts before diving in. Trust your instincts, and don’t let the allure of quick riches cloud your judgment.

Modern Scams: Are We Any Safer?

Fast forward to today, and the landscape of scams has evolved, but the essence remains the same. With the rise of the internet, online scams have become more prevalent, targeting even more individuals than ever before. From phishing emails to elaborate Ponzi schemes, the digital age has provided new avenues for deceitful individuals to exploit. The story of Blay-Miezah is a reminder that while the methods may have changed, the need for vigilance has never been more critical.

How to Spot a Scam

Here are a few red flags to look out for when considering investment opportunities:

- Promised Returns: If someone promises guaranteed high returns with little risk, that’s a major warning sign.

- Pressure Tactics: Scammers often use high-pressure tactics to get you to invest quickly. If you feel rushed, take a step back.

- Lack of Transparency: If the investment details are vague or the person is unwilling to provide documentation, that’s a huge red flag.

- Unsolicited Offers: Be cautious of unexpected messages or calls offering investments. Scammers often reach out cold.

Protecting Yourself Online

In today’s digital world, it’s crucial to protect yourself online. Here are some tips:

- Use Secure Websites: Ensure that the website you’re dealing with is secure (look for HTTPS in the URL).

- Keep Personal Information Private: Avoid sharing sensitive information unless you’re sure of whom you’re dealing with.

- Regularly Monitor Financial Accounts: Keep an eye on your accounts for any unusual activity.

- Educate Yourself: Stay informed about common scams and how they operate.

Resources for Victims

If you or someone you know has fallen victim to a scam, there are resources available to help. Organizations like the Federal Trade Commission (FTC) provide valuable information and support for victims of fraud. Additionally, reporting scams can help authorities take action and prevent others from being targeted.

The Legacy of John Ackay Blay-Miezah

The story of John Ackay Blay-Miezah serves as both a cautionary tale and a reflection of the human propensity to trust. While he may have gotten away with his crimes for a time, the impact of his actions continues to resonate. As we navigate the complexities of modern finance and investment, it’s essential to remain vigilant and informed to protect ourselves and our communities.

Final Thoughts

As we wrap up this story, it’s important to remember that scams are a reality we must face in our financial journeys. The tale of John Ackay Blay-Miezah is just one example of how far some individuals will go to deceive others for personal gain. By staying informed, recognizing the signs of scams, and trusting our instincts, we can better protect ourselves and our loved ones from becoming the next victims.

“`

This article covers the story of John Ackay Blay-Miezah, his scam, and its implications, while educating readers on how to spot and avoid scams in a conversational tone. It is structured with appropriate HTML headings for SEO optimization and includes practical advice for readers.

Ghanaian man, John Ackay Blay-Miezah scammed over 300 Americans of $250 million. He told them he had $27 billion in a bond, but needed help to unlock it. He was arrested in Ghana in 1975, but talked his way out of it. He got a Diplomatic passport and moved to Europe.