Senator Lummis Demands Fed Chair Powell’s Resignation: Is He Unfit to Lead?

Senate calls for Fed change, Jerome Powell criticism, Federal Reserve leadership controversy

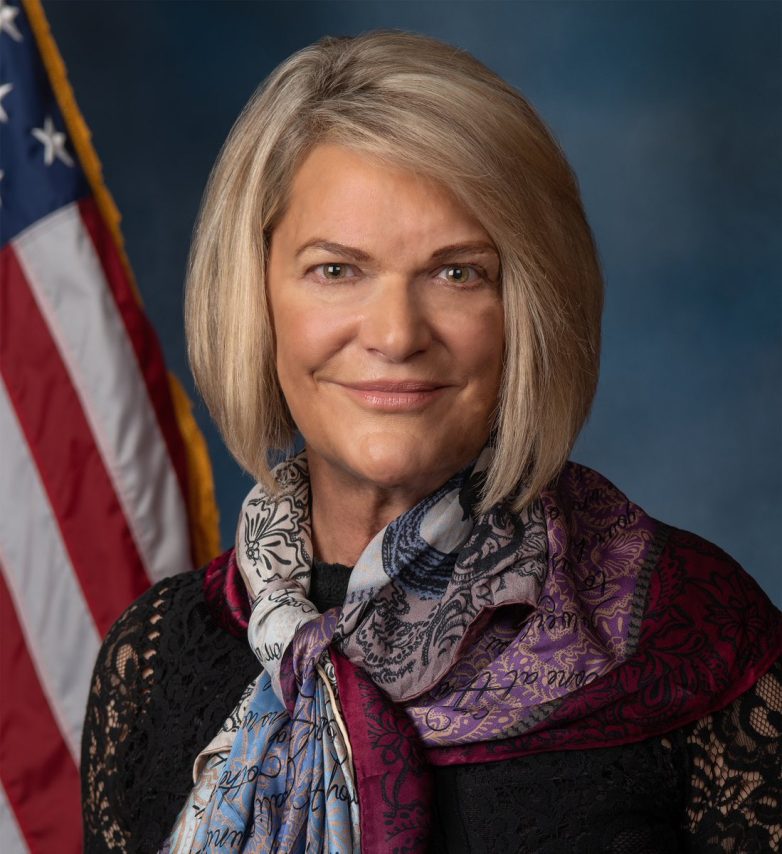

Senator Cynthia Lummis Calls for Fed Chair Jerome Powell’s Resignation

In a striking development within U.S. politics and economics, Senator Cynthia Lummis has publicly called for Federal Reserve Chair Jerome Powell to resign from his position. This bold statement comes amid ongoing debates about the effectiveness of monetary policy and the direction of the economy. Lummis, a prominent figure in the Senate, has expressed her concerns regarding Powell’s leadership, stating, “Powell has proven time and time again that he is unfit to run the Fed. He must resign now.” This sentiment echoes a growing discontent among some lawmakers and economists regarding the Fed’s handling of inflation, interest rates, and overall economic stability.

The Context of the Resignation Call

Senator Lummis’s call for Powell’s resignation is not an isolated incident but rather part of a broader conversation about the Federal Reserve’s role in managing the economy. The Fed, responsible for controlling inflation and stabilizing the financial system, has faced increasing scrutiny as inflation rates soar and the economic landscape becomes more volatile. Critics argue that the central bank’s policies have been ineffective in curbing inflation, leading to rising costs for consumers and businesses alike.

As inflation continues to pose challenges for everyday Americans, Senators like Lummis are growing impatient with what they perceive as inadequate leadership within the Federal Reserve. By calling for Powell’s resignation, Lummis aims to signal that change is necessary to restore public confidence in the institution and its ability to navigate the current economic climate.

Understanding the Role of the Federal Reserve

The Federal Reserve, often referred to simply as the Fed, plays a crucial role in the U.S. economy. It is responsible for setting monetary policy, regulating banks, and maintaining financial stability. One of its primary objectives is to manage inflation, ensuring that prices remain stable and that the economy grows at a sustainable rate. The Fed utilizes various tools, such as interest rate adjustments and open market operations, to influence economic activity.

Chair Jerome Powell, appointed by former President Donald Trump in 2018, has been at the helm during a tumultuous period marked by the COVID-19 pandemic and subsequent economic recovery efforts. His leadership has been characterized by a commitment to low interest rates and substantial monetary stimulus aimed at supporting the economy. However, as inflation has surged to levels not seen in decades, critics argue that these policies have contributed to the problem rather than alleviating it.

The Implications of Lummis’s Statement

Lummis’s call for Powell’s resignation could have significant implications for the Federal Reserve and the broader economic landscape. If Powell were to step down, it would pave the way for a new chairperson who may adopt a different approach to monetary policy. This change could lead to shifts in interest rates, which in turn would affect borrowing costs for consumers and businesses.

Moreover, Lummis’s statement highlights a growing rift within the political landscape regarding economic management. As inflation continues to impact American households, lawmakers are becoming increasingly vocal about their dissatisfaction with the Fed’s performance. This call for accountability could signal a turning point in how the Federal Reserve is perceived and managed, potentially leading to more stringent oversight and expectations from Congress.

Reactions to the Call for Resignation

Reactions to Senator Lummis’s statement have been mixed. Supporters of her position argue that the Fed needs new leadership to address the pressing issues facing the economy effectively. They believe that a change at the top could restore public trust and lead to more effective policies aimed at curbing inflation and promoting economic growth.

On the other hand, some economists and political analysts caution against a hasty decision to remove Powell from his position. They argue that the complexities of the economy require steady leadership and a careful approach to monetary policy. Removing Powell could lead to uncertainty in the markets and further complicate the already delicate economic situation.

The Future of the Federal Reserve

As the situation unfolds, the future of the Federal Reserve and its leadership remains uncertain. Senator Lummis’s call for Powell’s resignation has ignited a debate about the effectiveness of current monetary policies and the need for change. Whether or not Powell will heed this call remains to be seen, but it is clear that the pressure is mounting for the Fed to take decisive action in addressing the challenges facing the economy.

In conclusion, Senator Cynthia Lummis’s demand for Jerome Powell’s resignation encapsulates the growing frustration among lawmakers regarding the Federal Reserve’s handling of the economy. With inflation continuing to rise and the economic landscape evolving, the debate over the Fed’s leadership and direction is likely to intensify. As the nation navigates these turbulent waters, the Federal Reserve will need to adapt and respond to the concerns of lawmakers and the American public alike. The coming months will be critical as stakeholders from all sectors closely monitor the Fed’s actions and the potential implications for the wider economy.

JUST IN: Senator Cynthia Lummis calls for Fed Chair Jerome Powell to resign.

“Powell has proven time and time again that he is unfit to run the Fed. He must resign now.” pic.twitter.com/JTpPNlr7hC

— Watcher.Guru (@WatcherGuru) July 9, 2025

Senator Cynthia Lummis Calls for Fed Chair Jerome Powell to Resign

In a bold move that has captured attention across financial news platforms, Senator Cynthia Lummis has publicly called for Federal Reserve Chair Jerome Powell to step down. Her statement, made on July 9, 2025, has sparked discussions among economists, investors, and political analysts alike. Lummis’s assertion that “Powell has proven time and time again that he is unfit to run the Fed” has raised eyebrows and ignited debates about the future of monetary policy in the United States.

Who is Senator Cynthia Lummis?

Before we dive into the implications of Lummis’s call for resignation, let’s take a moment to understand who she is. Cynthia Lummis is a Republican senator representing Wyoming. Known for her strong advocacy on cryptocurrency and financial innovation, Lummis has established herself as a significant voice in the Senate, especially regarding economic policy. Her background as a former state treasurer and a member of the House Financial Services Committee gives her a solid foundation in financial matters, making her opinions on the Federal Reserve particularly noteworthy.

Understanding the Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in the country’s economic health by regulating monetary policy, managing inflation, and overseeing the banking system. Jerome Powell, who has been serving as the chair since 2018, has faced significant scrutiny during his tenure, particularly regarding interest rate adjustments and responses to economic crises.

Why the Call for Resignation?

So, why is Lummis calling for Powell’s resignation? There are several factors at play here. Critics have often pointed to Powell’s handling of interest rates and inflation as major concerns. Since the onset of the COVID-19 pandemic, the Fed has taken unprecedented measures to stabilize the economy, including lowering interest rates and implementing quantitative easing. While these actions were necessary at the time, some argue that they have led to long-term consequences, such as skyrocketing inflation rates.

In her statement, Lummis specifically mentions that Powell has “proven time and time again” his unfitness for the role. This phrase suggests a long-standing dissatisfaction with his tenure. Many share Lummis’s concerns, arguing that the Fed’s policies have not adequately addressed the needs of American families and businesses.

The Inflation Debate

Inflation has become a hot topic in recent years, and for good reason. Prices for everyday goods have soared, leaving many Americans struggling to make ends meet. Critics of Powell argue that his policies have contributed to this inflationary pressure, making life more difficult for the average person. Lummis’s call for resignation is, in part, a response to this growing frustration among her constituents and the broader public.

Implications for Monetary Policy

If Powell were to resign, what would that mean for monetary policy? The appointment of a new Fed chair would undoubtedly bring a shift in focus and strategy. Depending on who is appointed, we could see a more aggressive stance on inflation or a continuation of Powell’s policies. The selection of a new chair could also influence the Fed’s approach to interest rates, potentially leading to changes that could either stimulate or cool the economy.

Moreover, a leadership change at the Fed could have significant implications for the financial markets. Investors closely monitor the Fed’s actions and statements, and a new chair could lead to volatility as markets adjust to new policies and priorities.

The Political Landscape

Lummis’s call for Powell’s resignation is not just a financial issue; it’s also a political one. It reflects the growing divide between different factions within the Republican Party and the broader political landscape. Some members support Powell, believing that his leadership has been necessary during turbulent times. Others, like Lummis, are pushing for a change, arguing that new leadership could better address the challenges facing the economy.

Public Reaction and Broader Implications

The response to Lummis’s statements has been mixed. On social media, opinions vary widely, with some praising her boldness and others criticizing her for undermining the Fed during a crucial time. This division highlights the broader public sentiment regarding monetary policy and the Federal Reserve’s role in economic recovery.

As inflation continues to be a pressing issue, the public is increasingly aware of the Fed’s influence on their daily lives. Many are concerned about the long-term effects of current policies, leading to calls for accountability and change. Lummis’s voice adds to this growing chorus, suggesting that voters are ready for a new direction.

Looking Ahead: What’s Next?

As we move forward, the question remains: what will happen with Jerome Powell and the Federal Reserve? If Lummis’s call gains traction, we could see a significant shift in leadership at the Fed. This could lead to new approaches to tackling inflation, interest rates, and economic growth.

For investors and everyday Americans alike, staying informed about these developments is crucial. The Fed’s decisions can have far-reaching consequences, impacting everything from mortgage rates to job growth. As the political landscape evolves, so too will the conversation around monetary policy and the future of the Federal Reserve.

Conclusion: A Pivotal Moment for the Fed

Senator Cynthia Lummis’s call for the resignation of Jerome Powell marks a pivotal moment in the ongoing dialogue about monetary policy and economic stability in the United States. As inflation continues to rise and public frustration grows, the pressure on the Federal Reserve could lead to significant changes in leadership and strategy. The implications of these changes may resonate far beyond Wall Street, affecting the daily lives of Americans and the broader economy.

Whether or not Powell steps down remains to be seen, but one thing is clear: the conversation surrounding the Federal Reserve and its role in shaping the economy is far from over. As we watch this story unfold, it’s essential to stay engaged and informed, as the outcomes could have lasting impacts on our financial landscape.

JUST IN: Senator Cynthia Lummis calls for Fed Chair Jerome Powell to resign. "Powell has proven time and time again that he is unfit to run the Fed. He must resign now."