“Shockwaves in Finance: Is Jerome Powell’s Resignation Imminent?”

Federal Housing Director, Jerome Powell resignation news, US monetary policy updates

Breaking News: Jerome Powell’s Potential Resignation Sparks Market Speculation

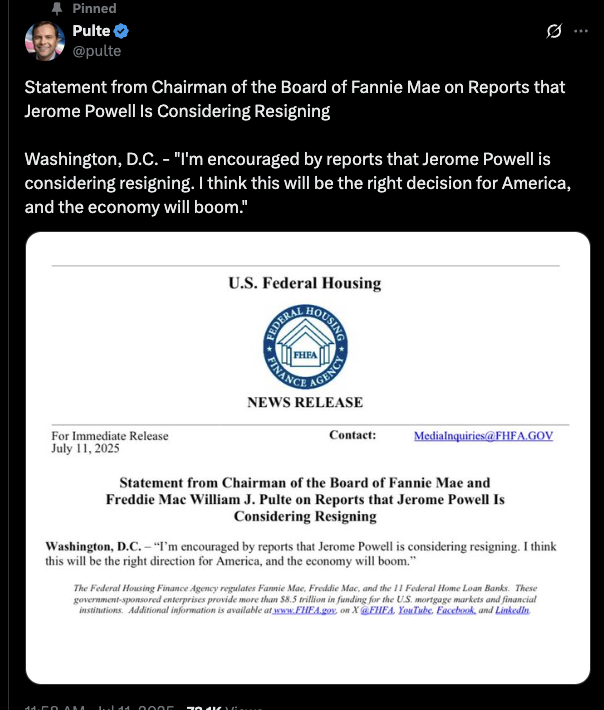

In a significant development for the financial markets, William Pulte, the US Director of Federal Housing, has revealed that Jerome Powell, the current Chair of the Federal Reserve, is contemplating resigning from his position. This news was shared in a tweet by the account @unusual_whales on July 11, 2025, igniting widespread discussion and speculation regarding the implications of such a move for the economy and financial markets.

The Context of Jerome Powell’s Tenure

Jerome Powell has been at the helm of the Federal Reserve since February 2018, overseeing monetary policy during a tumultuous period that has included the COVID-19 pandemic and subsequent economic recovery. Under his leadership, the Fed has navigated unprecedented challenges, including fluctuating inflation rates and varying unemployment levels. His tenure has been marked by significant policy decisions, including interest rate adjustments and asset purchasing programs aimed at stabilizing the economy.

Pulte’s mention of Powell’s potential resignation raises important questions about the future direction of U.S. monetary policy. Speculation surrounding Powell’s departure has already begun to affect market sentiment, with investors keenly watching how this news could influence interest rates and economic stability.

Market Reactions to the News

The announcement of Powell’s possible resignation has triggered immediate reactions in the financial markets. Stock indices may experience volatility as traders reassess their positions in light of this new information. Additionally, fluctuations in bond markets and currency values are expected as investors react to the uncertainty surrounding the Fed’s leadership.

Analysts are closely monitoring these developments, as a change in the Federal Reserve’s leadership could signal a shift in monetary policy. If Powell resigns, his successor may bring a different approach to handling inflation, interest rates, and economic growth, potentially reshaping the landscape for businesses and consumers alike.

Implications for Monetary Policy

The Federal Reserve plays a crucial role in guiding U.S. monetary policy, and any change in leadership can have profound implications. Jerome Powell has generally favored gradual interest rate adjustments and a cautious approach to tapering asset purchases. If he were to resign, his replacement might possess different philosophies and strategies regarding monetary policy.

Specifically, the new chair could prioritize tackling inflation more aggressively or adopt a more dovish stance to promote economic growth. This uncertainty could lead to increased volatility in financial markets as investors try to anticipate the new chair’s policy direction.

What Comes Next?

As the situation unfolds, market participants will be closely watching for further statements from Powell, the Federal Reserve, and the Biden administration regarding the leadership transition. If Powell officially announces his resignation, the process of selecting a successor will commence, which could take weeks or even months.

During this interim period, the Federal Reserve will likely continue its current policies until a new chair is confirmed. However, any potential shifts in communication or policy approach from Powell could provide clues about the future direction of the Fed.

Conclusion: The Importance of Monitoring Developments

In summary, the news of Jerome Powell’s potential resignation has created a ripple effect in financial markets and economic discussions. Investors and analysts should remain vigilant as this story develops, keeping an eye on how the Federal Reserve navigates this uncertain landscape.

The implications of a change in leadership at the Fed are significant, affecting everything from interest rates to inflation expectations. As such, understanding the dynamics at play will be essential for anyone looking to make informed decisions in the current economic climate.

As we await further updates, it is crucial to stay informed about the potential ramifications of Powell’s resignation on both the U.S. economy and global markets. By keeping an eye on this evolving situation, stakeholders can better prepare for the changes that may be on the horizon.

In a time of economic uncertainty, the actions and decisions of the Federal Reserve remain vital for maintaining stability and growth. Jerome Powell’s potential resignation is a pivotal moment that warrants careful attention and analysis in the coming days and weeks.

BREAKING: US Director of Federal Housing, William Pulte, has said that Jerome Powell is considering resigning. pic.twitter.com/PkUGZG8JN1

— unusual_whales (@unusual_whales) July 11, 2025

BREAKING: US Director of Federal Housing, William Pulte, has said that Jerome Powell is considering resigning

In a surprising twist, William Pulte, the US Director of Federal Housing, has revealed that Jerome Powell, the current Chair of the Federal Reserve, is contemplating resignation. This announcement sent shockwaves through financial markets and sparked discussions across various platforms. Let’s dive deeper into what this means for the economy, interest rates, and the future of U.S. monetary policy.

The Role of Jerome Powell in the Federal Reserve

Jerome Powell has been at the helm of the Federal Reserve since February 2018. His leadership has been pivotal, particularly during turbulent economic times like the COVID-19 pandemic and the subsequent recovery phase. Powell’s policies have aimed to stabilize the economy, control inflation, and promote maximum employment. His approach has often been characterized by a willingness to adapt to changing economic conditions, making him a somewhat unpredictable figure in the financial world.

Understanding the Implications of Powell’s Potential Resignation

If Powell does decide to step down, it could have significant implications for the U.S. economy and financial markets. The Chair of the Federal Reserve plays a crucial role in determining the direction of monetary policy, including interest rates and inflation control measures. A change in leadership could lead to shifts in these policies, creating uncertainty among investors and businesses alike.

Market reactions to Powell’s potential resignation might be immediate. Investors often react to news involving the Federal Reserve with volatility. For example, if Powell’s resignation leads to a shift towards more aggressive rate increases, we could see stock markets reacting negatively. Conversely, if a new appointee signals a continuation of Powell’s more dovish policies, it might provide some relief in the markets.

Who Might Succeed Jerome Powell?

The question on everyone’s mind is: who could replace Powell if he decides to resign? Several names have been floated, including current Fed governors and prominent economists. Each potential successor would bring their unique perspective and policy approach, further complicating the economic landscape.

For instance, if someone like Lael Brainard, who has been a vocal advocate for inclusive economic policies, were to take over, we might see a shift toward more progressive monetary policies. On the other hand, a more traditional candidate could focus on strict inflation control, potentially leading to higher interest rates sooner rather than later.

The Response from Financial Analysts and Economists

Financial analysts have been quick to dissect the implications of Powell’s potential resignation. Many are urging caution, noting that the stability of the Federal Reserve is paramount for economic confidence. According to a recent article from Bloomberg, any change at the top could shake investor confidence, especially given the current backdrop of inflationary pressures and supply chain issues.

Economists are also weighing in, emphasizing the need for continuity in monetary policy. As noted by a leading economist at Financial Times, a sudden change could disrupt the Fed’s current strategies aimed at curbing inflation while fostering economic growth.

The Current Economic Climate

As we analyze the potential impact of Powell’s resignation, it’s essential to consider the broader economic climate. The U.S. economy has been on a recovery path post-pandemic, but challenges remain. Inflation rates have been fluctuating, and the labor market is still not back to pre-pandemic levels. Any significant changes in monetary policy could either bolster this recovery or hinder it.

Additionally, with rising interest rates, mortgage markets are feeling the heat. Many potential homebuyers are concerned about affordability as rates rise, which could lead to a cooling of the housing market—a critical sector of the economy.

The Political Landscape Surrounding the Fed

The Federal Reserve is not immune to political pressures, and a potential resignation from Powell could open the floodgates for political debates about the direction of U.S. monetary policy. As we approach election seasons, the Fed often finds itself in the crosshairs of political agendas. A new chair could be seen as a reflection of the party in power, leading to further scrutiny and pressure from lawmakers.

Political analysts have suggested that whoever replaces Powell will likely have to navigate this complex web of expectations from both sides of the aisle. The implications of their decisions could resonate far beyond the Federal Reserve, impacting everything from fiscal policy to international trade.

What Happens Next?

So, what’s next? The financial world will be watching closely for any official announcements regarding Powell’s future. Until then, uncertainty will likely loom over the markets, with investors weighing their options in light of potential changes at the Fed. Analysts recommend a cautious approach, keeping an eye on economic indicators that might hint at the Fed’s future direction.

In the meantime, discussions surrounding Powell’s potential resignation highlight the importance of leadership in shaping economic policy. Regardless of whether Powell stays or goes, the Federal Reserve will continue to play a central role in navigating the U.S. economy through these uncertain times.

Conclusion

William Pulte’s announcement about Jerome Powell considering resignation has opened a Pandora’s box of discussions about the future of U.S. monetary policy. The implications of such a change can be profound, affecting everything from interest rates to the housing market. As the situation unfolds, staying informed will be crucial for anyone involved in or affected by the economic landscape.

“`

This article is structured to be SEO-friendly and conversational while providing detailed insights into the implications of Jerome Powell’s potential resignation. Each section links relevant concepts, facts, and sources for readers seeking more information.

BREAKING: US Director of Federal Housing, William Pulte, has said that Jerome Powell is considering resigning.