Jerome Powell’s Shocking Resignation Rumors: What It Means for Our Economy!

Federal Reserve leadership changes, Jerome Powell resignation impact, monetary policy future implications

Jerome Powell’s Potential Resignation: What It Means for the Economy

In a surprising turn of events, Federal Reserve Chair Jerome Powell is reportedly considering resigning from his position. This news, first shared by the popular social media account Libs of TikTok, has sent shockwaves through financial markets and sparked widespread speculation about the implications of such a move. As the head of the Federal Reserve, Powell has played a crucial role in shaping U.S. monetary policy, particularly during times of economic uncertainty. In this article, we will delve into the potential ramifications of his resignation and what it could mean for the future of the economy.

The Role of the Federal Reserve Chair

The Federal Reserve, often referred to as the Fed, is the central bank of the United States and is responsible for implementing monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates. The chair of the Federal Reserve is a pivotal figure, influencing not just U.S. economic policy but also global markets. Jerome Powell was appointed as the 16th chair of the Federal Reserve in February 2018 and has since navigated the complexities of the economic landscape, especially during the COVID-19 pandemic.

Current Economic Climate

As of now, the U.S. economy is facing several challenges, including inflationary pressures, fluctuating employment rates, and geopolitical tensions. The Fed has responded to these challenges with various monetary policy measures, including interest rate adjustments and quantitative easing. Powell’s leadership has been particularly scrutinized, with many economists and analysts evaluating the effectiveness of his strategies in stabilizing the economy.

Implications of Powell’s Resignation

Should Jerome Powell resign, the immediate concern would be the potential for increased volatility in financial markets. The appointment of a new chair could lead to shifts in monetary policy direction, which may unsettle investors and affect market confidence. Here are several key implications of Powell’s potential resignation:

1. **Monetary Policy Uncertainty**: A new chair may bring a different approach to monetary policy. Investors and businesses thrive on consistency, and any sudden change in direction could lead to uncertainty in investment decisions and economic forecasts.

2. **Impact on Interest Rates**: If Powell’s successor adopts a more aggressive stance on interest rate hikes or a more dovish approach, it could significantly affect borrowing costs for consumers and businesses. This change could either stimulate economic growth or contribute to a slowdown, depending on the chosen direction.

3. **Market Reaction**: Markets often react negatively to uncertainty. The stock market may experience fluctuations as investors digest news of Powell’s resignation and speculate on the future direction of the Fed under new leadership. This could lead to short-term volatility, affecting retirement accounts, investments, and overall economic confidence.

4. **Global Economic Influence**: The Federal Reserve plays a crucial role in global economics, and a change in leadership could ripple through international markets. Countries that rely on the U.S. economy may experience impacts in their own markets due to shifts in U.S. monetary policy.

Who Could Replace Powell?

If Jerome Powell were to resign, speculation would naturally arise about potential successors. Candidates could include current Fed governors, economists from academia, or financial experts with experience in monetary policy. The new chair would need to be someone who could navigate the complexities of today’s economic challenges while maintaining the Fed’s credibility and independence.

Public and Political Reaction

Powell’s potential resignation is likely to draw reactions from both the public and political arenas. Economists, investors, and policymakers will weigh in on the potential impact of a new leadership style on the economy. Additionally, political figures may use the situation to further their agendas, particularly in the context of upcoming elections.

Conclusion

Jerome Powell’s rumored resignation as Federal Reserve Chair is a significant development that could have far-reaching consequences for the U.S. and global economies. The uncertainties surrounding this potential change in leadership highlight the intricate relationship between monetary policy and economic stability. As the situation unfolds, it will be essential for stakeholders to stay informed about developments at the Federal Reserve and their implications for financial markets and the broader economy.

This potential resignation serves as a reminder of the importance of stable leadership within financial institutions and the vital role that these figures play in shaping economic policy. As we await further updates, the financial world will be closely monitoring the impacts of this news and preparing for the possible changes that lie ahead.

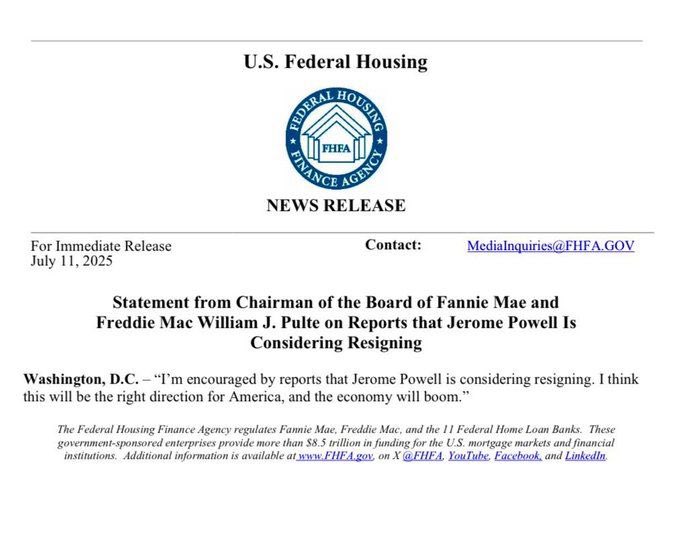

BREAKING: Federal Reserve Chair, Jerome Powell is reportedly considering resigning pic.twitter.com/K7ak4OanJ4

— Libs of TikTok (@libsoftiktok) July 11, 2025

BREAKING: Federal Reserve Chair, Jerome Powell is reportedly considering resigning

Hey there! If you’ve been tuning into the latest financial news, you probably caught wind of the buzz surrounding Federal Reserve Chair Jerome Powell. That’s right! Rumors are swirling that he’s contemplating resigning from his position. This news has sent ripples through the financial world, and it’s important to unpack what this could mean for the economy and beyond.

Who is Jerome Powell?

Let’s start with a little background on Jerome Powell. Appointed by President Trump in 2018, Powell has been at the helm of the Federal Reserve during some pretty turbulent times. His tenure has seen unprecedented events, including a global pandemic and rising inflation, which has required some tough decisions. He’s been known for his cautious yet firm approach to monetary policy, which has made him a pivotal figure in the financial landscape.

Why is Powell Considering Resigning?

Now, the million-dollar question: why is Powell considering stepping down? According to reports, there are a few factors at play. One major consideration is the political climate. With the upcoming elections and potential shifts in power, Powell might feel the pressure to exit before any new policies take effect. Additionally, some speculate that he’s been feeling the weight of criticism over the Fed’s handling of inflation and interest rates.

Many believe that Powell’s decision could be influenced by the need for a fresh perspective in the central bank. With economic conditions constantly changing, the Federal Reserve might benefit from new leadership that can adapt to the evolving financial landscape. This sentiment is echoed by various financial analysts who suggest that a change at the top could lead to innovative strategies in tackling economic challenges.

The Impact on the Financial Markets

So, what does this mean for the financial markets? If Powell were to resign, we could see increased volatility in stock prices and interest rates as investors react to the uncertainty. The Fed Chair plays a crucial role in shaping monetary policy, and any change at that level can lead to shifts in market confidence.

For instance, if a new chair is perceived as more hawkish (favoring higher interest rates to curb inflation), we might see a decline in stock prices as borrowing costs rise. On the flip side, a dovish chair (more focused on stimulating the economy) could lead to a rally in stocks as investors anticipate lower interest rates.

Public Reaction and Speculation

The public reaction to this news has been nothing short of explosive. Social media is ablaze with opinions and speculation. Many are weighing in on the potential candidates who could replace Powell. Some names floating around include Lael Brainard, who has been a Fed governor and is known for her progressive stance on monetary policy, and John Williams, the president of the Federal Reserve Bank of New York.

It’s interesting to see how this news has sparked discussions not just among economists but also within the general public. People are curious about how a change in leadership might impact their wallets, from mortgage rates to credit card interest rates. It’s a reminder of just how interconnected the economy is and how decisions made at the top can trickle down to everyday Americans.

What’s Next for Jerome Powell?

As we await more concrete news, many are left wondering what’s next for Powell. If he does decide to resign, it will undoubtedly be a significant moment in economic history. His leadership has been characterized by a pragmatic approach to monetary policy, and his departure would mark the end of an era.

In the meantime, it’s crucial to keep an eye on the developments within the Federal Reserve. Any official statements or actions taken by Powell or the board will provide more clarity on the situation. We’re living in a time of uncertainty, and having a clear understanding of the implications of these changes is vital for anyone interested in finance.

The Broader Economic Context

To truly understand the implications of Powell’s potential resignation, we need to consider the broader economic context. The U.S. economy is currently grappling with inflation rates not seen in decades. The Federal Reserve has been aggressive in raising interest rates to combat inflation, but whether this strategy is effective is still up for debate.

This backdrop of economic challenges makes Powell’s leadership even more pivotal. If he resigns, the next chair will face the daunting task of navigating these turbulent waters. Economic indicators such as unemployment rates, consumer spending, and global trade dynamics will all play a role in shaping the policies of the new chair.

Conclusion: The Road Ahead

In the end, Jerome Powell’s potential resignation is more than just a headline — it’s a reflection of the complex and often unpredictable nature of economic leadership. Whether he stays or goes, the choices made by the Federal Reserve will have lasting impacts on the economy and the lives of everyday Americans.

As we continue to monitor this unfolding story, it’s essential to stay informed and engaged. The world of finance can be a rollercoaster, but understanding the players and the implications of their decisions can help us navigate these choppy waters with confidence.

So, keep your ears to the ground and your eyes on the news. The future of the Federal Reserve and its leadership could shape the economic landscape for years to come!

BREAKING: Federal Reserve Chair, Jerome Powell is reportedly considering resigning