“Whale’s $25M Bitcoin Bet Explodes to $350M: Is This the New Crypto Craze?”

cryptocurrency trading profits, Bitcoin leverage strategies, whale market influence

Whale Makes $25 Million in Bitcoin Trade with 20X Leverage

In the ever-evolving world of cryptocurrency, significant trades often capture the attention of investors and enthusiasts alike. A recent tweet from notable crypto influencer Crypto Rover revealed a remarkable trading event that has sent shockwaves through the Bitcoin community. A cryptocurrency whale, an investor who holds a substantial amount of Bitcoin, executed a staggering trade that yielded an extraordinary profit, highlighting the potential for massive gains within the crypto market.

The Trade: A Breakdown

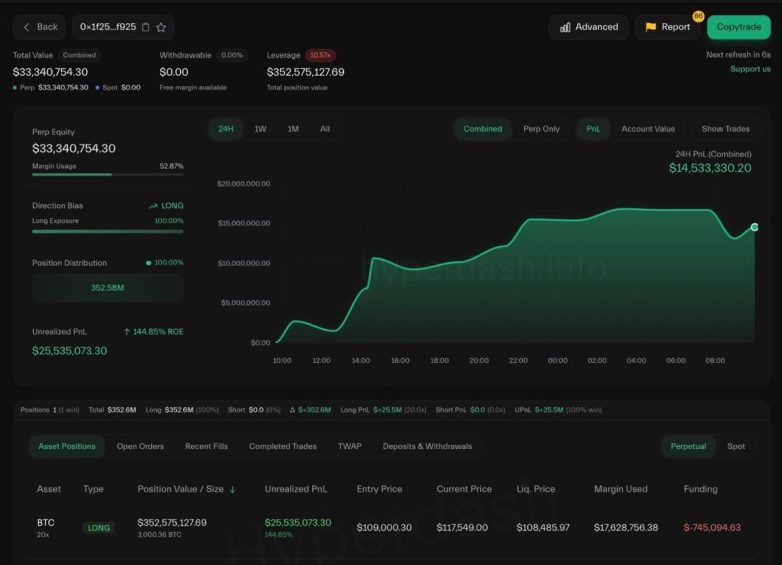

On July 12, 2025, the whale reportedly entered a long position in Bitcoin that was valued at approximately $25 million, employing an impressive 20X leverage. This means that the trader was able to control a position worth $500 million using only $25 million of their own capital. Such high leverage is a double-edged sword; while it allows for significant profits, it also amplifies risks, making it essential for traders to be cautious and strategic.

The tweet detailed that the position had skyrocketed in value, reaching an estimated worth of over $350 million shortly after the trade was executed. This meteoric rise in value demonstrates the volatility and potential profitability of trading in the cryptocurrency market, particularly for those who are willing to take calculated risks.

Understanding Leverage in Cryptocurrency Trading

Leverage is a powerful tool in trading that allows investors to increase their exposure to the market without committing a substantial amount of capital. By borrowing funds, traders can amplify their potential returns — and losses. In the case of the whale’s trade, utilizing 20X leverage meant that for every dollar the price of Bitcoin increased, the whale would benefit significantly more than if they had only invested their own capital.

While leverage can lead to impressive profits, it also heightens the risk of liquidation, where the trader’s position is forcibly closed by the exchange due to insufficient margin to cover potential losses. Therefore, while the whale’s successful trade is a testament to high-risk trading strategies, it also serves as a cautionary tale for novice traders who may not fully understand the implications of using leverage.

The Impact on the Crypto Market

Such a monumental trade can have ripple effects throughout the cryptocurrency landscape. A position worth over $350 million can influence market sentiment, leading to increased trading volume and potentially affecting Bitcoin’s price trajectory. Large trades like this one can cause price swings, as the market reacts to the buying and selling activity of influential players.

Moreover, this event is likely to attract attention from both retail and institutional investors who may seek to capitalize on similar opportunities. As news of this trade spreads, it could lead to increased interest in Bitcoin and other cryptocurrencies, potentially driving prices higher as more investors look to enter the market.

The Role of Whales in Cryptocurrency

Whales play a significant role in the cryptocurrency ecosystem. They have the power to influence market movements due to their large holdings and trading activities. Their decisions can create volatility, impacting the price of digital assets. While some see whales as a threat due to their ability to manipulate prices, others argue that they provide liquidity and market depth.

For retail investors, understanding the behavior of whales can be crucial. Tracking whale movements can provide insights into market trends and potential price actions. Tools and platforms that offer whale tracking services are becoming increasingly popular as traders seek to gain an edge in the competitive crypto market.

Conclusion

The recent trade executed by a cryptocurrency whale, resulting in a $25 million investment growing to over $350 million, highlights the immense potential for profit in the digital asset space. However, it also underscores the importance of understanding the inherent risks associated with high-leverage trading.

As the crypto market continues to mature, events like this serve as a reminder of the volatility that defines it. For traders, both seasoned and new, staying informed about market trends and the actions of influential players can provide valuable insights into making more strategic trading decisions.

In a world where fortunes can be made — and lost — in the blink of an eye, this whale’s remarkable trade is not just a story of immense profit but also a lesson in the complexities of cryptocurrency trading. Whether you’re a seasoned investor or just starting your journey in crypto, it’s essential to approach the market with caution, knowledge, and a clear strategy. As the landscape evolves, staying ahead of the game will require constant learning and adaptation to the ever-changing dynamics of the cryptocurrency ecosystem.

BREAKING:

THIS WHALE JUST MADE $25M LONGING BITCOIN WITH 20X LEVERAGE, THE POSITION IS NOW WORTH OVER $350M.

ABSOLUTE INSANITY. pic.twitter.com/B4r7yjCsh2

— Crypto Rover (@rovercrc) July 12, 2025

BREAKING: THIS WHALE JUST MADE $25M LONGING BITCOIN WITH 20X LEVERAGE, THE POSITION IS NOW WORTH OVER $350M. ABSOLUTE INSANITY.

Alright, folks, let’s dive into one of the most mind-blowing events in the crypto world. Recently, a major player in the Bitcoin game—referred to as a ‘whale’—made headlines by turning a $25 million bet into a staggering position worth over $350 million. How did this happen? Buckle up because we’re about to explore the insanity of this trade, the mechanics behind leverage, and what it means for the crypto market.

Understanding the Whale Phenomenon in Crypto

First off, let’s unpack what a whale is in the crypto space. A whale is someone or an entity that holds a large amount of cryptocurrency—in this case, Bitcoin. These individuals or institutions have the power to influence market movements due to their substantial holdings. When a whale makes a move, the entire market often reacts, creating a ripple effect.

The Leverage Game Explained

Now, let’s talk about leverage. In simple terms, leverage allows traders to control a larger position with a smaller amount of capital. In this case, our whale used 20X leverage to amplify their investment. So, when the price of Bitcoin moved in their favor, the returns—like the jaw-dropping $25 million—became possible.

Here’s how it works: with 20X leverage, for every dollar you put in, you can control $20 worth of Bitcoin. However, while leverage can multiply gains, it can also amplify losses. That means it’s not for the faint of heart. If the market turns against you, you can lose your investment quickly. But clearly, this whale knew what they were doing!

Breaking Down the Trade

Let’s break down the whale’s trade. Starting with a $25 million investment, using 20X leverage allowed them to control a whopping $500 million worth of Bitcoin. If Bitcoin’s price moved positively—let’s say it surged—this whale’s position could skyrocket in value, leading to the reported worth of over $350 million.

This kind of trading isn’t just about luck; it requires a keen understanding of market trends, technical analysis, and a solid risk management strategy. It’s a high-stakes game that can turn even the most seasoned traders pale with anxiety.

The Impact on the Bitcoin Market

Now, you might be wondering: what does this mean for the broader Bitcoin market? When a whale makes a significant move, it can lead to increased volatility. Other traders might see this massive bet and feel compelled to jump in, driving prices even higher. Alternatively, some might panic and sell, fearing a correction.

Additionally, this whale’s actions can serve as a signal to the market. When a major player takes a bullish position, it can instill confidence in other investors, potentially leading to a broader rally. On the flip side, if the market doesn’t react as expected, it can lead to sharp corrections, leaving many traders in a precarious position.

Why This Matters for Retail Investors

If you’re a retail investor (like many of us), you might feel overshadowed by these whales. But don’t fret! Understanding the dynamics at play can help you make informed decisions. For instance, following whale activity can provide insights into potential market trends. Tools like Whale Alert can help you track large transactions in real time.

While you might not have millions to throw around, keeping an eye on the big players can guide your own trading strategies. Just remember that with great power comes great responsibility—and risk!

Market Sentiment and Future Implications

The sentiment surrounding this whale’s trade is one of cautious optimism. While the immediate impact may be positive, it’s essential to consider the long-term effects. With Bitcoin’s price reaching new heights, the question arises: are we in a bull market, or is this just a temporary spike?

Market analysts will be scrutinizing the charts and trading volumes to decipher the next moves. Factors like regulatory changes, macroeconomic trends, and technological advancements in the blockchain space will play crucial roles in determining Bitcoin’s trajectory.

The Role of Social Media in Shaping Perception

Social media platforms, particularly Twitter, have become vital in shaping public perception in the crypto space. The tweet from @rovercrc about the whale’s remarkable trade quickly went viral, generating buzz and excitement among traders and investors alike.

In today’s digital age, information spreads like wildfire. This can be both advantageous and disadvantageous. While it helps in raising awareness and attracting more investors, it can also lead to FOMO (Fear of Missing Out) and panic selling, depending on market movements and sentiment.

Conclusion: What’s Next for Bitcoin?

As we analyze this monumental trade, the overarching question remains: what’s next for Bitcoin? Will this whale’s bold move catalyze a new bull run, or are we headed for a correction? The answer lies in the hands of market dynamics and, of course, the sentiments of traders across the globe.

For retail investors, the key takeaway here is to stay informed, keep an eye on market trends, and never underestimate the power of whales in the crypto ocean. Whether you’re a seasoned trader or just dipping your toes into Bitcoin, understanding these movements can provide a significant edge in the game.

So, keep your eyes peeled, your strategies sharp, and let’s see where this wild ride takes us!

BREAKING: THIS WHALE JUST MADE $25M LONGING BITCOIN WITH 20X LEVERAGE, THE POSITION IS NOW WORTH OVER $350M. ABSOLUTE INSANITY.