Trump’s Bold Tariff Threat: EU and Mexico Face 30% Levy—Retaliation Looms!

trade tariffs, international trade relations, economic policy impact

President Trump’s Announcement of 30% Tariff on the European Union and Mexico

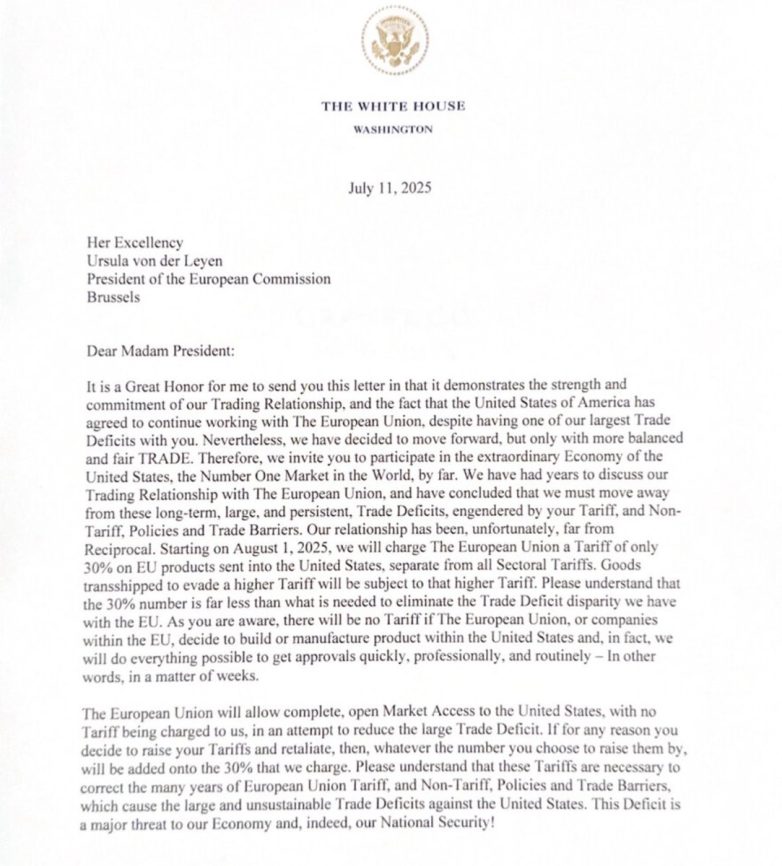

In a significant economic development, President Donald Trump has announced a 30% tariff on imports from the European Union and Mexico. The announcement, made on July 12, 2025, has sent ripples through financial markets and trade discussions globally. Trump’s decision comes amidst ongoing trade tensions and aims to protect American industries and jobs.

Understanding Tariffs and Their Impact

Tariffs are taxes imposed on imported goods, intended to make foreign products more expensive and less competitive compared to domestic goods. The 30% tariff introduced by Trump is one of the most substantial tariffs imposed in recent years and is likely to affect various sectors, including automotive, agriculture, and manufacturing.

The President emphasized that if the European Union or Mexico retaliates against this tariff, the U.S. would respond by raising the tariffs by an equal margin. This tit-for-tat approach suggests a potential escalation in trade disputes, raising concerns among economists and business leaders about the broader implications for the global economy.

Reasons Behind the Tariff Announcement

Trump’s administration has long advocated for fair trade practices, arguing that American industries have been unfairly disadvantaged by existing trade agreements. The President’s announcement is part of a broader strategy to renegotiate trade deals that he believes do not benefit the United States.

By imposing a tariff on the European Union and Mexico, Trump aims to address what he perceives as trade imbalances that have harmed American workers. The administration has argued that such tariffs could encourage domestic production and create jobs, especially in manufacturing sectors that have been hit hard by globalization.

Potential Reactions from the European Union and Mexico

The announcement of the 30% tariff is expected to provoke strong reactions from both the European Union and Mexico. Historically, both regions have responded to U.S. tariffs with their own retaliatory measures. Such actions could lead to an escalating trade war, further straining international relations and complicating economic recovery efforts in the aftermath of the COVID-19 pandemic.

European leaders have expressed concerns over the potential economic impact of these tariffs, particularly on industries that rely heavily on exports to the United States. Similarly, Mexican officials are likely to assess the implications for their economy, which is closely tied to U.S. trade.

The Broader Economic Implications

The introduction of a 30% tariff on imports from the European Union and Mexico could have several far-reaching consequences. Firstly, consumers in the United States may face higher prices for imported goods, leading to increased inflation. This, in turn, could affect consumer spending and economic growth.

Secondly, American businesses that rely on imported materials or products may experience increased costs, potentially leading to reduced profit margins. Some analysts warn that the tariffs could lead to job losses in industries that depend on global supply chains, countering the intended effects of job creation.

Lastly, the potential for a trade war could disrupt global markets, affecting currencies, stock prices, and international trade dynamics. Investors may become increasingly cautious, leading to volatility in financial markets.

Conclusion: The Future of U.S. Trade Policy

President Trump’s announcement of a 30% tariff on the European Union and Mexico marks a pivotal moment in U.S. trade policy. As the administration prepares for possible retaliation from these regions, the implications for American businesses, consumers, and the global economy remain uncertain.

The coming weeks and months will be critical in determining the trajectory of trade relations between the United States and its international partners. Stakeholders will be closely monitoring reactions from the European Union and Mexico, as well as the President’s next steps in this unfolding trade saga.

As the situation develops, it will be essential for businesses and consumers alike to stay informed about the potential impacts of these tariffs and the broader economic landscape. The outcome of this trade policy could shape the future of international trade and economic relations for years to come.

BREAKING: President Trump announces 30% tariff on the European Union and Mexico.

Trump says if they retaliate, these tariffs will be raised by the same amount as the retaliation. pic.twitter.com/JQ1HsLeseO

— The Kobeissi Letter (@KobeissiLetter) July 12, 2025

BREAKING: President Trump Announces 30% Tariff on the European Union and Mexico

In a surprising move that sent ripples through the global economy, President Trump has announced a 30% tariff on imports from both the European Union and Mexico. This decision, communicated during a press conference on July 12, 2025, has raised eyebrows and ignited discussions across various sectors. Let’s dive into the implications of this tariff and what it means for international trade relationships.

Understanding the 30% Tariff

The 30% tariff represents a significant hike in import duties that will affect a wide range of goods coming from the EU and Mexico. Tariffs are essentially taxes imposed on imported goods, and they can drastically alter the pricing structures in international trade. By increasing the cost of imports, the intent is often to protect domestic industries from foreign competition. However, the consequences can be far-reaching.

President Trump stated, “If they retaliate, these tariffs will be raised by the same amount as the retaliation.” This statement underscores a tit-for-tat approach to trade that is characteristic of Trump’s negotiations. It raises questions about how countries will respond and what kind of economic showdown could unfold.

The Rationale Behind the Tariff

So, what is the reasoning behind this bold move? The Trump administration has consistently argued that American manufacturers have faced unfair competition from abroad. The tariffs are a strategy aimed at leveling the playing field by encouraging consumers to buy domestically produced goods, thereby supporting American jobs.

However, it’s essential to recognize that while tariffs can protect certain industries, they might also lead to increased costs for consumers. When tariffs are placed on imports, the prices of those goods typically go up, affecting everything from electronics to clothing. Additionally, companies that rely on imported materials may also see their production costs rise, which can lead to higher prices for consumers.

Potential Impact on the Economy

The introduction of a 30% tariff on the European Union and Mexico could have several effects on the economy. Let’s break down some of the potential outcomes:

1. Increased Prices for Consumers

As mentioned earlier, tariffs can lead to higher prices. If companies pass on the costs of tariffs to consumers, we may see an increase in the prices of everyday items. This could affect household budgets and reduce consumer spending, which is a crucial driver of the U.S. economy.

2. Trade Wars

Trump’s warning about retaliation suggests that this could spark a trade war. If the EU and Mexico decide to impose their tariffs in response, it could escalate tensions and lead to a broader conflict over trade practices. This back-and-forth could hurt businesses and consumers on both sides, as retaliatory tariffs can lead to a cycle of increases that are hard to break.

3. Effects on American Businesses

While some American companies may benefit from reduced competition, others may suffer due to increased costs for imported materials. For instance, industries that rely heavily on raw materials from the EU or Mexico could see their margins shrink, leading to potential layoffs or cutbacks. The manufacturing sector, especially, could feel the brunt of these changes.

4. Shifts in Supply Chains

In response to these tariffs, businesses might look to adjust their supply chains. Companies could seek alternative suppliers within the U.S. or in countries not affected by tariffs. This could lead to a reconfiguration of global trade networks and potentially impact international relations.

Reactions from the European Union and Mexico

As expected, the announcement of a 30% tariff on the EU and Mexico has drawn swift reactions. Leaders from both regions have expressed concern over the potential consequences of such measures.

The European Union has historically been a significant trading partner for the U.S., and tariffs could strain this relationship. The EU has previously imposed tariffs on American goods in retaliation for other trade measures, indicating that they are prepared to respond similarly this time.

Mexico, too, has voiced its discontent. Given the close economic ties between the U.S. and Mexico, the tariffs could have severe consequences for both economies, particularly for industries like automotive manufacturing and agriculture, which are heavily integrated.

Historical Context of Tariffs in U.S. Trade Policy

To fully understand the implications of this 30% tariff, it’s helpful to look at the historical context of tariffs in U.S. trade policy. Tariffs have been a contentious issue throughout American history, often used as a tool for political leverage.

For instance, during the 1930s, the Smoot-Hawley Tariff Act raised duties on hundreds of imports, which many economists believe exacerbated the Great Depression. In more recent years, tariffs have been used intermittently, with varying degrees of success. The Trump administration’s previous tariffs on steel and aluminum were met with mixed results, showcasing the complexities of trade negotiations.

FAQs About the 30% Tariff

As this situation unfolds, many people have questions about what a 30% tariff on the EU and Mexico means for them. Let’s address some of the most pressing concerns:

Will the 30% tariff affect prices immediately?

While it’s likely that some prices will increase due to the tariffs, the exact timeline for when these changes will take effect can vary. Retailers may take time to adjust their pricing structures, but consumers could see changes within weeks or months.

How will this impact American jobs?

The impact on American jobs could be mixed. While some industries may see job growth due to reduced competition, others may face layoffs if costs rise and companies struggle to remain profitable. It’s essential to monitor specific sectors for more insight.

What can consumers do to prepare?

Consumers might want to budget for potential increases in prices for imported goods. Additionally, it could be wise to consider supporting local businesses as a way to mitigate the impact of increased import costs.

Conclusion

The announcement of a 30% tariff on the European Union and Mexico marks a significant moment in U.S. trade policy. As President Trump emphasizes a protectionist approach, the implications for consumers, businesses, and international relations remain to be seen. It’s crucial to stay informed about how this situation develops, as it could reshape the landscape of global trade in the years to come.

“`

This article covers the announcement of the 30% tariff on the EU and Mexico, its implications, potential impacts on the economy, and reactions from involved parties, all while maintaining an informal and conversational tone.

BREAKING: President Trump announces 30% tariff on the European Union and Mexico. Trump says if they retaliate, these tariffs will be raised by the same amount as the retaliation.