“Crypto ETFs Surge to New Heights: Is This the Start of a Market Revolution?”

Bitcoin ETF growth, Ethereum investment surge, cryptocurrency market trends

Record-Breaking Week for Crypto ETFs: A New Era in Digital Asset Investment

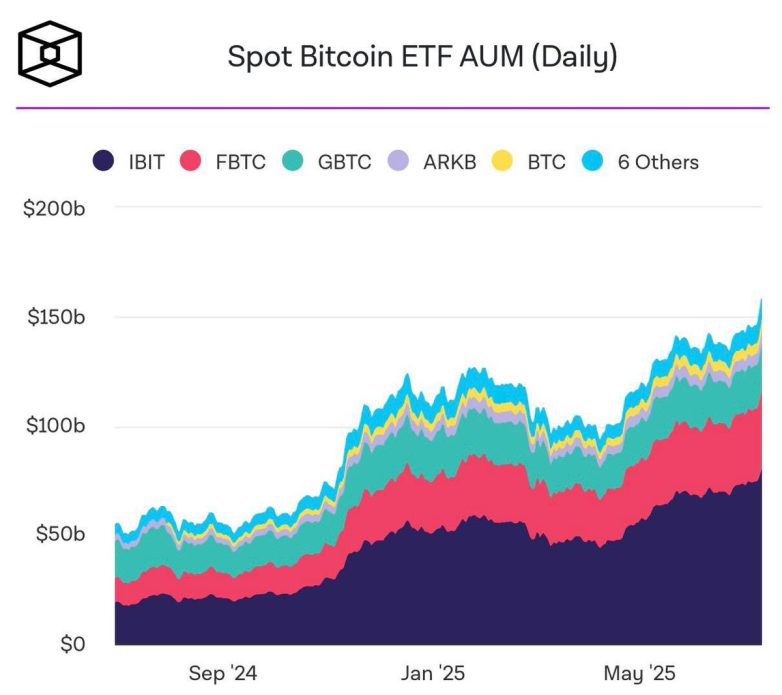

The cryptocurrency market is witnessing unprecedented growth, particularly in the realm of exchange-traded funds (ETFs). Recently, a monumental milestone was achieved by U.S. spot Bitcoin ETFs, which reached an all-time high (ATH) of $158 billion in total net assets. This surge reflects a burgeoning interest in digital assets, signaling a pivotal moment for both retail and institutional investors.

Unprecedented Inflows: A Surge in Investments

The week in question saw remarkable inflows into cryptocurrency ETFs, with over $1 billion entering the market on both Thursday and Friday. This two-day stretch represents the largest inflow period ever recorded for crypto ETFs, highlighting the accelerating momentum driving investors towards these financial products. Such inflows not only underline the growing acceptance of cryptocurrencies but also indicate a broader trend of diversification in investment portfolios.

Spot Ethereum ETFs: Breaking Records

In addition to Bitcoin, spot Ethereum ETFs have also made headlines, accumulating over $1 billion in inflows within just six days. This rapid influx signifies a new record for Ethereum-based ETFs and further emphasizes the robust interest in alternative digital assets. Investors are increasingly recognizing the potential of Ethereum as a foundational technology for decentralized applications and smart contracts, which has contributed to its rising popularity.

The Bull Run: Driving Forces Behind the Surge

Several factors are propelling this crypto bull run. One significant driver is the ongoing institutional adoption of cryptocurrencies. Major financial institutions and corporations are increasingly investing in digital assets, viewing them as a hedge against inflation and a means to diversify traditional investment strategies. This institutional participation lends credibility to the market and encourages retail investors to follow suit.

Moreover, regulatory clarity surrounding cryptocurrency ETFs has played a crucial role in this surge. As the U.S. Securities and Exchange Commission (SEC) provides clearer guidelines for the approval of crypto ETFs, investors feel more secure entering the market. The approval of multiple Bitcoin and Ethereum ETFs has opened the floodgates for a wider audience, allowing more individuals to invest in cryptocurrencies through familiar financial instruments.

Market Sentiment: A Shift Towards Adoption

The overall sentiment within the cryptocurrency market has shifted towards optimism. Analysts and experts are beginning to predict a sustained bull market, driven by increasing adoption rates and technological advancements in blockchain. This optimism is reflected in the recent trading volumes and price movements of major cryptocurrencies, which have shown signs of growth and resilience.

As the crypto market continues to evolve, the recent influx of investments into ETFs may pave the way for the next generation of financial products. With more investors looking for exposure to digital assets, the demand for crypto ETFs is likely to continue its upward trajectory.

The Future of Crypto ETFs

Given the current momentum, the outlook for crypto ETFs appears bright. Both Bitcoin and Ethereum ETFs have established themselves as significant players in the financial landscape, attracting a diverse range of investors. As the cryptocurrency market matures, we can expect to see an influx of new ETF products targeting various digital assets, further broadening the investment landscape.

Additionally, as technological advancements in blockchain continue to develop, the potential applications for cryptocurrencies and their underlying technologies will expand. This growth in utility may lead to even greater demand for crypto ETFs, as investors seek to capitalize on emerging trends and innovations.

Conclusion: Embracing the Digital Asset Revolution

The record-breaking week for crypto ETFs marks a significant turning point in the digital asset space. With spot Bitcoin ETFs reaching a new ATH and Ethereum ETFs breaking inflow records, it is evident that the interest in cryptocurrencies is rapidly gaining traction. The combination of institutional adoption, regulatory clarity, and positive market sentiment has created a fertile environment for investment in digital assets.

As we look to the future, it is crucial for investors to stay informed about the evolving cryptocurrency landscape. The surge in ETF inflows not only reflects growing acceptance but also signifies the dawn of a new era in investment strategies. With the potential for continued growth and innovation, the digital asset revolution is well underway, and the possibilities for crypto ETFs are limitless.

Investors who wish to engage in this burgeoning market should consider the implications of this record-breaking week. With a clear understanding of the forces at play and a strategic approach to investing, individuals can position themselves to benefit from the ongoing transformation of the financial landscape. The future is bright for crypto ETFs, and now is the time to embrace the opportunities presented by this dynamic market.

By staying updated on trends and developments in the cryptocurrency space, investors can make informed decisions and potentially reap the rewards of this exciting financial frontier. As the bull run heats up and new records are set, the world of crypto ETFs is poised for continued growth and success.

RECORD BREAKING WEEK FOR CRYPTO ETFs

▸ U.S. spot Bitcoin ETFs just hit $158B ATH in total net assets

▸ $1B+ inflows on both Thurs & Fri,biggest 2-day stretch ever

▸ Spot $ETH ETFs took in $1B+ in 6 days, hitting a new inflow record

Bull run heating up fast. pic.twitter.com/n4sSq3lsO6

— Kamil (@KamilShaheen19) July 13, 2025

RECORD BREAKING WEEK FOR CRYPTO ETFs

If you’ve been keeping an eye on the crypto market lately, you might have noticed an incredible surge in interest and investment. This past week has been nothing short of phenomenal for cryptocurrency exchange-traded funds (ETFs), and it’s worth diving into the details to understand what’s happening and why it matters.

U.S. Spot Bitcoin ETFs Just Hit $158B ATH in Total Net Assets

First off, let’s talk about the astonishing achievement of U.S. spot Bitcoin ETFs reaching an all-time high (ATH) of $158 billion in total net assets. This milestone marks a significant moment for the crypto landscape, as it indicates a growing acceptance and integration of Bitcoin into mainstream finance. The rise of Bitcoin ETFs allows investors a more accessible route to gain exposure to the world’s leading cryptocurrency without having to navigate the complexities of direct ownership.

For those new to the concept, a spot Bitcoin ETF is essentially a fund that tracks the price of Bitcoin and allows investors to trade shares of the fund on traditional stock exchanges. This means you don’t need to worry about wallets or private keys; you can simply purchase shares through your brokerage account, just like you would with any other stock or ETF. It’s this simplicity and ease of access that has fueled the rapid growth of assets in these funds.

$1B+ Inflows on Both Thurs & Fri, Biggest 2-Day Stretch Ever

The excitement doesn’t stop there. Inflows into these ETFs have been staggering, with over $1 billion pouring in on both Thursday and Friday of this past week. This two-day stretch marks the largest inflow period ever recorded for Bitcoin ETFs, showcasing a surge of confidence from investors eager to capitalize on the current market momentum.

Why such a rush? Well, the crypto market is known for its volatility, and with Bitcoin often seen as a hedge against inflation and a store of value, many investors are jumping back in, especially as the market shows signs of a bullish run. With more institutional players entering the space and greater regulatory clarity emerging, it seems that the appetite for Bitcoin ETFs is only going to grow.

Spot $ETH ETFs Took in $1B+ in 6 Days, Hitting a New Inflow Record

It’s not just Bitcoin that’s seeing a surge; Ethereum has also hit new heights. Spot Ethereum ETFs have taken in over $1 billion in just six days, setting a new inflow record. This is a clear indicator that investors are not only interested in Bitcoin but are also recognizing the potential of Ethereum as a leading smart contract platform. Ethereum’s unique features, such as decentralized applications (dApps) and non-fungible tokens (NFTs), keep it in the spotlight and attract significant investment.

As Ethereum continues to evolve, especially with upcoming upgrades like Ethereum 2.0, its potential for growth is immense. Investors are keenly aware of this and are positioning themselves to take advantage of the opportunities that lie ahead.

Bull Run Heating Up Fast

The bull run in the crypto market is heating up, and it’s exciting to witness. With record-breaking inflows into both Bitcoin and Ethereum ETFs, the enthusiasm is palpable. Many analysts predict that this trend might continue as more investors seek to diversify their portfolios and tap into the potential returns that cryptocurrencies offer.

But let’s not forget that with great opportunity comes volatility. The crypto market can be unpredictable, and while the current momentum is impressive, it’s essential for investors to remain cautious and do their homework. Understanding the risks associated with crypto investments is crucial, especially as the landscape continues to evolve.

What Does This Mean for the Future of Crypto ETFs?

The recent record-breaking week for crypto ETFs signals a pivotal shift in how cryptocurrencies are perceived by the traditional financial community. As more investors, particularly institutional ones, flock to ETFs, it’s likely we’ll see an increase in legitimacy for the entire crypto market. This could lead to further innovations, additional product offerings, and even more robust regulatory frameworks that could stabilize the market.

Moreover, as ETFs become more mainstream, they could pave the way for other cryptocurrencies to gain similar recognition. We might see new ETFs emerging for lesser-known altcoins, giving investors even more opportunities to participate in this fast-growing sector.

How Can You Get Involved?

If you’re interested in diving into the world of crypto ETFs, here are a few steps to get started:

- Research Different ETFs: Not all ETFs are created equal. Take the time to research the various options available, including their performance history, management fees, and investment strategies.

- Choose a Brokerage: To invest in ETFs, you’ll need a brokerage account. Look for a platform that offers access to crypto ETFs and has a good reputation for security and customer service.

- Diversify Your Investments: Just like any other investment, it’s important not to put all your eggs in one basket. Consider diversifying your portfolio by investing in different ETFs or a mix of crypto and traditional assets.

- Stay Informed: The crypto space is ever-evolving. Keep yourself updated on market trends, regulatory changes, and technological advancements that could impact your investments.

Final Thoughts

The excitement surrounding the recent record-breaking week for crypto ETFs is just the beginning of what could be a transformative era for the cryptocurrency sector. As more investors recognize the potential of Bitcoin and Ethereum, we’re likely to see continued growth and innovation in the space. Whether you’re a seasoned investor or just starting, now may be the perfect time to explore the opportunities that crypto ETFs present.

So, buckle up and get ready for what’s next in the world of cryptocurrencies. The future looks bright, and it’s a thrilling ride for those willing to join in!

RECORD BREAKING WEEK FOR CRYPTO ETFs ▸ U.S. spot Bitcoin ETFs just hit $158B ATH in total net assets ▸ $1B+ inflows on both Thurs & Fri,biggest 2-day stretch ever ▸ Spot $ETH ETFs took in $1B+ in 6 days, hitting a new inflow record Bull run heating up fast.